Illinois Collections Coordinator Checklist is a comprehensive guide designed to assist collections coordinators in effectively managing debt collection processes in the state of Illinois. This checklist serves as a valuable resource, providing step-by-step instructions, essential tasks, and relevant guidelines to ensure adherence to state regulations and maximized collections efficiency. From initiating the collection process to handling legal procedures, the Illinois Collections Coordinator Checklist covers every aspect of debt recovery. Some key tasks covered in the Illinois Collections Coordinator Checklist include: 1. Research and Compliance: — Conducting thorough research to verify debt details and relevancy. — Ensuring compliance with Illinois debt collection laws and regulations. — Gathering all necessary documentation and information required for debt recovery. 2. Communication and Outreach: — Developing effective communication strategies for reaching out to debtors. — Utilizing various modes of communication, such as phone calls, emails, and letters. — Establishing professional and respectful relationships with debtors to facilitate successful negotiations and payment arrangements. 3. Documentation and Record-Keeping: — Maintaining accurate and up-to-date records of all debt collection activities. — Recording details of communication with debtors, including dates, times, and outcomes. — Properly storing all supporting documentation related to the debt. 4. Negotiation and Settlement: — Initiating negotiations with debtors to achieve mutually beneficial settlement agreements. — Determining suitable payment plans and schedules that align with debtors' financial capabilities. — Documenting settlement terms and ensuring compliance from the debtor's end. 5. Legal Procedures: — Identifying situations that require legal intervention, such as non-responsive or uncooperative debtors. — Initiating legal proceedings, including filing lawsuits, obtaining judgments, and enforcing liens. — Coordinating with legal counsel and external agencies to handle complex legal cases effectively. Different types of Illinois Collections Coordinator Checklists may exist, catering to specific industries or debt collection sectors. For instance: 1. Medical Collections Coordinator Checklist: Tailored to healthcare providers or institutions dealing with medical debt collections. 2. Financial Services Collections Coordinator Checklist: Focused on debt collection procedures in the banking or financial sectors. 3. Small Business Collections Coordinator Checklist: Designed for small business owners or entrepreneurs managing their own debt collections. Regardless of the specific checklist, the ultimate goal remains the same — to guide collections coordinators through the debt collection process, ensure compliance with Illinois laws, and maximize successful debt recovery outcomes.

Illinois Collections Coordinator Checklist

Description

How to fill out Illinois Collections Coordinator Checklist?

If you wish to total, download, or print out legitimate papers themes, use US Legal Forms, the greatest assortment of legitimate kinds, that can be found on the web. Use the site`s simple and easy handy research to get the papers you will need. Numerous themes for organization and person reasons are categorized by types and claims, or keywords. Use US Legal Forms to get the Illinois Collections Coordinator Checklist in a number of clicks.

If you are currently a US Legal Forms customer, log in for your accounts and then click the Down load option to obtain the Illinois Collections Coordinator Checklist. Also you can access kinds you in the past delivered electronically from the My Forms tab of your respective accounts.

Should you use US Legal Forms the very first time, refer to the instructions listed below:

