Illinois Employment of Bookkeeper: Exploring Roles and Responsibilities The Illinois Employment of Bookkeeper entails hiring individuals to manage financial records, maintain accurate bookkeeping systems, and provide vital support to businesses across various industries. With a strong emphasis on maintaining financial records, bookkeepers are essential in ensuring the smooth functioning of the organization's financial operations. Below, we will delve into the different types and key responsibilities associated with Illinois Employment of Bookkeepers. Types of Illinois Employment of Bookkeeper: 1. Full-Charge Bookkeeper: Typically found in small to medium-sized businesses, full-charge bookkeepers are responsible for handling all aspects of bookkeeping, including managing accounts payable/receivable, reconciling bank statements, preparing financial statements, and processing payroll. 2. Payroll Bookkeeper: This type of bookkeeper is primarily focused on processing payroll, including calculating employee wages, benefits, and taxes, and generating paychecks. Ensuring compliance with state and federal regulations is a crucial aspect of the payroll bookkeeper's role. 3. Tax Bookkeeper: Specializing in tax-related responsibilities, tax bookkeepers are responsible for preparing income tax returns, ensuring accuracy and compliance with state and federal tax laws. They stay updated with ever-evolving tax regulations and assist in minimizing tax liabilities. 4. Accounts Payable/Receivable Bookkeeper: These bookkeepers handle the organization's financial transactions by managing accounts payable and accounts receivable. They maintain accurate records of payments, invoices, and outstanding debts, ensuring timely payments both to suppliers and from customers. Key Responsibilities of Illinois Employment of Bookkeepers: 1. Maintaining Accurate Financial Records: Bookkeepers record and classify financial transactions, including sales, expenses, and payments, to ensure transparent and accurate financial records of the company's operations. 2. Reconciliation: Bookkeepers reconcile bank statements, credit card statements, and other financial documents to identify discrepancies, resolve any issues, and maintain accurate cash flow records. 3. Payroll Processing: Paying employees accurately and on time is a critical responsibility. Bookkeepers calculate wages, submit payments, and withhold necessary taxes while ensuring compliance with state and federal regulations. 4. Developing Financial Reports: Bookkeepers prepare financial statements, including balance sheets, income statements, and cash flow statements. These reports provide essential insights into the organization's financial health and aid in decision-making. 5. Data Entry and Management: Bookkeepers diligently enter financial data into the organization's accounting software, ensuring accuracy and maintaining data integrity. They are responsible for organizing and managing financial records efficiently, enabling easy retrieval when needed. 6. Tax Support: When working alongside accountants or tax professionals, bookkeepers provide vital support by providing accurate financial records, reconciliations, and transaction details to facilitate tax preparation and ensure compliance. In conclusion, the different types of Illinois Employment of Bookkeepers include full-charge bookkeepers, payroll bookkeepers, tax bookkeepers, and accounts payable/receivable bookkeepers. Regardless of the type, bookkeepers play a crucial role in managing financial records, reconciliations, financial reporting, payroll processing, data management, and tax support. By fulfilling these responsibilities effectively, bookkeepers contribute to the overall financial stability and success of the organization they serve.

