The Illinois Marital-Deduction Residuary Trust with a Single Trust or and Lifetime Income and Power of Appointment in Beneficiary Spouse is a legal instrument designed to provide financial protection and benefits to a surviving spouse after the death of the trust or. This trust is specifically tailored to comply with the relevant laws and regulations in the state of Illinois. In this type of trust, a single individual referred to as the trust or granter establishes the trust and transfers assets into it. The trust assets may include various types of property, such as real estate, investments, business interests, or personal belongings, depending on the trust or's preferences and circumstances. The primary purpose of the trust is to provide income to the surviving spouse for the duration of their lifetime. The trust or can specify the terms and conditions under which the income is distributed, ensuring the financial well-being of the surviving spouse. This income can be derived from the trust's assets, such as rental income, dividends, interest, or distributions from investments. Additionally, the surviving spouse is granted a power of appointment. This power allows the spouse to have some control over how the trust assets are distributed upon their death. They can appoint beneficiaries and specify how much of the trust property each beneficiary will receive. This power gives the surviving spouse flexibility in estate planning and allows them to consider changing circumstances or family dynamics. It's worth noting that there might be different variations of the Illinois Marital-Deduction Residuary Trust with a Single Trust or and Lifetime Income and Power of Appointment in Beneficiary Spouse, as the terms and provisions can be customized according to the specific needs and objectives of the trust or. These variations may include the use of different types of assets, alternative income distribution methods, or additional conditions on the exercise of the power of appointment. In conclusion, the Illinois Marital-Deduction Residuary Trust with a Single Trust or and Lifetime Income and Power of Appointment in Beneficiary Spouse provides a comprehensive and flexible solution for married individuals in Illinois who want to ensure the financial security of their surviving spouse while retaining some control over the ultimate distribution of their assets.

