Illinois Letter Requesting Transfer of Property to Trust

Description

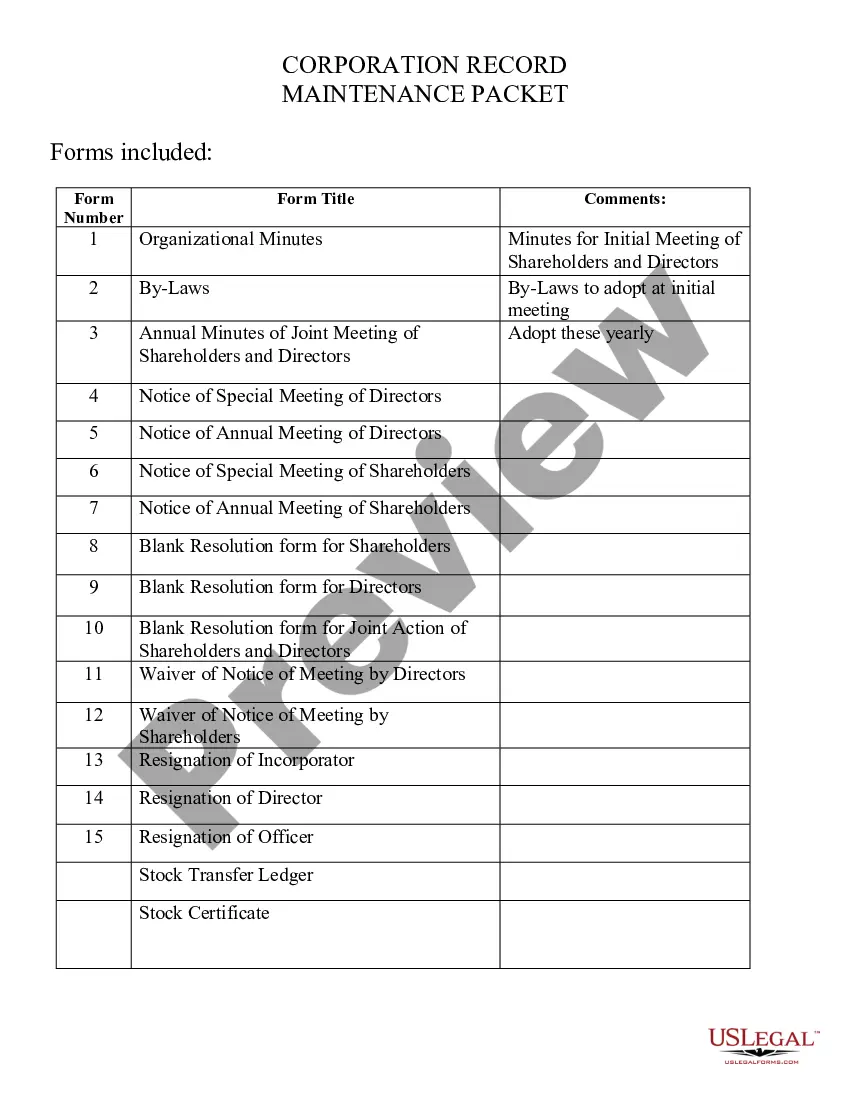

How to fill out Letter Requesting Transfer Of Property To Trust?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a variety of legal document templates that you can download or print. By utilizing the website, you will access thousands of forms for business and personal use, sorted by categories, states, or keywords.

You can find the latest versions of forms like the Illinois Letter Requesting Transfer of Property to Trust within minutes.

If you already have an account, Log In and download the Illinois Letter Requesting Transfer of Property to Trust from the US Legal Forms library. The Download button will appear on every form you review. You can access all previously downloaded forms under the My documents tab of your account.

Process the transaction. Use a credit card or PayPal account to complete the purchase.

Download the form to your device in the selected format. Edit. Complete, modify, print, and sign the downloaded Illinois Letter Requesting Transfer of Property to Trust. Every template you added to your account does not expire and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you require. Access the Illinois Letter Requesting Transfer of Property to Trust with US Legal Forms, the most extensive library of legal document templates. Use thousands of professional and state-specific templates that meet your personal or business needs and requirements.