Illinois Employment of Bookkeeper

Description

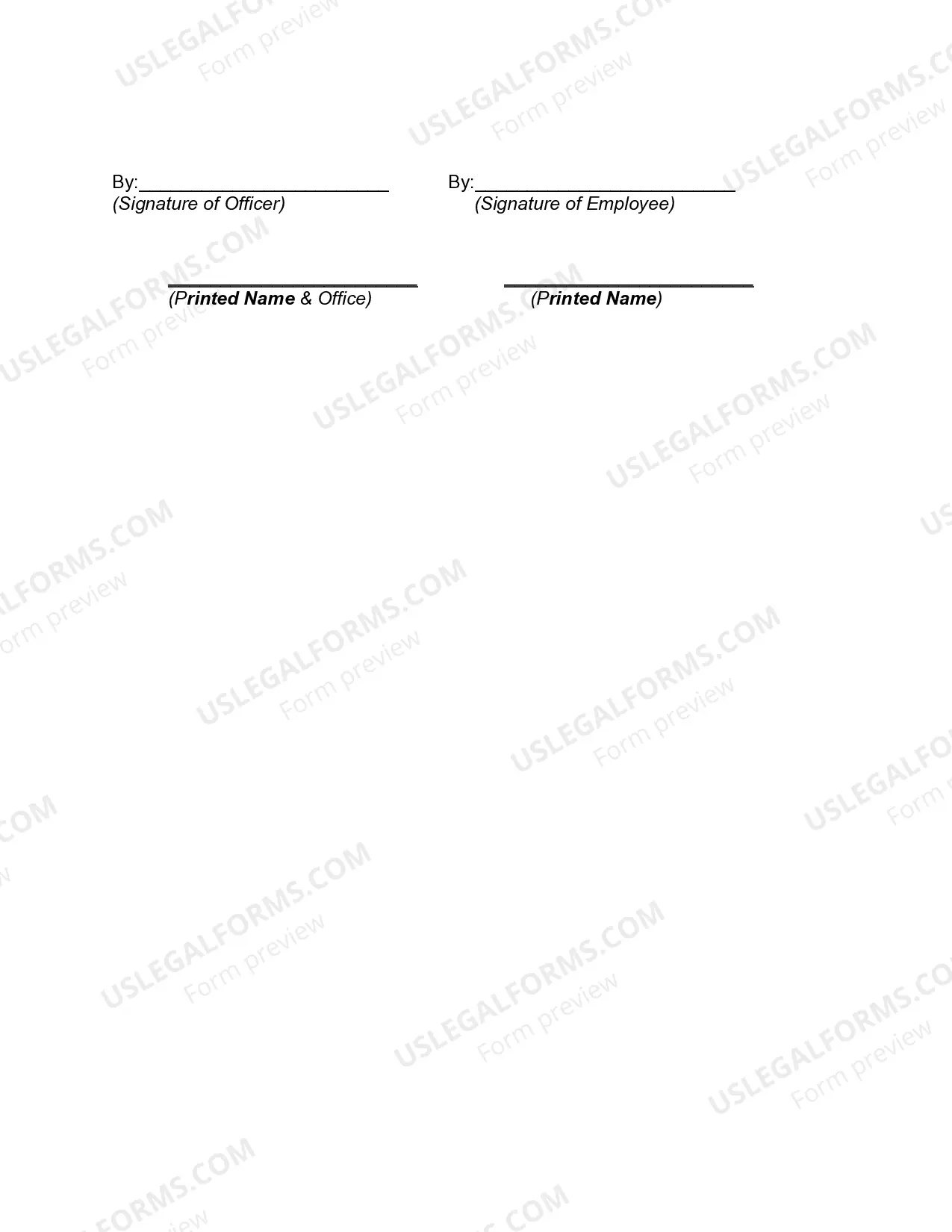

How to fill out Illinois Employment Of Bookkeeper?

You are able to devote several hours on-line searching for the lawful record template that fits the state and federal specifications you want. US Legal Forms gives a huge number of lawful varieties that are analyzed by specialists. It is simple to acquire or print out the Illinois Employment of Bookkeeper from our service.

If you already possess a US Legal Forms accounts, you are able to log in and click the Down load option. Following that, you are able to full, modify, print out, or signal the Illinois Employment of Bookkeeper. Each and every lawful record template you buy is yours forever. To get another version associated with a obtained type, check out the My Forms tab and click the related option.

If you use the US Legal Forms internet site for the first time, keep to the easy directions below:

- Initial, ensure that you have chosen the right record template for the county/metropolis of your choice. Look at the type outline to ensure you have picked the appropriate type. If readily available, make use of the Review option to look from the record template too.

- If you would like get another model in the type, make use of the Lookup industry to get the template that meets your needs and specifications.

- After you have found the template you need, just click Get now to move forward.

- Select the prices plan you need, type in your references, and register for your account on US Legal Forms.

- Full the deal. You can utilize your bank card or PayPal accounts to cover the lawful type.

- Select the structure in the record and acquire it for your product.

- Make modifications for your record if possible. You are able to full, modify and signal and print out Illinois Employment of Bookkeeper.

Down load and print out a huge number of record web templates making use of the US Legal Forms site, that offers the biggest variety of lawful varieties. Use expert and status-particular web templates to handle your organization or person requires.