Illinois Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

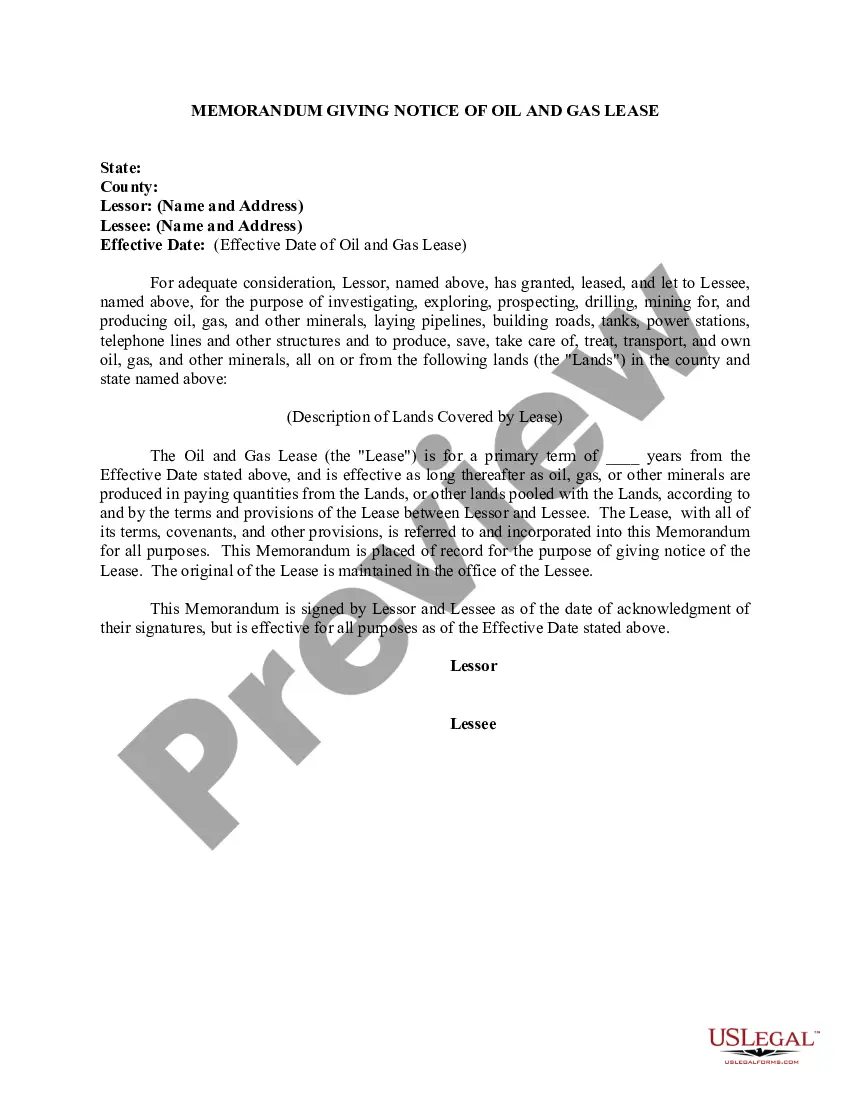

How to fill out Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

US Legal Forms - one of many biggest libraries of legal forms in America - provides a variety of legal papers templates you may download or print. Making use of the internet site, you may get 1000s of forms for organization and personal reasons, sorted by categories, states, or key phrases.You will discover the most recent variations of forms such as the Illinois Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse within minutes.

If you already possess a monthly subscription, log in and download Illinois Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse from the US Legal Forms local library. The Acquire switch will show up on every type you view. You have access to all earlier acquired forms from the My Forms tab of your accounts.

In order to use US Legal Forms for the first time, allow me to share basic recommendations to help you get started off:

- Make sure you have selected the best type for your personal city/county. Go through the Review switch to analyze the form`s articles. Browse the type outline to ensure that you have chosen the right type.

- In the event the type does not fit your specifications, utilize the Research field near the top of the display screen to find the one which does.

- When you are content with the shape, confirm your decision by clicking on the Buy now switch. Then, choose the pricing strategy you like and supply your qualifications to sign up to have an accounts.

- Approach the purchase. Make use of credit card or PayPal accounts to perform the purchase.

- Choose the formatting and download the shape in your product.

- Make adjustments. Load, modify and print and indicator the acquired Illinois Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse.

Every single design you added to your account lacks an expiry date and it is your own forever. So, in order to download or print one more duplicate, just visit the My Forms portion and then click about the type you require.

Obtain access to the Illinois Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse with US Legal Forms, one of the most comprehensive local library of legal papers templates. Use 1000s of specialist and status-particular templates that satisfy your company or personal requirements and specifications.

Form popularity

FAQ

The marital deduction is determinable from the overall gross estate. The total value of the assets passed on to the spouse is subtracted from that amount, giving us the marital deduction. This interspousal transfer can occur during the couple's lifetime or after one spouse's death, ing to a will.

In order to qualify the trust instrument must provide that at least one trustee be a United States citizen or domestic corporation, and that any distribution from the trust principal be subject to the United States trustee's right to withhold the estate tax due on the distribution.

A QTIP trust offers more control to the grantor but less control to the surviving spouse compared to marital trust. The surviving spouse cannot choose final beneficiaries and has limited control over the assets, receiving only trust income in ance with the IRS laws.

RESIDUARY TRUST. Unlike the Marital Trust, the Residuary Trust can provide for substantial flexibility and give broader discretion to the Trustee. This trust may be structured as a single trust for the benefit of all your descendants or separate trusts for each of your children (and such child's descendants).

A marital deduction trust is a trust where transfers of property between married partners are free of federal transfer tax. A marital deduction trust can take one of two forms: A life estate coupled with a general power of appointment given to the spouse, or. A Qualified Terminable Interest Property (QTIP) trust.

The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

A Marital Trust is created for the benefit of a spouse. At the same time, a Family Trust can be made for the benefit of any family member. Most marital trusts are irrevocable, whereas family trusts are usually revocable.

An example of when a marital trust might be used is when a couple has children from a previous marriage and wants to pass all property to the surviving spouse upon death, but also provide for their individual children.