Illinois Notice of Meeting of LLC Members To Consider Dissolution of the Company

Description

How to fill out Notice Of Meeting Of LLC Members To Consider Dissolution Of The Company?

Are you currently within a situation that you need to have paperwork for possibly enterprise or personal purposes virtually every day? There are a variety of lawful papers templates accessible on the Internet, but locating kinds you can rely isn`t simple. US Legal Forms delivers 1000s of type templates, such as the Illinois Notice of Meeting of LLC Members To Consider Dissolution of the Company, which can be created to meet federal and state needs.

In case you are presently acquainted with US Legal Forms web site and possess a free account, basically log in. Next, it is possible to obtain the Illinois Notice of Meeting of LLC Members To Consider Dissolution of the Company web template.

If you do not offer an bank account and would like to begin to use US Legal Forms, adopt these measures:

- Obtain the type you will need and ensure it is for that right town/region.

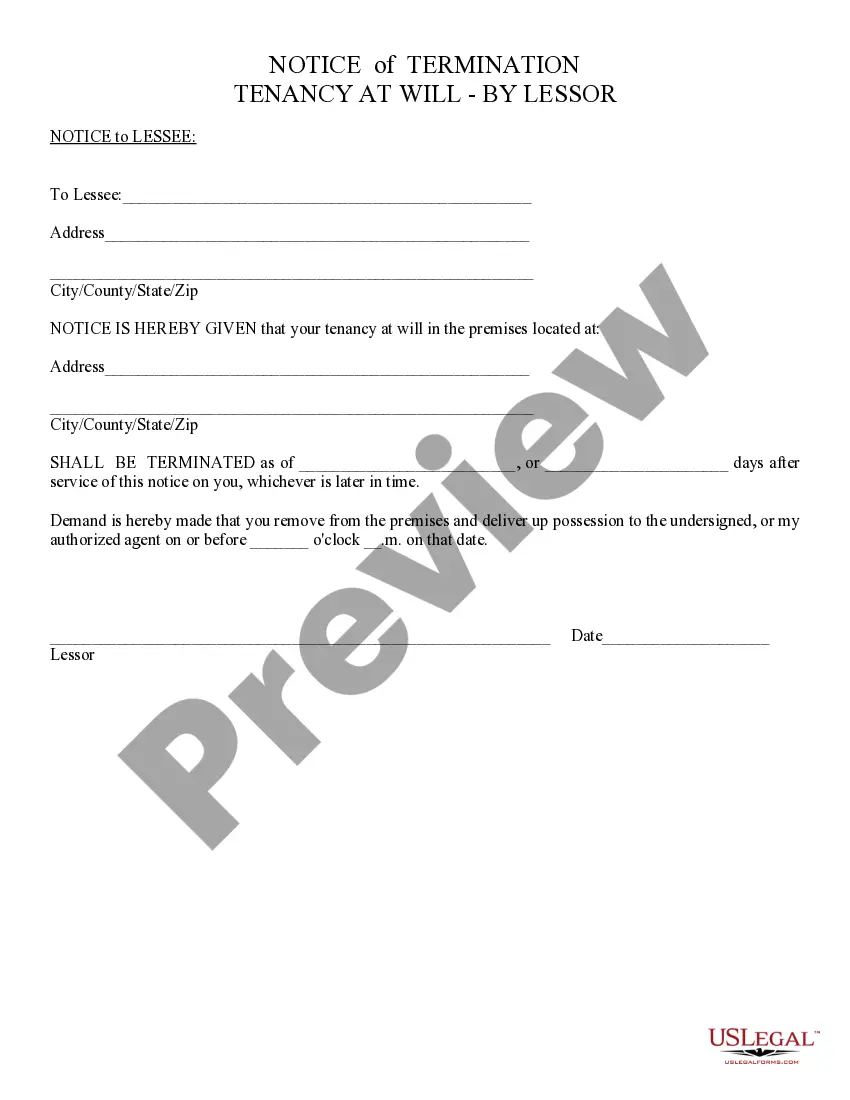

- Make use of the Preview button to check the form.

- Read the explanation to actually have selected the appropriate type.

- When the type isn`t what you`re seeking, make use of the Research discipline to obtain the type that meets your needs and needs.

- Whenever you discover the right type, simply click Acquire now.

- Opt for the costs prepare you want, complete the required information to create your bank account, and pay money for an order utilizing your PayPal or credit card.

- Choose a practical file format and obtain your copy.

Locate all the papers templates you may have purchased in the My Forms food list. You can obtain a additional copy of Illinois Notice of Meeting of LLC Members To Consider Dissolution of the Company at any time, if possible. Just click the necessary type to obtain or produce the papers web template.

Use US Legal Forms, probably the most comprehensive variety of lawful types, to save lots of time and stay away from faults. The service delivers skillfully created lawful papers templates which you can use for a range of purposes. Generate a free account on US Legal Forms and begin producing your daily life a little easier.

Form popularity

FAQ

To dissolve/terminate your domestic LLC in Illinois, you must submit the completed form LLC-35-15, Statement of Termination in duplicate to the Illinois Secretary of State by mail or in person along with the filing fee.

Dissolution is the first step in the termination process is to dissolve the LLC. Although some people confuse dissolution and termination, dissolution does not terminate an LLC's existence. What it does is change the purpose of its existence.

By dissolving an LLC properly, it means that the LLC is no longer a legal business entity so you won't be expected to pay any fees or taxes, or file any more documents. Despite no longer operating, it is possible for members to create a new LLC and run it in the same way as the dissolved company.

Dissolution of corporation refers to the closing of a corporate entity which can be a complex process. Ending a corporation becomes more complex with more owners and more assets.

To dissolve an LLC in Illinois, simply follow these three steps: Follow the Operating Agreement. Close Your Business Tax Accounts....Step 1: Follow Your Illinois LLC Operating Agreement.Step 2: Close Your Business Tax Accounts.Step 3: File Articles of Dissolution.

How to Dissolve an LLCConfirm the Company Is in Good Standing.Hold a Vote to Dissolve the Business.File LLC Articles of Dissolution.Notify the Company's Stakeholders.Cancel Business Licenses and Permits.File the LLC's Final Payroll Taxes.Pay Final Sales Tax.File Final Income Tax Returns.More items...?19-Oct-2021

Closing Correctly Is ImportantOfficially dissolving an LLC is important. If you don't, you can be held personally liable for the unpaid debts and taxes of the LLC. A few additional fees you should look for; Many states also levy a fee against LLCs each year.

Your filing usually will be processed in a week to 10 days. Expedited processing is available for an additional fee by in-person request in Chicago or Springfield. An articles of dissolution form is available for download from the SOS website.