The Illinois Resolution of Meeting of LLC Members to Sell Assets is a legal document that outlines the decision-making process and approval required for members of a limited liability company (LLC) in the state of Illinois to sell the assets of the company. This resolution is typically used when the members of an LLC decide to pursue selling the assets rather than continuing business operations. The resolution begins by stating the purpose of the meeting, which is to discuss and vote upon the sale of the LLC’s assets. It then identifies the members present or participating in the meeting, along with their voting interests in the company. This information is crucial as the resolution requires a certain percentage of member approval for the sale to proceed. The resolution then outlines the details of the proposed asset sale, including the assets to be sold, the terms and conditions of the sale, and any other relevant agreements or arrangements that need to be executed for the sale to be finalized. It may also include provisions for any necessary filings or approvals required by state or federal authorities. In addition, the resolution specifies the voting requirements for approving the sale. Different classes of LLC members may have different voting rights, and the resolution will outline the percentage of member approval needed for the resolution to pass. For example, it may state that a two-thirds majority or unanimous consent is required for the sale to be approved. Furthermore, the Illinois Resolution of Meeting of LLC Members to Sell Assets may have variations based on the specific circumstances of the asset sale. For instance, there may be a resolution specifically for the sale of real estate assets, intellectual property assets, or tangible assets like equipment and inventory. Each variation will include the necessary provisions and considerations unique to the particular type of asset being sold. It is important to note that this document must adhere to the requirements set forth by the Illinois Limited Liability Company Act and the LLC’s operating agreement. Consulting an attorney or legal professional with expertise in LLC matters is advisable to ensure compliance and a smooth transaction process. In summary, the Illinois Resolution of Meeting of LLC Members to Sell Assets is a critical legal document that sets the guidelines and necessary approvals for LLC members to sell assets. It serves as a record of the decision-making process, ensuring proper governance and protection for all members involved.

