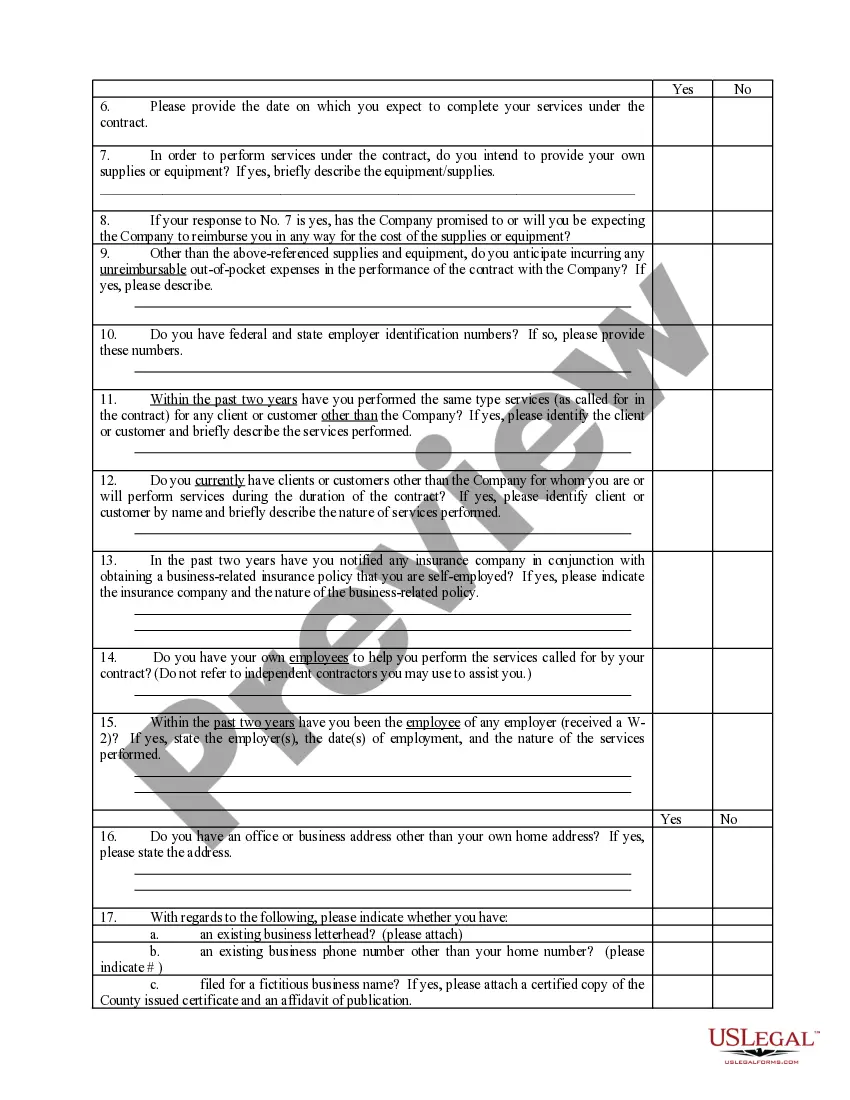

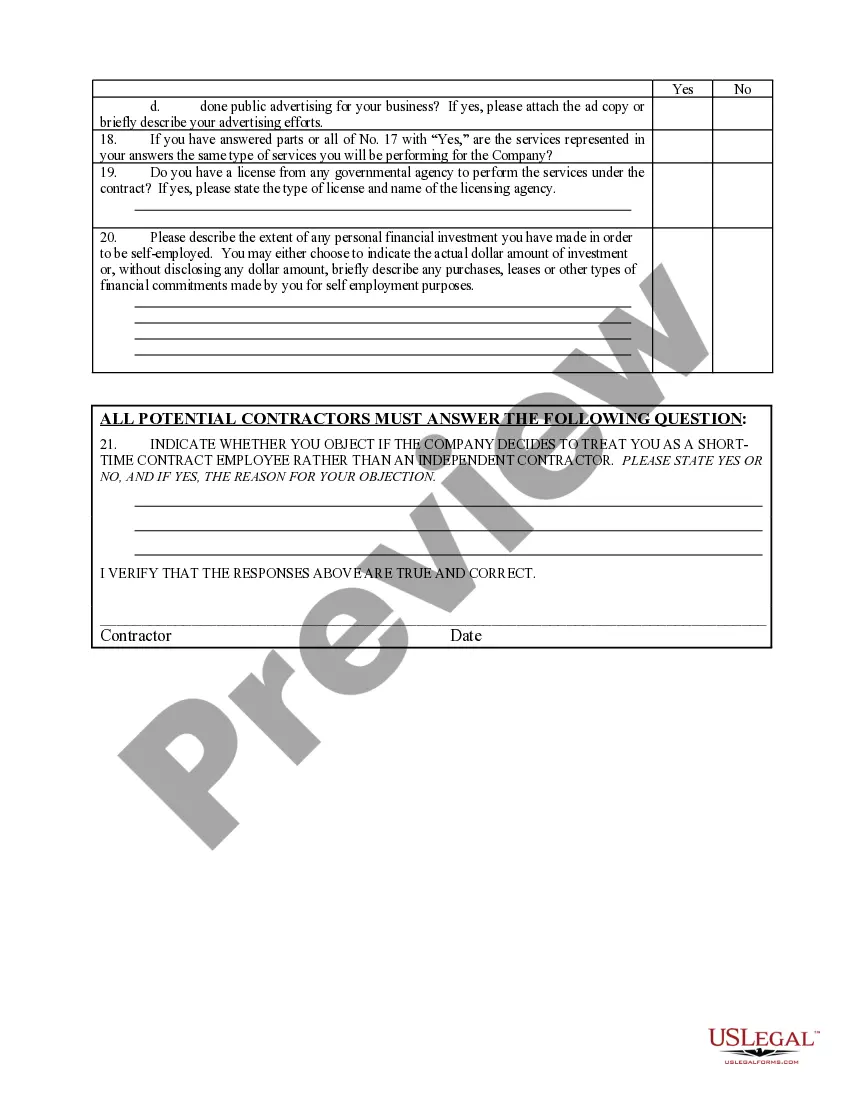

The Illinois Self-Employed Independent Contractor Questionnaire is a document used in the state of Illinois to determine whether an individual should be classified as an independent contractor or an employee for tax and employment purposes. This questionnaire helps the Illinois Department of Employment Security (IDES) make a determination regarding the classification of workers to ensure compliance with state laws. The purpose of the Illinois Self-Employed Independent Contractor Questionnaire is to gather information about the working arrangement between the worker and the entity they provide services for. It collects essential details about the nature of the work, control and independence of the worker, compensation structure, and other relevant factors that influence the classification. By carefully examining the questionnaire responses, the IDES can assess whether the individual is genuinely operating as an independent contractor or if they should actually be treated as an employee under Illinois labor laws. The distinction is crucial as it determines the tax obligations, insurance requirements, and rights and benefits that apply to the worker. There are different types of Illinois Self-Employed Independent Contractor Questionnaires, each specifically designed to address different job categories or industries. Some common types may include: 1. Illinois Self-Employed Independent Contractor Questionnaire for Construction Workers: This questionnaire focuses on gathering information from workers in the construction industry. It assesses factors such as project-specific work, tools and equipment, degree of control by the individual, and other relevant details specific to this field. 2. Illinois Self-Employed Independent Contractor Questionnaire for Gig Economy Workers: This questionnaire is tailored for individuals involved in the gig economy, such as ride-share drivers, food delivery couriers, or freelance workers. It aims to determine the level of control, independence, and platform interactions these workers have, as well as the specifics of their compensation structure. 