The Illinois Agreement for Sale of Assets of Corporation is a legal document that outlines the terms and conditions for the sale of assets belonging to a corporation based in the state of Illinois. This agreement serves as a binding contract between the buyer and the seller, detailing the specific assets being sold, the purchase price, and the rights and obligations of both parties involved in the transaction. Keywords: Illinois, Agreement for Sale of Assets, Corporation, legal document, terms and conditions, sale of assets, binding contract, buyer, seller, purchase price, rights, obligations, transaction. There are different types of Illinois Agreements for Sale of Assets of Corporation, which can vary depending on the specific nature of the transaction. Some common types include: 1. Asset Purchase Agreement: This type of agreement involves the transfer of specific assets from the corporation, such as property, equipment, inventory, contracts, or intellectual property rights. The agreement details the condition of the assets, any warranties or representations made by the seller, and how the purchase price will be determined. 2. Stock Purchase Agreement: In this agreement, the buyer purchases the shares of the corporation, acquiring ownership and control of the entire company. The agreement outlines the number and price of shares being sold, any conditions for the purchase, and the representations and warranties given by both the buyer and the seller. 3. Merger Agreement: When two corporations decide to merge, they enter into a merger agreement that covers the consolidation of assets and liabilities. This agreement specifies the terms of the merger, such as the exchange ratio of shares, the treatment of outstanding stock options, the composition of the new board of directors, and any other relevant provisions. 4. Asset Purchase Agreement with Assumption of Liabilities: In this type of agreement, the buyer not only acquires the assets but also assumes certain liabilities of the selling corporation. This can include debts, obligations, legal claims, or contractual commitments. The agreement outlines the specific liabilities being assumed, any limitations or exclusions, and the procedures for transferring the liabilities to the buyer. 5. Bulk Sale Agreement: A bulk sale agreement is used when a substantial part of a corporation's assets is being sold outside the ordinary course of business. This type of agreement is subject to specific notice requirements to protect creditors and allows the buyer to purchase assets free and clear of certain claims against the seller. Overall, the Illinois Agreement for Sale of Assets of Corporation is a crucial legal document that ensures a transparent and legally compliant transfer of assets. Different types of agreements cater to unique circumstances, allowing buyers and sellers to define their rights and responsibilities accurately during the sale process.

