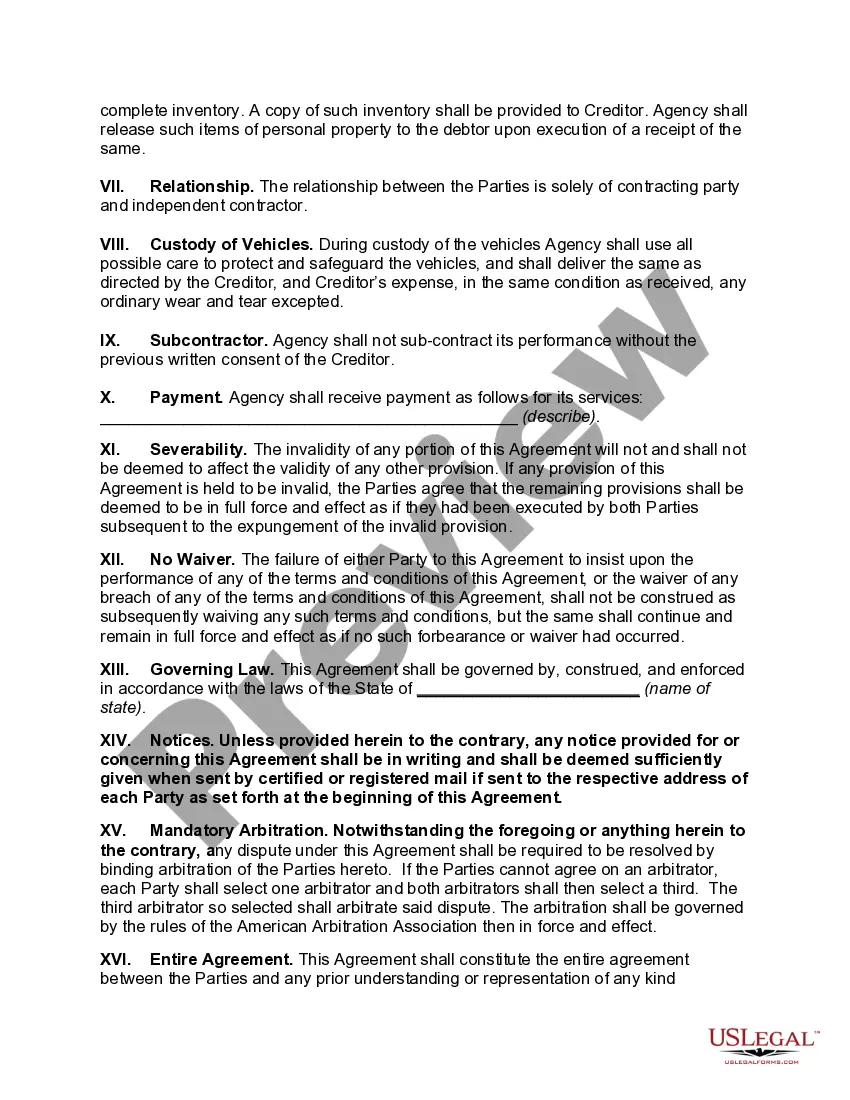

The Illinois Repossession Services Agreement for Automobiles is a legal contract that outlines the terms and conditions between a lender and a repossession service provider in the state of Illinois. This agreement is necessary when a vehicle owner defaults on their loan payment, leading the lender to repossess the vehicle to recover their outstanding debt. The agreement includes various elements that ensure a clear and mutually beneficial relationship between the lender and the repossession service provider. It typically outlines the responsibilities and obligations of both parties involved, ensuring that the repossession process adheres to the laws and regulations set forth by the state of Illinois. Some important keywords related to the Illinois Repossession Services Agreement for Automobiles are: 1. Repossession Services: This refers to the act of seizing back the vehicle by the lender or their assigned repossession service provider. 2. Lender: The entity or organization that provided the loan and has the legal right to repossess the vehicle in case of default. 3. Automobile: Refers to any motor vehicle, including cars, trucks, motorcycles, or any other motorized vehicle that is subject to repossession. 4. Default: When a borrower fails to make the agreed-upon loan payments within the specified period, they are considered in default, triggering the repossession process. 5. Debtor: The individual who took out the loan and is responsible for the payments. In case of default, their vehicle may be subject to repossession. 6. Repossession Service Provider: A licensed agency or company authorized to engage in the repossession process on behalf of the lender. 7. Collateral: The vehicle that serves as collateral for the loan. If the debtor defaults on their payments, the lender has the right to repossess and sell the vehicle in order to recover the outstanding debt. There may be different types of Illinois Repossession Services Agreements for Automobiles, including: 1. Direct Agreement: This is a standard repossession agreement where the lender directly contracts with a repossession service provider. 2. Indirect Agreement: In some cases, lenders may work with a third-party agency or a repossession management company to handle the repossession process on their behalf. This type of agreement outlines the terms between the lender and the third-party agency. 3. Master Agreement: A master agreement is a long-term contract between a lender and a repossession service provider, where they establish the terms and conditions for multiple repossession operations over a specified period. In conclusion, the Illinois Repossession Services Agreement for Automobiles is a crucial legal document that governs the relationship between lenders and repossession service providers. It ensures that the repossession process is carried out within the boundaries of Illinois laws and protects the rights of all parties involved.