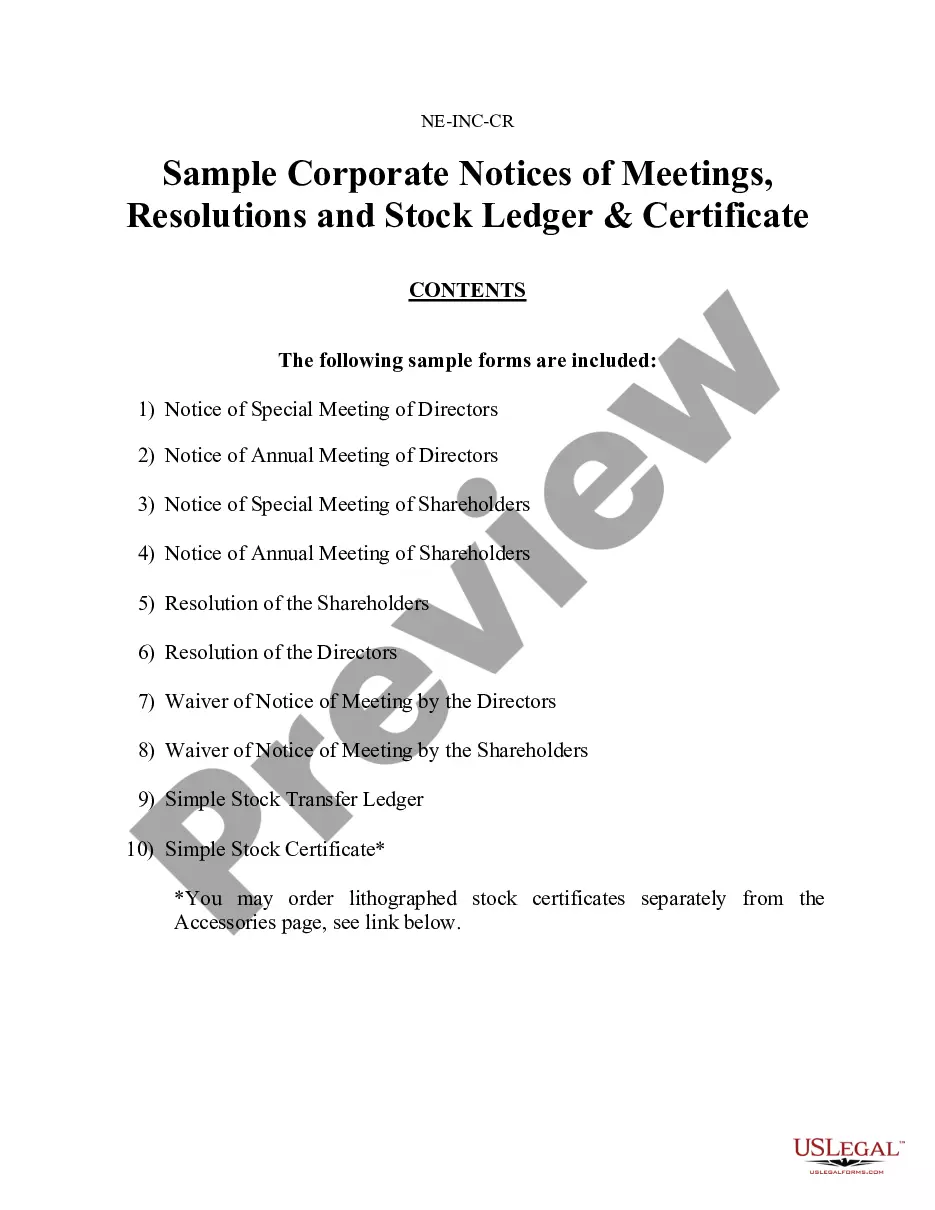

Company Property Issuance Form

Description

How to fill out Illinois Resolution Of Meeting Of LLC Members To Sell Assets?

Are you presently within a position in which you need paperwork for possibly company or specific uses almost every day time? There are plenty of legitimate papers themes accessible on the Internet, but getting kinds you can trust isn`t straightforward. US Legal Forms provides a large number of form themes, like the Illinois Resolution of Meeting of LLC Members to Sell Assets, that are composed to fulfill federal and state needs.

If you are presently knowledgeable about US Legal Forms internet site and have a free account, basically log in. Next, you may obtain the Illinois Resolution of Meeting of LLC Members to Sell Assets template.

Should you not have an account and need to begin using US Legal Forms, adopt these measures:

- Find the form you will need and ensure it is to the right metropolis/county.

- Make use of the Preview button to analyze the shape.

- Read the explanation to ensure that you have chosen the right form.

- In case the form isn`t what you are looking for, make use of the Research discipline to get the form that suits you and needs.

- When you discover the right form, just click Acquire now.

- Choose the costs prepare you would like, fill in the necessary information to make your account, and pay money for an order using your PayPal or credit card.

- Select a handy data file file format and obtain your copy.

Find every one of the papers themes you possess bought in the My Forms menu. You may get a further copy of Illinois Resolution of Meeting of LLC Members to Sell Assets anytime, if possible. Just click the necessary form to obtain or printing the papers template.

Use US Legal Forms, probably the most considerable collection of legitimate types, to save lots of time and avoid faults. The services provides appropriately created legitimate papers themes that can be used for a range of uses. Produce a free account on US Legal Forms and begin making your life a little easier.

Form popularity

FAQ

Any LLC member can propose a resolution, but all members must vote on it. Typically a majority of the members is needed to pass the resolution, but each LLC may have different voting rights. Some LLCs give a different value to each member's vote based on their percentage of interest in the company.

An LLC resolution is a document describing an action taken by the managers or owners of a company, with a statement regarding the issue that needs to be voted on. This does not need to be a complicated document, and need only include necessary information.

LLC authorization to sign is generally assigned to a managing member who has the authority to sign binding documents on behalf of the LLC. When signing, the managing member must clarify if the signature is as an individual or in their capacity to sign as the representative of the LLC.

An LLC member resolution is the written record of a member vote authorizing a specific business action. Formal resolutions aren't necessary for small, everyday decisions. However, they're useful for granting authority to members to transact significant business actions, such as taking out a loan on behalf of the LLC.

Any LLC member can propose a resolution, but all members must vote on it. Typically a majority of the members is needed to pass the resolution, but each LLC may have different voting rights. Some LLCs give a different value to each member's vote based on their percentage of interest in the company.

An LLC Corporate Resolution Form is a document that describes the management and decision-making processes of the LLC. While LLCs are generally not required to draft a resolution form, it is highly beneficial and important for all businesses to draft corporate resolutions.

How to Sell Your LLC and Transfer Complete OwnershipReview your Operating Agreement and Articles of Organization.Establish What Your Buyer Wants to Buy.Draw Up a Buy-Sell Agreement with the New Buyer.Record the Sale with the State Business Registration Agency.

With a SMLLC, you'd only use a resolution to document the most important business matters or actions such as: buying or selling real estate. getting a loan, establishing a bank account, or otherwise working with a financial institution.

The state of Illinois doesn't require LLCs to have an LLC operating agreement, but it's highly recommended. The operating agreement is a legally binding document that breaks down the management structure of the LLC and each owner's duties and profit share.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...