Illinois Agreement for Sale of Assets of Corporation

Description

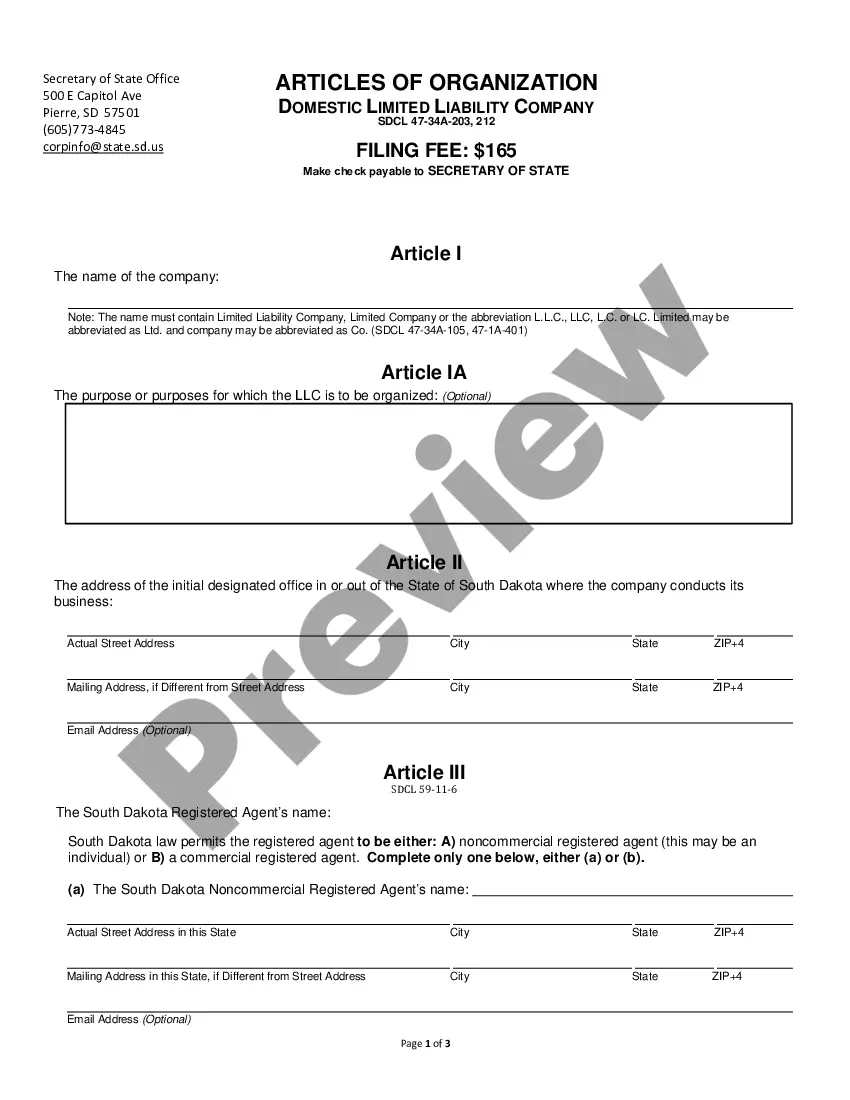

How to fill out Illinois Agreement For Sale Of Assets Of Corporation?

Are you currently in a situation where you require documents for either organizational or personal purposes nearly every working day.

There are numerous legitimate document templates available online, but finding ones that you can trust is not simple.

US Legal Forms provides thousands of form templates, including the Illinois Agreement for Sale of Assets of Corporation, designed to adhere to federal and state requirements.

When you find the appropriate form, click Acquire now.

Select the pricing plan you prefer, fill in the required details to set up your payment method, and complete your order using your PayPal or credit card. Choose a convenient format and download your copy. All the document templates you've purchased can be found in the My documents section. You can retrieve another copy of the Illinois Agreement for Sale of Assets of Corporation anytime, if needed. Just click on the form you need to download or print the document template. Use US Legal Forms, the most extensive collection of legitimate forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates for a variety of uses. Create an account on US Legal Forms and start making your life more manageable.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Illinois Agreement for Sale of Assets of Corporation template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it corresponds to your specific area/county.

- Use the Review button to check the form.

- Go through the information to ensure you have selected the correct form.

- If the form isn't what you are looking for, utilize the Search field to find a form that caters to your requirements.

