Illinois Shipping Reimbursement

Description

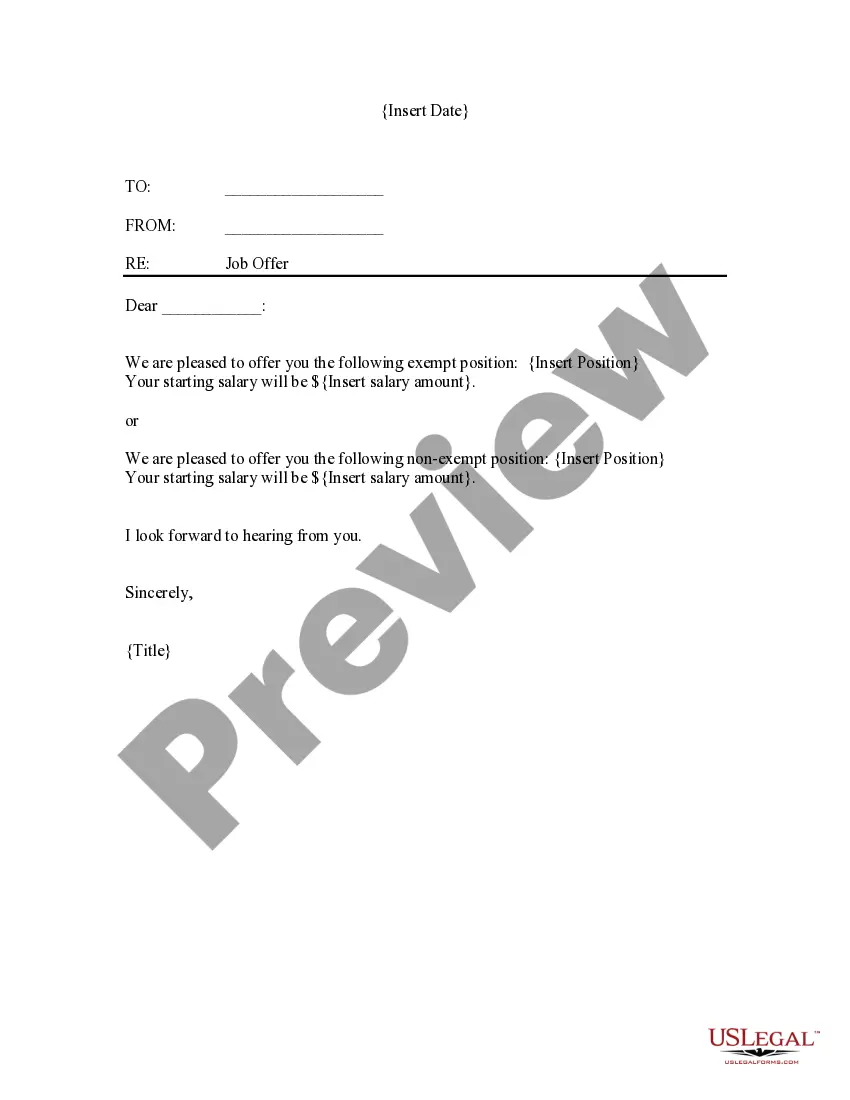

How to fill out Shipping Reimbursement?

Finding the appropriate legal document template can be challenging.

Indeed, there are numerous templates accessible online, but how do you find the legal form you require.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Illinois Shipping Reimbursement, which can be utilized for both business and personal purposes.

First, ensure that you have selected the correct form for your city/region. You can review the document using the Preview button and examine the document description to confirm this is indeed the right one for you.

- All of the documents are verified by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the Illinois Shipping Reimbursement.

- Use your account to search for the legal documents you have purchased previously.

- Visit the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions that you should follow.

Form popularity

FAQ

If the cost of shipping is separately stated and if the customer is offered the option of pickup or free shipping, then the shipping charges are not subject to Illinois sales tax.

If you can't get the support you need from the retailer in the form of a refund, repair or replacement, you can file a complaint with the company. If that still doesn't help, you can contact the Consumer Ombudsman. They'll aim to help resolve your dispute within 10 working days.

Can a Store Refuse to Give a Refund According to Federal Law? There are no federal laws that require a merchant to refund money unless the product they sell turns out to be defective, despite the federal consumer protection regulation enforced by the Federal Trade Commission (FTC).

United States While there are no federal refund laws in the US, many state laws don't legally require refunds, instead allowing businesses to set their own refund policy. In some states, not conspicuously displaying a no refund policy means customers are entitled to refunds.

You can get a full refund within 30 days. This is a nice new addition to our statutory rights. The Consumer Rights Act 2015 changed our right to reject something faulty, and be entitled to a full refund in most cases, from a reasonable time to a fixed period (in most cases) of 30 days.

California As long as they are stated separately on the invoice and not more than the actual cost of delivery, shipping charges are not subject to sales tax in California. Delivery must also be through a common carrier, and handling charge are taxable, so they must be listed separately as well.

You must offer a full refund if an item is faulty, not as described or does not do what it's supposed to. Check when you have to offer refunds and accept returns. Customers have exactly the same rights to refunds when they buy items in a sale as when they buy them at full price.

Illinois is an origin-based sales tax state. So if you live in Illinois, collecting sales tax is fairly easy. Collect sales tax at the tax rate where your business is located. You can look up your local sales tax rate with TaxJar's Sales Tax Calculator.

For taxable sales, delivery and shipping charges that are included in the sale price are generally subject to state sales tax. Sellers can only separately state the delivery charge if the buyer can avoid it (i.e., by picking up the goods). Different rules may apply for local sales tax.

If the buyer's billing address or event is in one of 14 states with consumer laws around refund then the customer still can receive a refund. That includes includes California, Connecticut, Florida, Hawaii, Maryland, Massachusetts, Minnesota, New Jersey, New York, Ohio, Rhode Island, Utah, and Virginia.