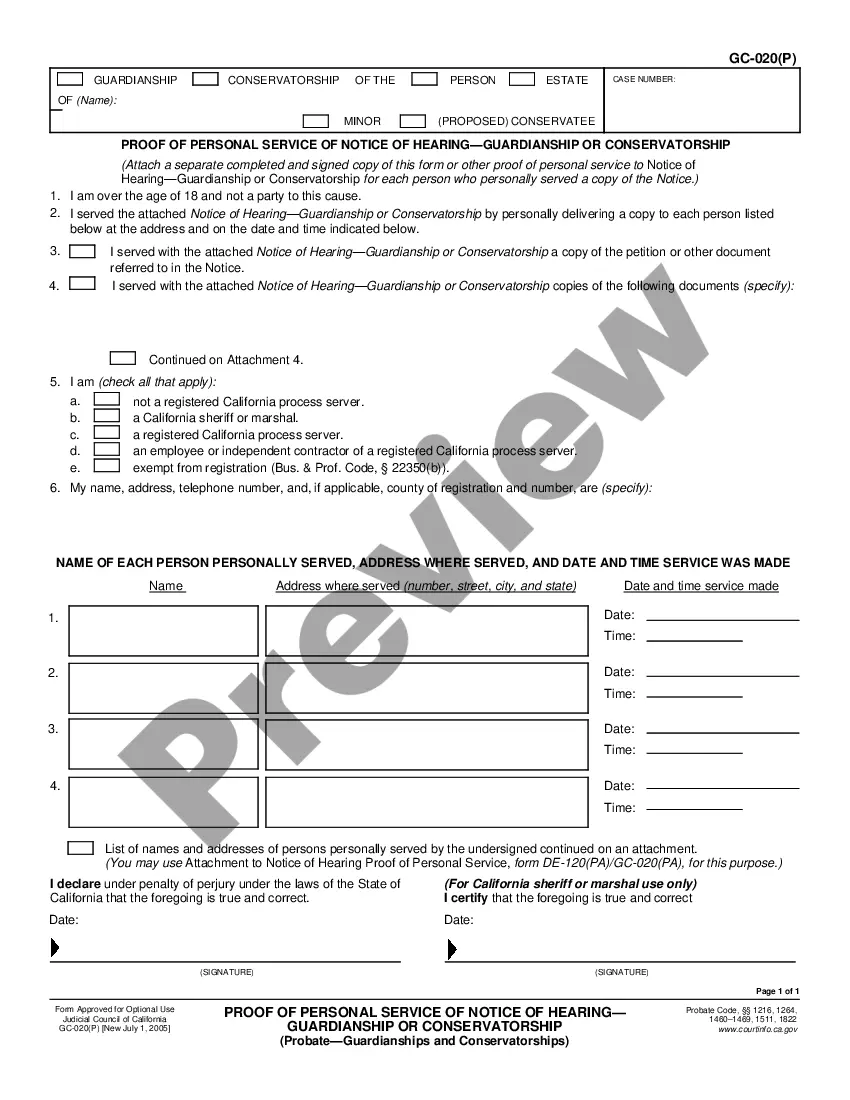

- Step 1. Be sure you have selected the shape to the appropriate city/land.

- Step 2. Make use of the Review solution to look over the form`s articles. Never overlook to read the explanation.

- Step 3. If you are unhappy using the kind, take advantage of the Look for discipline near the top of the monitor to find other variations in the legitimate kind design.

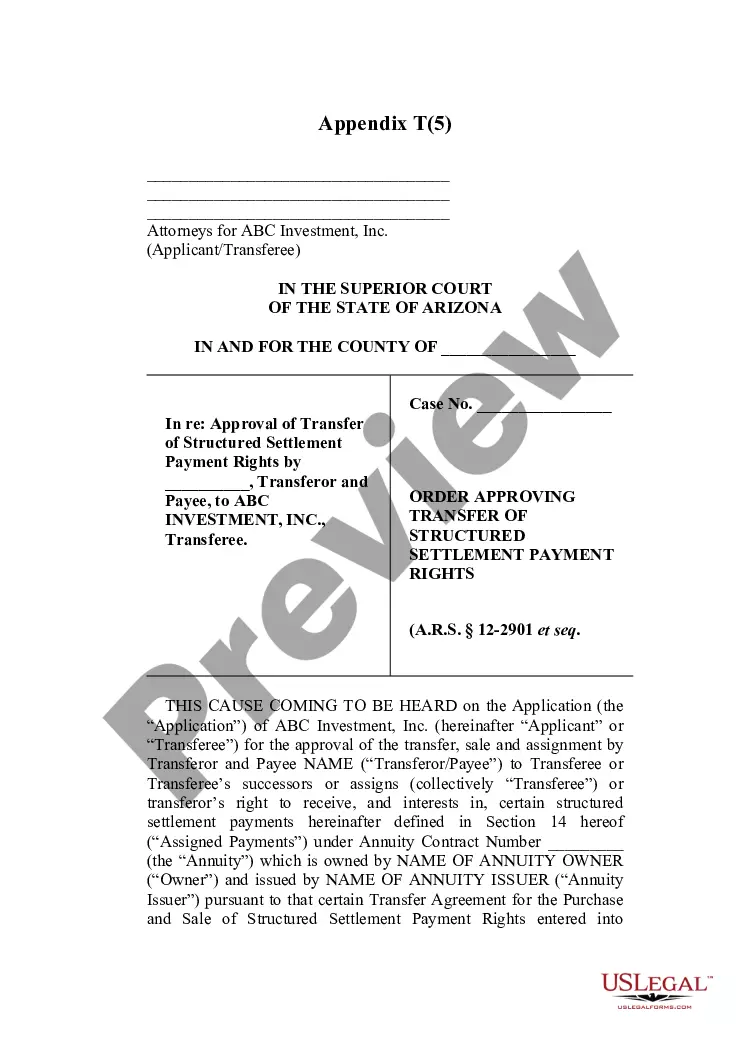

- Step 4. When you have discovered the shape you will need, click on the Buy now option. Choose the prices prepare you prefer and put your qualifications to sign up on an accounts.

- Step 5. Procedure the transaction. You can use your bank card or PayPal accounts to finish the transaction.