Form popularity

FAQ

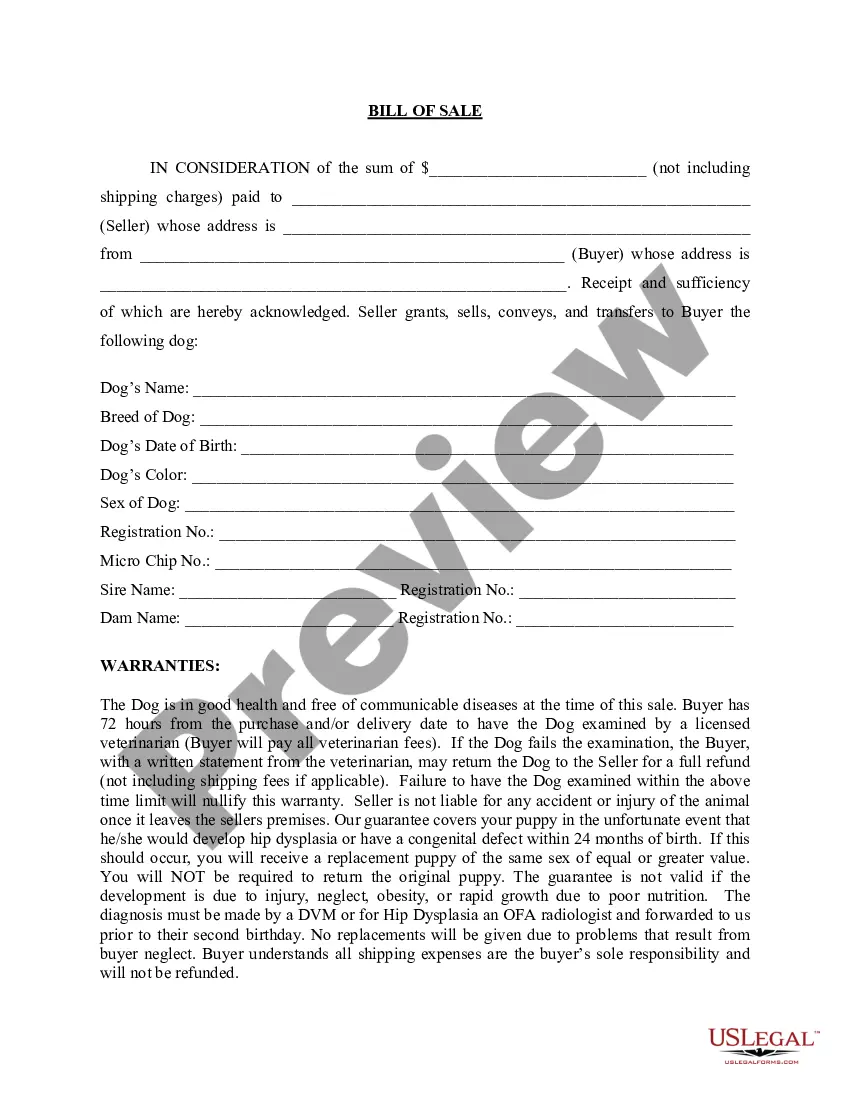

To effectively sell off business assets, start with an assessment to gauge their value. Next, publicize your available assets and engage interested parties. Using the Illinois Agreement for Sale of Assets of Corporation during this process can streamline transactions, ensuring all parties understand the terms and conditions of the sale, thus creating a smoother experience.

Selling business assets involves advertising them, negotiating with potential buyers, and finalizing the sale. It is beneficial to draft an Illinois Agreement for Sale of Assets of Corporation to formalize the transaction and outline the terms clearly. This agreement not only protects your rights but also enhances transparency in the sales process.

To write off business assets, you first need to determine the asset's current value and its depreciation over time. You may then document this process using the Illinois Agreement for Sale of Assets of Corporation, which allows for a clear outline on how to handle asset write-offs. By doing so, you not only ensure accuracy in your financial records but also simplify the tax reporting process.

An Illinois business tax number is the identification number assigned to businesses operating within the state for tax compliance. This number is crucial for conducting various business activities, including filing taxes and obtaining permits. If you are preparing an Illinois Agreement for Sale of Assets of Corporation, it is vital to have this number on hand to facilitate a seamless transaction.

Yes, a business EIN (Employer Identification Number) is considered a form of tax ID number. It is used by the IRS to identify your business for tax purposes, much like a Social Security Number identifies an individual. If you are engaging in an Illinois Agreement for Sale of Assets of Corporation, having your EIN readily available will ensure a smooth process.

You can find your business tax number by referring to your tax documents or contacting the IRS directly. Your business tax number is often included on income tax returns, forms filed with the IRS, or other official business correspondence. This number is essential for various transactions, including those related to an Illinois Agreement for Sale of Assets of Corporation.

The bulk sale law in Illinois governs the sale of a significant amount of a business's inventory or assets. This law is designed to protect creditors by requiring sellers to notify them of an impending sale. If you are contemplating an Illinois Agreement for Sale of Assets of Corporation, understanding this law is crucial to ensure compliance and avoid legal issues.

A business license number and a tax ID number serve different purposes. The business license number identifies a legally registered company, while the tax ID number, or Employer Identification Number (EIN), is used by the IRS for tax purposes. It's important to have both numbers in order to operate your business effectively, especially when dealing with documents like an Illinois Agreement for Sale of Assets of Corporation.

To find your Illinois Property Index Number (PIN), you can start by checking your property tax bill or contacting your local county assessor's office. These offices usually maintain records that include your PIN information. If you prefer, you can also access online databases that provide public records related to property ownership. Knowing your PIN can be useful when preparing an Illinois Agreement for Sale of Assets of Corporation.

Yes, if you plan to sell tangible goods or services in Illinois, a seller's permit is often required. This permit allows the state to track sales tax collection. Before finalizing any sale, ensure you have the right permits, including any necessary documents related to an Illinois Agreement for Sale of Assets of Corporation. This will streamline your selling process.

Interesting Questions

More info

Illinois State Controller and State Treasurer the State Treasurer is providing by rule for consideration of the Signed hereon this 6th day of July 2017 and executed this 20th day of July 2017 by the parties hereto: Signed by Exhibit 1 Signed hereon this 6th day of July 2017 and executed this 20th day of July 2017 by the parties hereto: I. DESCRIPTION OF ASSETS SOLD THE ASSETS SOLD WILL BE AN ESTIMATED LIST OF INVENTORY AND RESOURCES OF DEVELOPMENT RESIDENCES OF INDIA, INCLUDING: INDIAN RESOURCES FOUNDATION, FOUNDATION AND CENTER OF THE FOUNDATIONS INDIAN ORGANIZATION, INDIAN ORGANIZATION, CENTER OF THE FOUNDATIONS INDIAN SCHOOLS, INDIAN HOUSING CENTERS IN INDIA CUSTOMERS OF HOUSING ASSETS IN INDIA E.