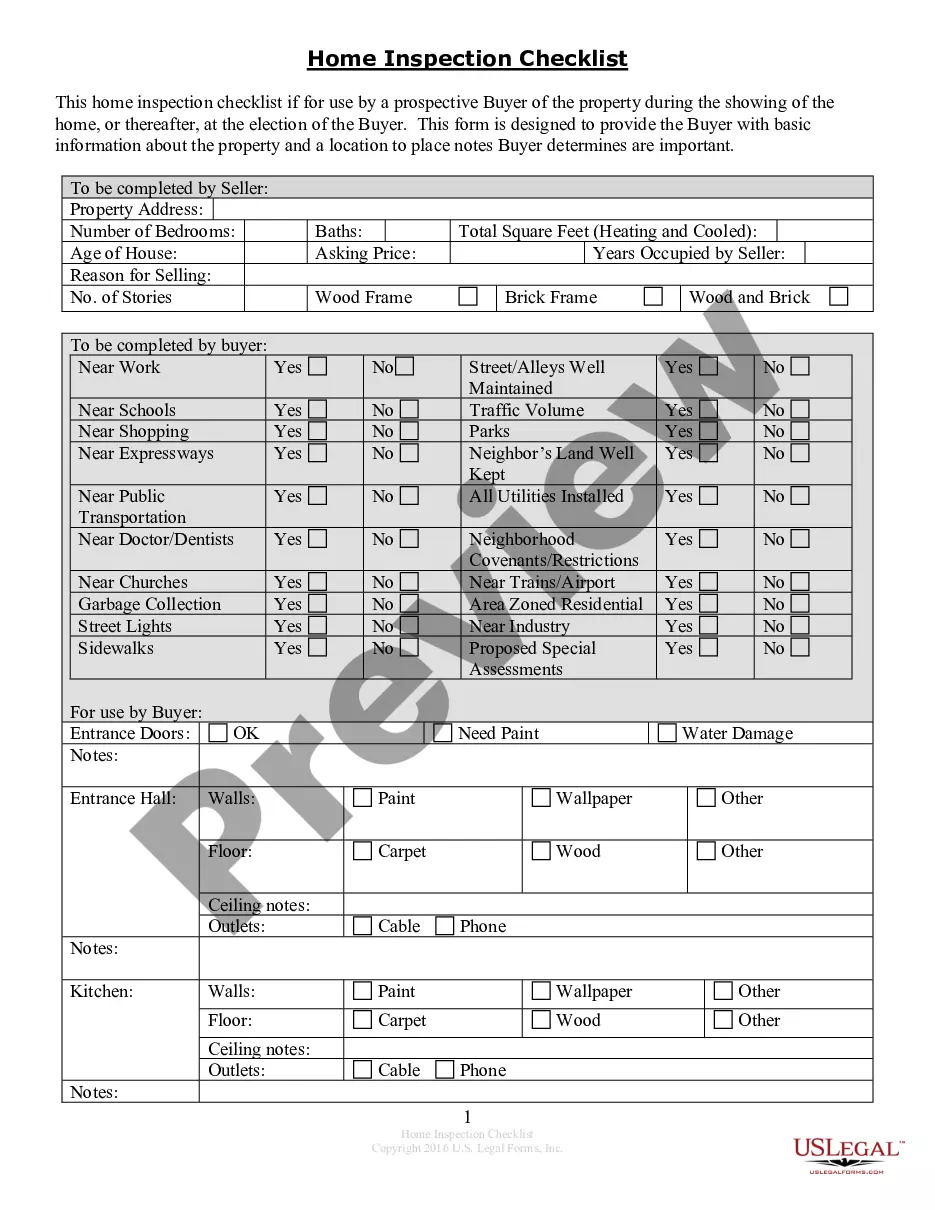

- Ensure you have selected the correct form for your city/county.

- Click the Preview button to check the form's content.

- Read the form description to confirm that you have selected the right form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, choose your preferred pricing plan and provide your credentials to register for the account.