Illinois Repossession Services Agreement for Automobiles

Description

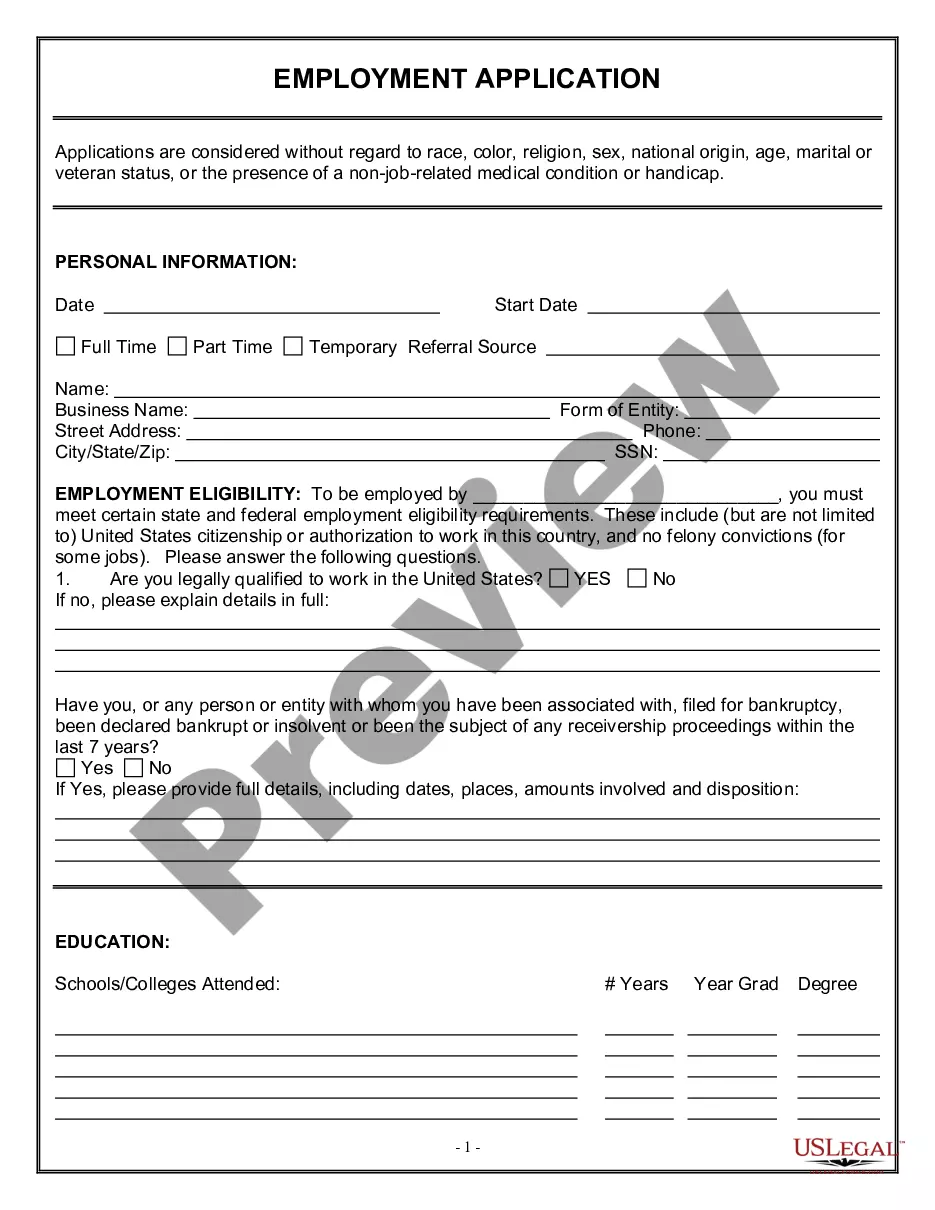

How to fill out Repossession Services Agreement For Automobiles?

Choosing the best lawful file format can be quite a struggle. Obviously, there are a lot of web templates available on the Internet, but how would you find the lawful form you need? Make use of the US Legal Forms site. The assistance delivers thousands of web templates, for example the Illinois Repossession Services Agreement for Automobiles, which can be used for company and personal needs. All the varieties are checked out by specialists and meet up with state and federal demands.

When you are currently authorized, log in for your accounts and click the Down load option to get the Illinois Repossession Services Agreement for Automobiles. Make use of accounts to search throughout the lawful varieties you may have ordered earlier. Go to the My Forms tab of the accounts and have an additional copy in the file you need.

When you are a brand new end user of US Legal Forms, here are basic instructions so that you can adhere to:

- Initial, be sure you have chosen the proper form for your personal area/region. You can check out the form while using Preview option and read the form description to guarantee this is basically the best for you.

- When the form is not going to meet up with your expectations, utilize the Seach field to obtain the right form.

- Once you are certain the form would work, click the Buy now option to get the form.

- Choose the prices prepare you need and enter the required info. Design your accounts and purchase your order making use of your PayPal accounts or bank card.

- Opt for the data file file format and acquire the lawful file format for your device.

- Full, edit and produce and indicator the acquired Illinois Repossession Services Agreement for Automobiles.

US Legal Forms may be the most significant library of lawful varieties for which you can find a variety of file web templates. Make use of the service to acquire professionally-produced files that adhere to status demands.

Form popularity

FAQ

You can "redeem" the property by offering the creditor the entire unpaid balance on the debt plus expenses reasonably caused by the repossession. You must do this before the creditor has disposed of or sold the property. Usually you cannot redeem just by paying the amount in arrears unless the creditor approves it.

Repossession is used to help lenders ensure that their debt is paid or as close to paid as is possible.

What is Repossession? The contractual right of repossession is a process where a creditor can legally take possession of a specific asset or property if a debtor fails to meet their obligations on a contract. This right of repossession exists in many different sorts of agreements and transactions.

In Illinois, Gov. J.B. Pritzker issued an executive order that suspended vehicle repossessions for as long as the state's disaster proclamation is in effect.

If you've missed a payment on your car loan, don't panic but do act fast. Two or three consecutive missed payments can lead to repossession, which damages your credit score. And some lenders have adopted technology to remotely disable cars after even one missed payment.

