Illinois Charitable Contribution Payroll Deduction Form

Description

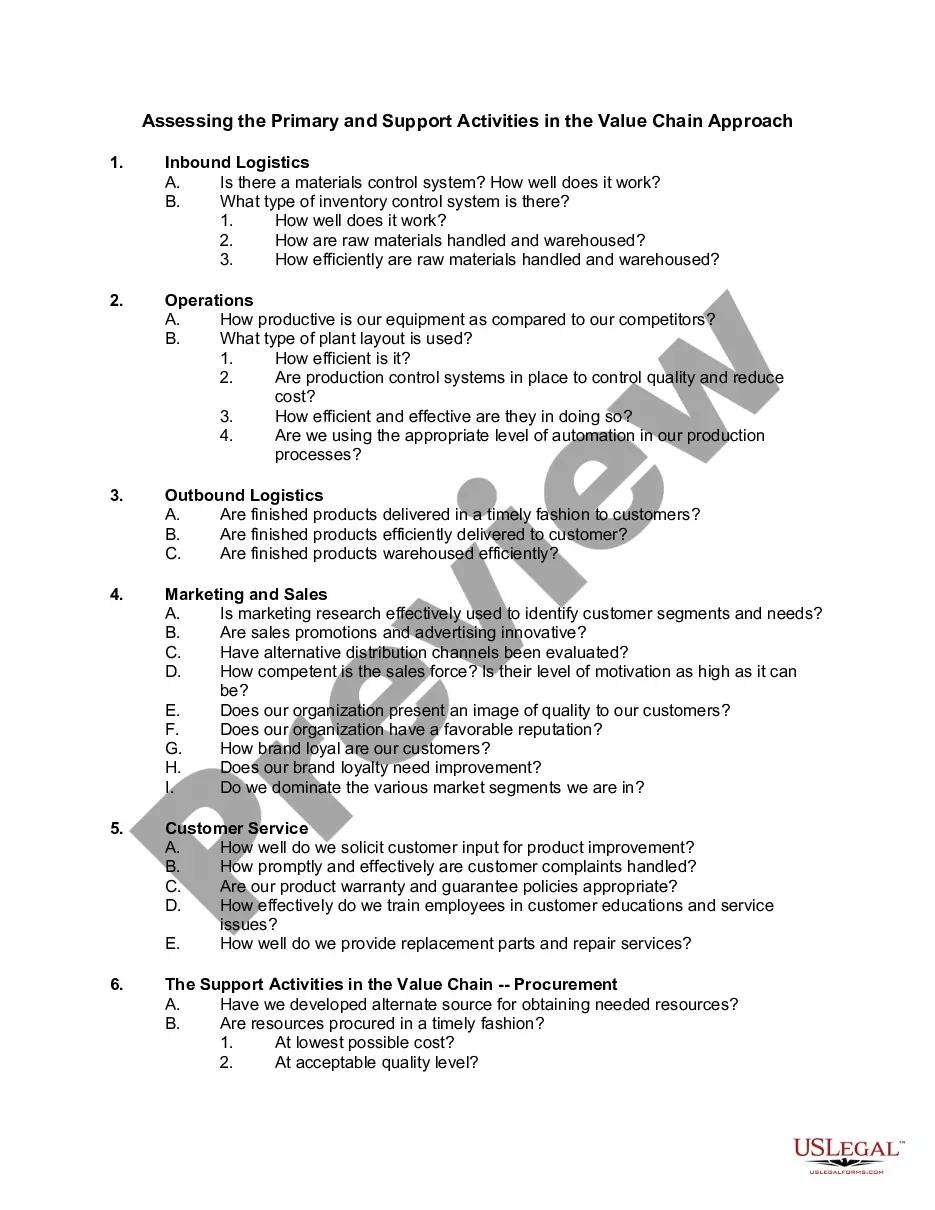

How to fill out Charitable Contribution Payroll Deduction Form?

You might spend hours online searching for the legal document template that meets the local and federal requirements you need. US Legal Forms offers thousands of legal documents that have been vetted by professionals.

You can download or print the Illinois Charitable Contribution Payroll Deduction Form from the platform.

If you currently possess a US Legal Forms account, you can Log In and then click the Download button. Afterwards, you can complete, modify, print, or sign the Illinois Charitable Contribution Payroll Deduction Form. Every legal document template you buy is yours indefinitely. To obtain another copy of any purchased form, navigate to the My documents section and click the corresponding button.

Select the file format of the document and download it to your device. Make any necessary modifications. You can complete, edit, sign, and print the Illinois Charitable Contribution Payroll Deduction Form. Acquire and print thousands of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the simple steps below.

- First, ensure that you have chosen the correct document template for the region/area of your preference. Review the form description to confirm you have selected the right one.

- If available, use the Preview button to examine the document template as well.

- If you wish to find another version of the form, utilize the Search field to locate the template that suits your needs and requirements.

- Once you find the template you desire, click Get now to proceed.

- Select the pricing plan you prefer, enter your information, and register for an account with US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to purchase the legal document.

Form popularity

FAQ

How to score a tax write-off for 2021 donations to charity if you don't itemize deductions. Single taxpayers can claim a tax write-off for cash charitable gifts up to $300 and married couples filing together may get up to $600 for 2021.

Just like last year, individuals, including married individuals filing separate returns, who take the standard deduction can claim a deduction of up to $300 on their 2021 federal income tax for their charitable cash contributions made to certain qualifying charitable organizations.

If you itemize deductions, you will be able to use the amount in Box 14 as a charitable deduction. Depending on the code you enter, the program may enter it automatically. Enter the Box 14 description/code from your Form W-2 in the first field in the row for Box 14 (e.g. NONTX PK).

However, in 2021, U.S. taxpayers can deduct up to $300 in charitable donations made this year, even if they choose to take the standard deduction. One donation of $300 may not move the needle much but multiplied across millions of donations; the impact for charities can be huge.

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. A corporation may deduct qualified contributions of up to 25 percent of its taxable income....To qualify, the contribution must be:a cash contribution;made to a qualifying organization;made during the calendar year 2020.

Taxpayers who take the standard deduction can claim a deduction of up to $300 for cash contributions to qualifying charities made in 2021.

By giving through recurring or one-time payroll deduction, your donation is automatically deducted from your paycheck, there are no extra fees and because employees' payroll donations come out of their after-tax earnings, their donation is tax-deductible.

Pre-tax deductions: Medical and dental benefits, 401(k) retirement plans (for federal and most state income taxes) and group-term life insurance. Mandatory deductions: Federal and state income tax, FICA taxes, and wage garnishments. Post-tax deductions: Garnishments, Roth IRA retirement plans and charitable donations.

Generally, you can only deduct charitable contributions if you itemize deductions on Schedule A (Form 1040), Itemized Deductions.

In general, you can deduct up to 60% of your adjusted gross income via charitable donations, but you may be limited to 20%, 30% or 50% depending on the type of contribution and the organization (contributions to certain private foundations, veterans organizations, fraternal societies, and cemetery organizations come