3. Illinois Self-Employed Independent Contractor Questionnaire for Professional Services: This questionnaire is designed for professionals like doctors, lawyers, consultants, or other licensed professionals. It focuses on factors like expertise, autonomy, client interactions, and overall control over the work performed. It is essential for both employers and workers to carefully complete and submit the Illinois Self-Employed Independent Contractor Questionnaire to ensure accurate classification. Misclassification may result in legal ramifications, penalties, or inadequate access to benefits and protections under Illinois labor laws. Therefore, it is advisable to consult with legal or tax professionals when completing the questionnaire to ensure compliance with applicable regulations.

Illinois Self-Employed Independent Contractor Questionnaire

Description

How to fill out Illinois Self-Employed Independent Contractor Questionnaire?

Choosing the right lawful record web template could be a struggle. Needless to say, there are plenty of themes available on the Internet, but how would you discover the lawful kind you require? Utilize the US Legal Forms web site. The support delivers a huge number of themes, such as the Illinois Self-Employed Independent Contractor Questionnaire, that you can use for organization and private needs. All the forms are inspected by specialists and fulfill federal and state specifications.

In case you are presently signed up, log in to the bank account and click the Acquire switch to have the Illinois Self-Employed Independent Contractor Questionnaire. Make use of bank account to check with the lawful forms you might have ordered earlier. Check out the My Forms tab of your own bank account and have yet another version of the record you require.

In case you are a fresh user of US Legal Forms, here are straightforward instructions that you should stick to:

- Very first, make certain you have chosen the appropriate kind to your town/region. You can look through the form utilizing the Review switch and study the form explanation to guarantee this is the right one for you.

- In case the kind will not fulfill your preferences, utilize the Seach area to find the proper kind.

- Once you are positive that the form would work, go through the Acquire now switch to have the kind.

- Opt for the pricing prepare you want and enter the essential info. Create your bank account and pay money for an order making use of your PayPal bank account or credit card.

- Choose the submit formatting and download the lawful record web template to the device.

- Complete, modify and printing and indicator the attained Illinois Self-Employed Independent Contractor Questionnaire.

US Legal Forms is the biggest library of lawful forms that you can discover different record themes. Utilize the service to download professionally-made documents that stick to status specifications.