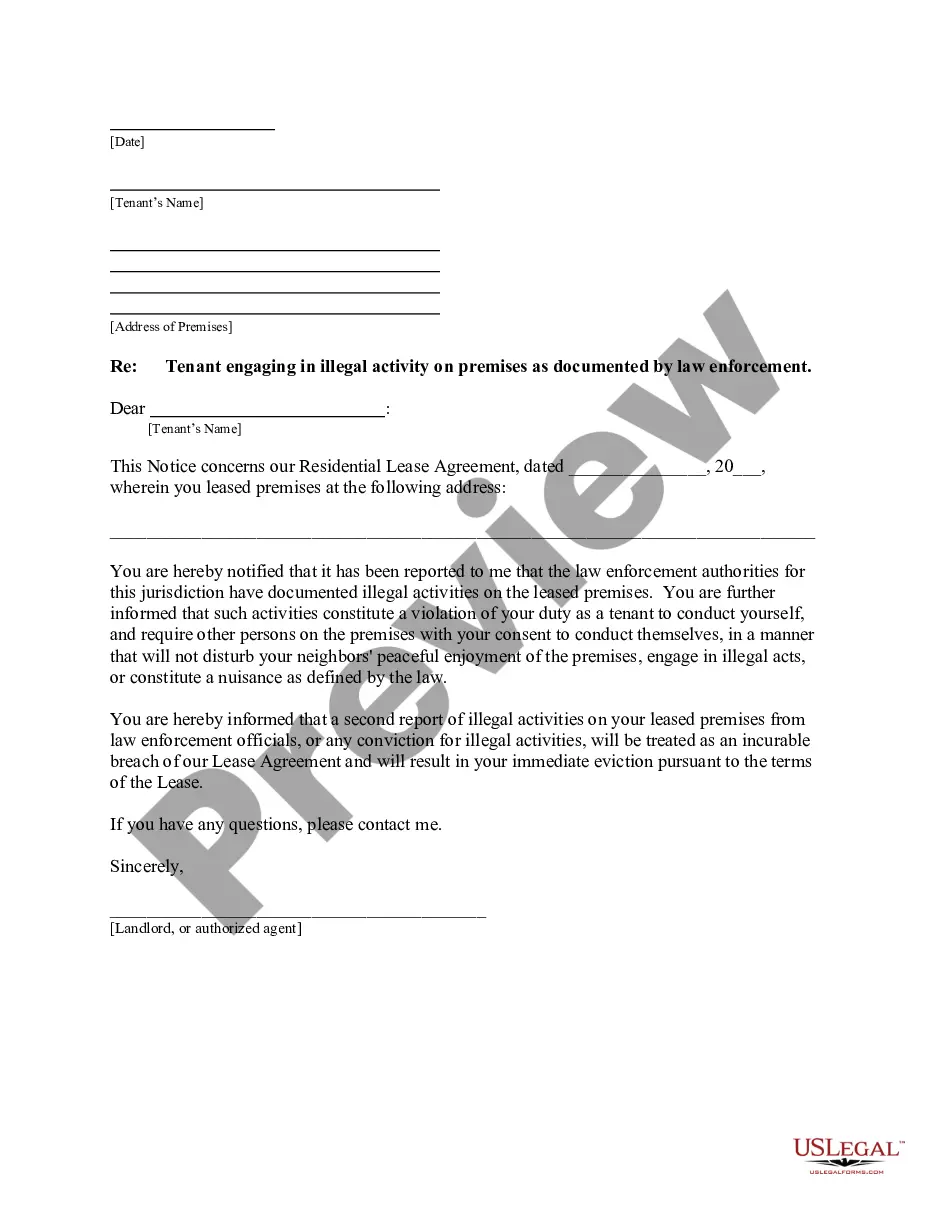

By agreeing to the loan, you permit the vehicle to serve as "collateral" that the creditor can repossess if you don't make your payments. If you can't afford to pay your loan, Illinois laws entitle the lender to take back the automobile as long as it is done in a way that does not breach the peace.

Under the Illinois vehicle code, lenders can repossess your car if you miss even one car payment. In some cases, your car loan agreement will give you more time.

You have the right to buy your car back after repossession. Sometimes repossession is unlawful if the creditor doesn't give you enough notice. For example, the creditor must give you at least 21 days to buy back, or redeem, your car after repossession. The police helped repossess your car.

In Illinois, Gov. J.B. Pritzker issued an executive order that suspended vehicle repossessions for as long as the state's disaster proclamation is in effect.

Repossession happens when your lender or leasing company takes your car away because you've missed payments on your loanand it can occur without warning if you've defaulted on your auto loan.