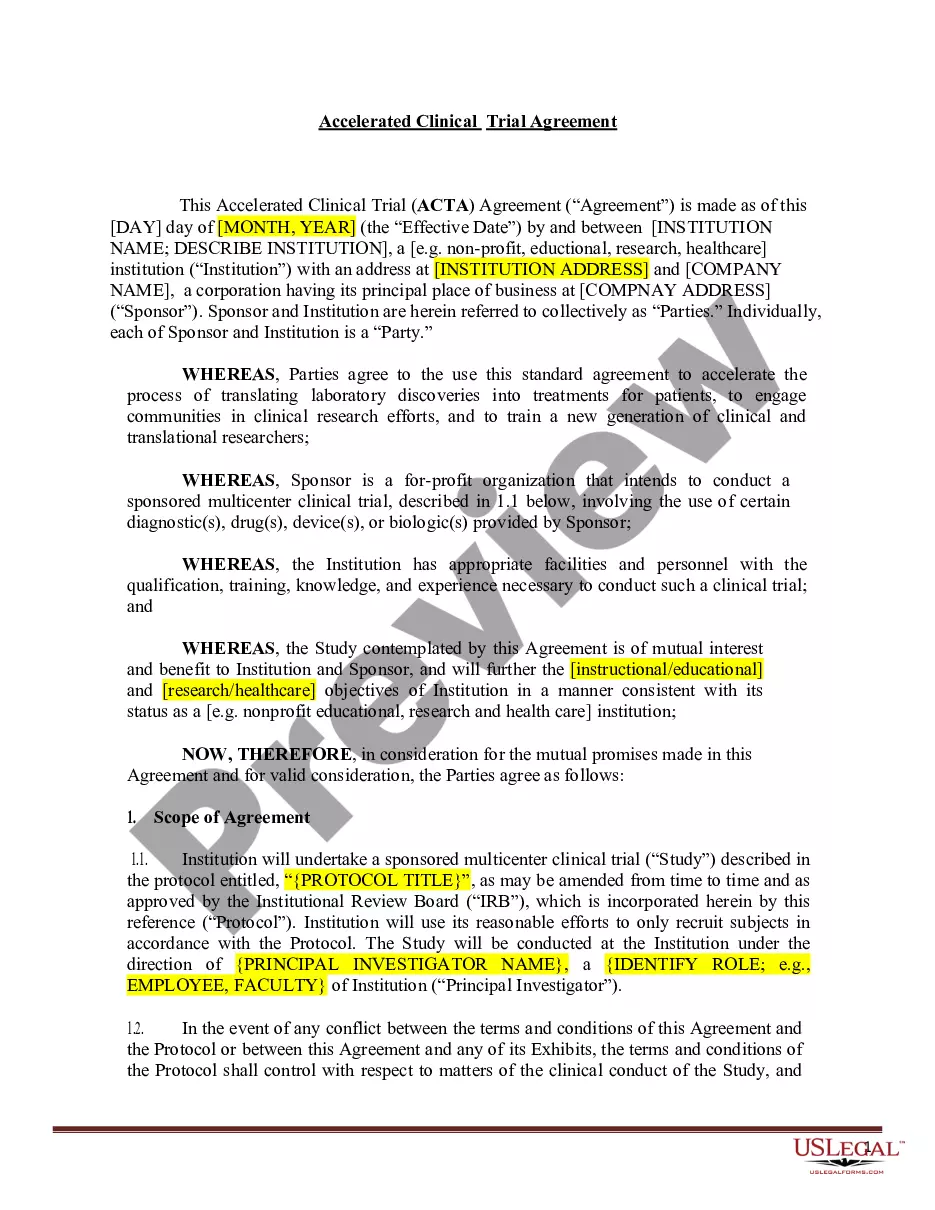

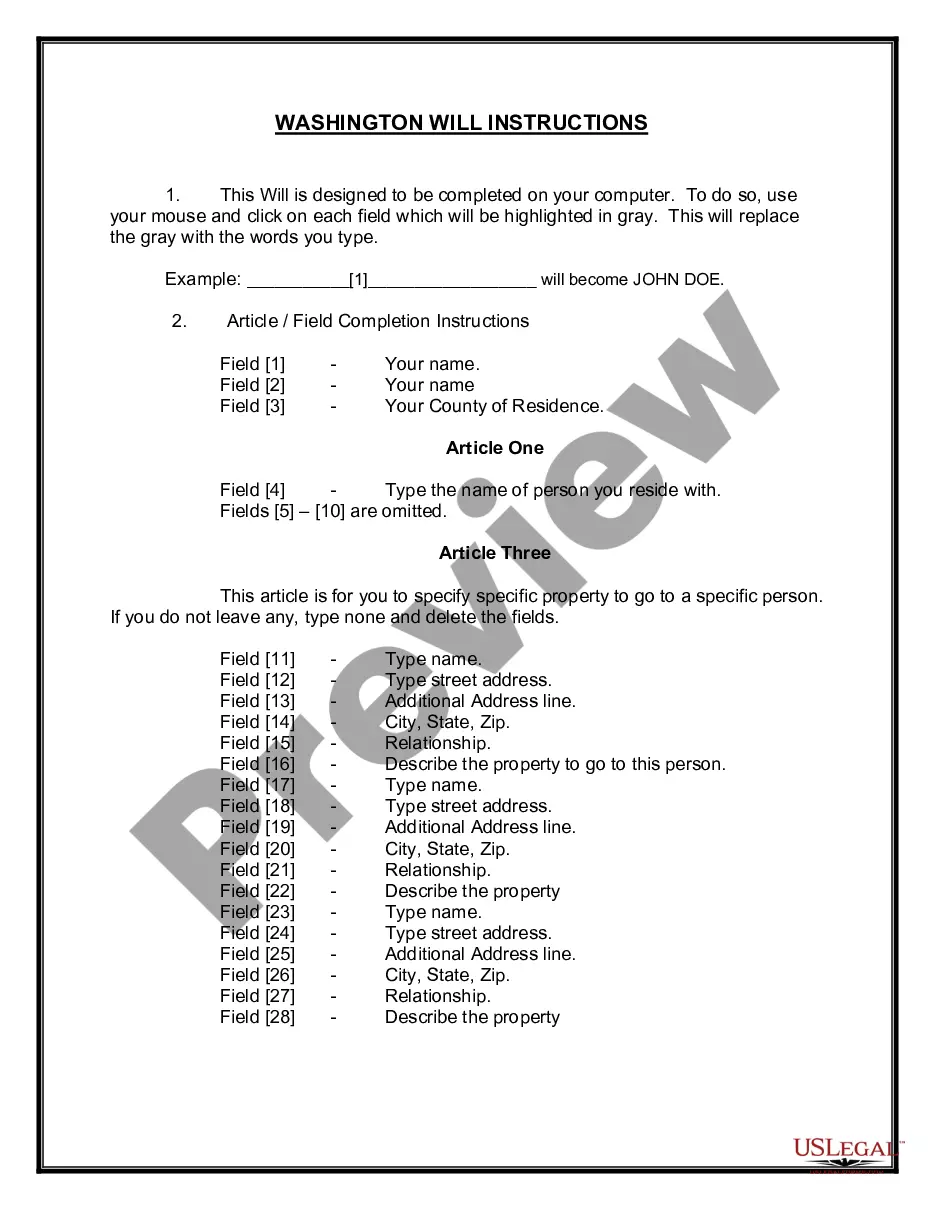

This form is a business type form that is formatted to allow you to complete the form using Adobe Acrobat or Word. The word files have been formatted to allow completion by entry into fields. Some of the forms under this category are rather simple while others are more complex. The formatting is worth the small cost.

Illinois Yearly Expenses by Quarter refers to the comprehensive breakdown of the expenses incurred by the state of Illinois on a quarterly basis throughout the year. These expenses encompass various sectors and departments, including education, healthcare, infrastructure, public safety, social services, and administration. The purpose of analyzing Illinois Yearly Expenses by Quarter is to gain insights into the state's financial performance, identify trends, make informed budgetary decisions, and ensure the efficient allocation of resources. By assessing the quarterly expenses, policymakers can evaluate the effectiveness of existing programs, prioritize funding for crucial areas, and plan for future needs. The different types of Illinois Yearly Expenses by Quarter can be broadly categorized as follows: 1. Education Expenses: This category includes costs related to primary, secondary, and higher education institutions in Illinois. It covers funding for schools, colleges, universities, research programs, scholarships, and other educational initiatives. 2. Healthcare Expenses: Illinois' healthcare expenses encompass expenditure on medical facilities, hospitals, clinics, public health programs, Medicaid, health insurance programs, public health emergencies, and initiatives to improve healthcare accessibility and quality. 3. Infrastructure Expenses: This category includes the costs associated with transportation systems, roads, bridges, public transit, airports, water and sewage systems, and other infrastructure development and maintenance projects. 4. Public Safety Expenses: Expenses here revolve around police departments, fire departments, emergency services, prisons, correctional facilities, crime prevention programs, and initiatives to ensure public safety and security. 5. Social Services Expenses: This category includes expenses directed towards providing essential social services to residents, such as welfare programs, child protection services, mental health services, disability assistance, and programs supporting vulnerable populations. 6. Administrative Expenses: Administrative expenses refer to the funds allocated for the day-to-day operations of the state government, including salaries of government employees, office space rentals, utilities, technology infrastructure, and general administrative support. Analyzing Illinois Yearly Expenses by Quarter allows policymakers and stakeholders to evaluate the state's financial performance, identify areas of potential savings or reallocation, and align budget priorities according to the needs of the citizens. The data obtained from this analysis assists in ensuring a transparent and accountable system of governance, focused on providing quality public services and equitable distribution of resources.