Form popularity

FAQ

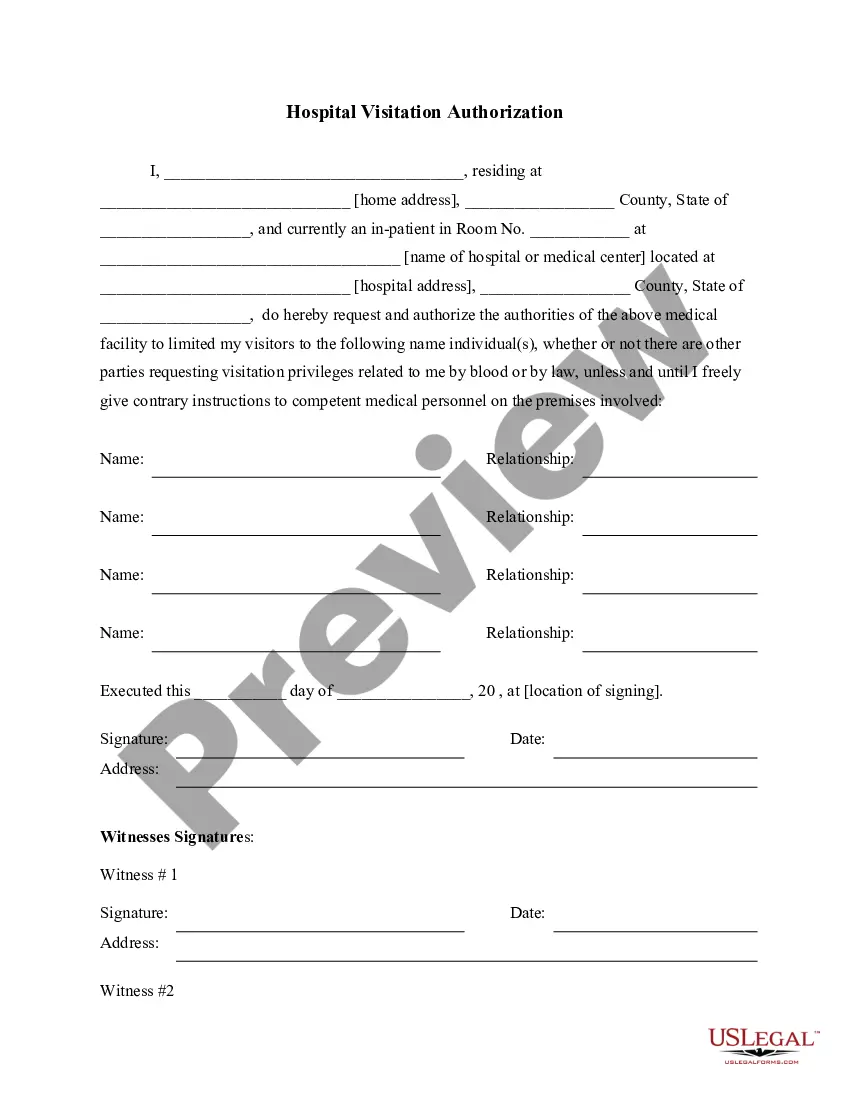

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

Property is often transferred into a trust as part of inheritance tax planning however the trust needs to meet certain conditions and to be set up correctly by a solicitor. By putting a property into trust rather than making an outright gift, you are able to control how the property is used after it is given away.

How to Transfer Assets Into an Irrevocable TrustIdentify Your Assets. Review your assets and determine which ones you would like to place in your trust.Obtain a Trust Tax Identification Number.Transfer Ownership of Your Assets.Purchase a Life Insurance Policy.

What Assets Should Go Into a Trust?Bank Accounts. You should always check with your bank before attempting to transfer an account or saving certificate.Corporate Stocks.Bonds.Tangible Investment Assets.Partnership Assets.Real Estate.Life Insurance.

Since your house has a title, you need to change the title to show that the property is now owned by the trust. To do this you need to prepare and sign a new deed to transfer ownership to you as trustee of the trust.

Basic revocable living Trusts may be included in a flat-fee estate planning package costing between $2,500 and $6,000. Revocable living Trusts help you bypass the costly and public probate process and can evolve into testamentary Trusts that allow you to control your assets long after you have departed this world.

Potential DisadvantagesEven modest bank or investment accounts named in a valid trust must go through the probate process. Also, after you die, your estate may face more expense, as the trust must file tax returns and value assets, potentially negating the cost savings of avoiding probate.

Mechanism of Transfer Real estate is transferred through the execution of the appropriate deed transferring the real estate property to the Trust. You or your attorney must then record the deed with the Recorder of Deeds for your county.

When you buy a home, you may have the option of buying it in a trust. Legally, that means the trust, rather than you, owns the home. However, you can be the trustee of the property and have significant control over it and what happens to it after you die.