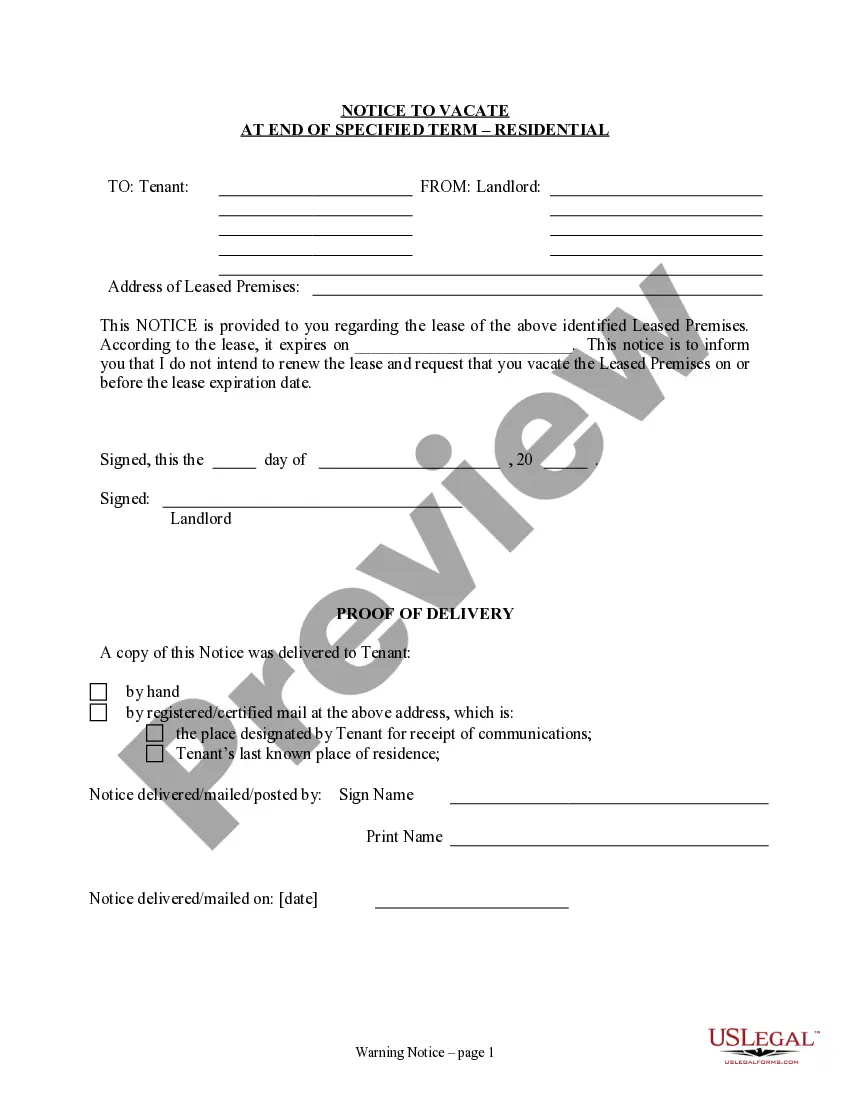

- Step 6. Select the structure in the legitimate kind and download it on the device.

- Step 7. Comprehensive, edit and print out or indicator the Illinois Collections Coordinator Checklist.

Every legitimate papers design you buy is yours for a long time. You might have acces to every single kind you delivered electronically in your acccount. Select the My Forms area and select a kind to print out or download yet again.

Remain competitive and download, and print out the Illinois Collections Coordinator Checklist with US Legal Forms. There are thousands of specialist and condition-certain kinds you can utilize for your organization or person needs.

Form popularity

FAQ

Credit collectors, also known as bill and account collectors, are primarily responsible for helping companies get paid. Their job description entails tracking down people who owe money from overdue bills and negotiating repayment.

Collections Specialist/Customer Service RepresentativeNegotiate repayment plans on outstanding debt from customers for national financial institutions. Ability to communicate and negotiate with a variety of customers in various financial situations.

A collection representative holds an entry-level position with a debt collection company, although some larger corporations may use collectors as part of an accounts receivable department. Collection representatives contact past-due debtors and attempt to secure payment for amounts owed.

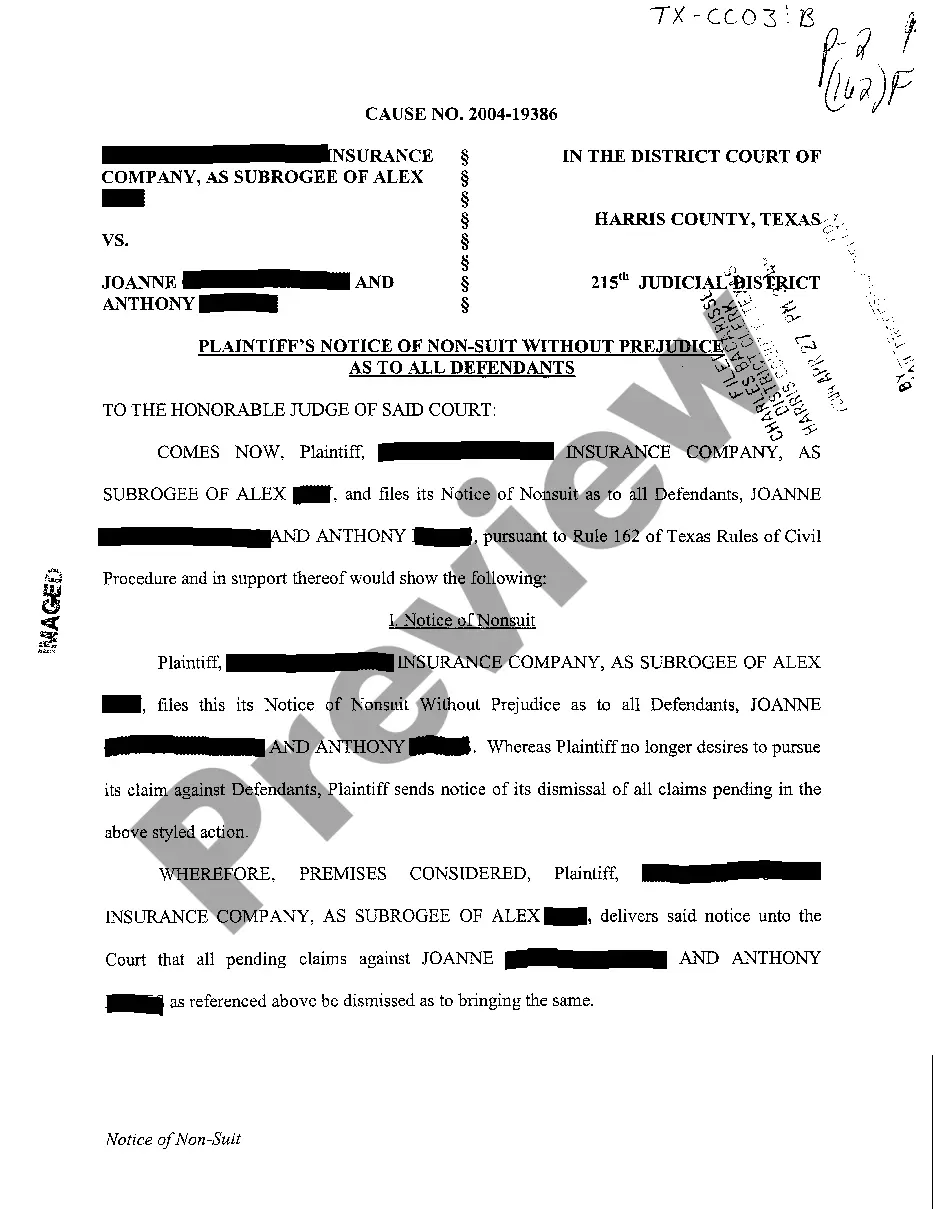

What Do Collections Coordinators Do? Identify and communicate with customers with delinquent accounts by mail, phone, etc. Work out terms for payment or initiates other actions as necessary. Ensure collections operations function smoothly and effectively.

Debt Collector skills and qualificationsOffice and database software skills.Negotiation and conflict resolution skills.Speaking and listening skills.Multi-tasking and time management skills.Prioritization skills.Knowledge of relevant legal requirements.Ability to work independently.Attention to detail.

Collections Representative I is responsible for initiating calls with delinquent customers by phone, mail or personal visit to collect payments and settle accounts. Follows-up delinquent accounts, updates and maintains accurate financial records including accounting, receivable, and credit records.

Collector Requirements:High School Diploma, GED, or suitable equivalent.Previous work experience in customer service, sales, collections or related field.1+ years telemarketing experience preferred.Excellent knowledge of collection processes.Excellent verbal communication, negotiation and people skills.More items...

ResponsibilitiesKeep track of assigned accounts to identify outstanding debts.Plan course of action to recover outstanding payments.Locate and contact debtors to inquire of their payment status.Negotiate payoff deadlines or payment plans.Handle questions or complaints.Investigate and resolve discrepancies.More items...

The Top 8 Characteristics of Successful Collection AgentsGreat Listener. This holds true for most successful people.Understands How to Overcome Objections.Gets Past the Gatekeeper.Closes the Deal.Comfortable Communicator.Creative Problem Solver.Balances Empathy with Collections.Competitive.

Collections can be a stressful job. As a collection agent you're dealing with intimate details of people's businesses and their lives. You occasionally hear disturbing stories, and are faced with difficult decisions. Few people are happy to get a call from a collection agent and some are downright cruel or threatening.