Illinois Job Offer Letter for Accountant: A Comprehensive Guide Introduction: An Illinois Job Offer Letter for Accountant is a written document presented by employers to candidates who have been selected for the position of an accountant in the state of Illinois. This letter provides a detailed outline of the job responsibilities, compensation package, benefits, and general terms and conditions of employment for the accountant position. Main Body: 1. Job Position and Responsibilities: The offer letter starts by clearly stating the job title — Accountant, specifying the department or team the candidate will be a part of. It provides a detailed description of the primary responsibilities and duties expected from the candidate, such as preparing financial statements, analyzing financial data, managing accounts payable and receivable, and assisting in budgeting and forecasting activities. 2. Compensation Package: The Illinois Job Offer Letter for Accountant includes comprehensive details about the compensation package. It mentions the salary or hourly rate the candidate can expect, along with information on how often they will be paid (e.g., weekly, biweekly, monthly). Additionally, it may outline any potential bonuses, commissions, or profit-sharing plans that the accountant may be entitled to. 3. Benefits: Employers in Illinois often include a section in the offer letter that highlights the benefits the accountant will be eligible for. Benefits may include health insurance coverage (medical, dental, vision), retirement plans (401k), paid time off (holidays, vacations, personal days), and other perks (employee discounts, wellness programs, professional development opportunities). 4. Employment Terms and Conditions: This section outlines the terms and conditions of employment, including the anticipated start date and the duration of the probationary period (if applicable). It may also mention the expected working hours, work schedule, and the possibility of overtime requirements. Additionally, it provides essential information about the employer's policies and procedures, such as the code of conduct, dress code, and confidentiality agreements. Different Types of Illinois Job Offer Letters for Accountants: Aside from the general Illinois Job Offer Letter for Accountant, there might be specific variations based on the level of experience or specialization required. Some examples include: 1. Senior Accountant Job Offer Letter: This offer letter may cater to candidates with significant experience in accounting roles, additional supervisory responsibilities, or specialized knowledge in certain accounting areas. 2. Staff Accountant Job Offer Letter: Designed for candidates who are just starting their accounting careers or have limited experience in the field. It may offer specific training opportunities and a clear growth path. 3. Tax Accountant Job Offer Letter: Tailored for candidates who will primarily focus on tax-related accounting duties, such as preparing tax returns, conducting tax audits, and ensuring compliance with tax regulations. Conclusion: An Illinois Job Offer Letter for Accountant serves as a vital communication tool between employers and candidates. It ensures transparency by detailing the job responsibilities, compensation, benefits, and terms and conditions of employment. Employers may further customize the letter based on specific accountant positions, such as Senior Accountant, Staff Accountant, or Tax Accountant.

Illinois Job Offer Letter for Accountant

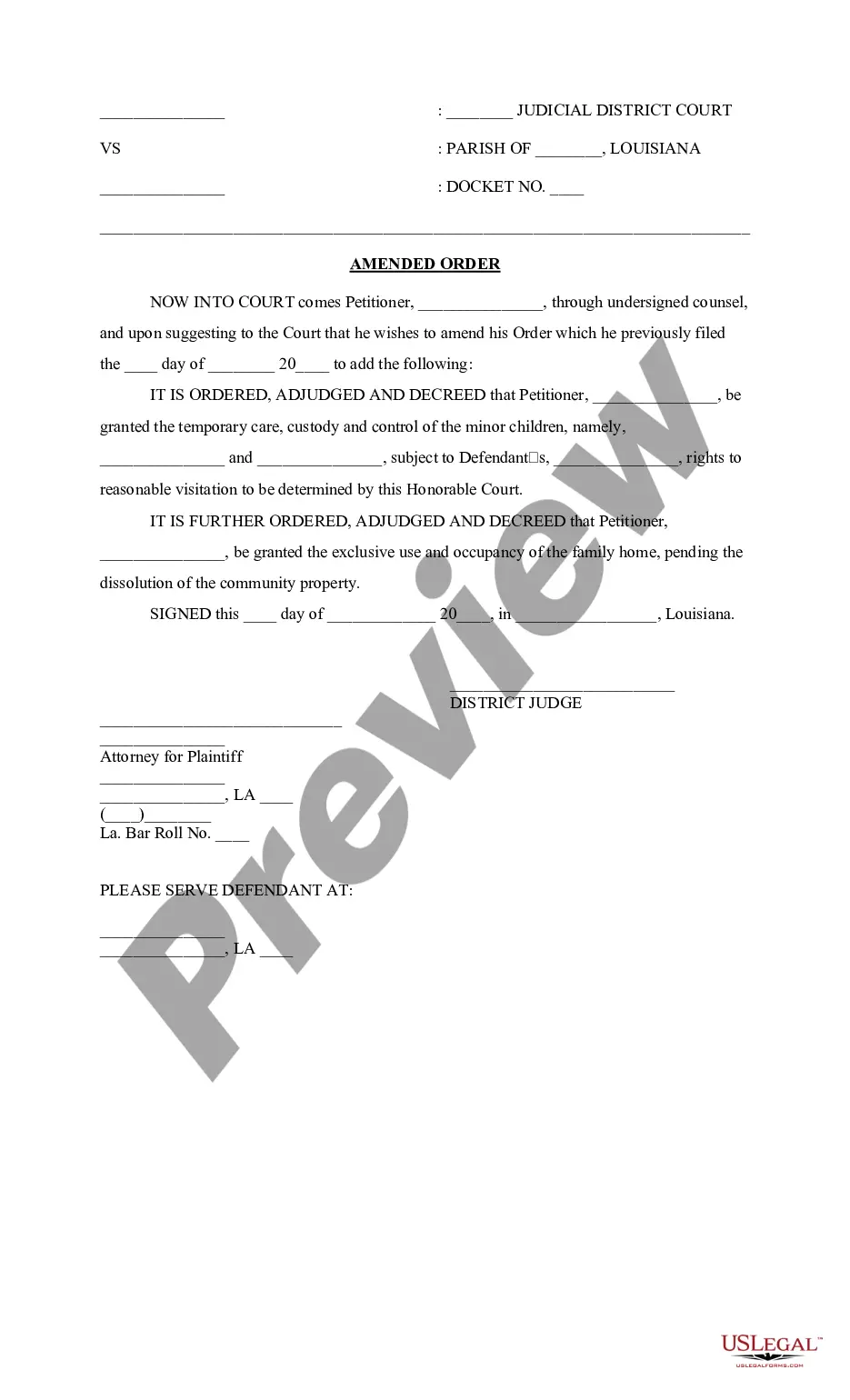

Description

How to fill out Job Offer Letter For Accountant?

It is possible to commit time on the web attempting to find the authorized file format that fits the state and federal requirements you will need. US Legal Forms offers 1000s of authorized types that are analyzed by pros. It is simple to download or printing the Illinois Job Offer Letter for Accountant from my services.

If you currently have a US Legal Forms bank account, you can log in and click on the Download button. Following that, you can comprehensive, modify, printing, or sign the Illinois Job Offer Letter for Accountant. Each authorized file format you get is the one you have forever. To have one more copy associated with a obtained kind, visit the My Forms tab and click on the corresponding button.

If you use the US Legal Forms internet site for the first time, follow the straightforward instructions under:

- First, be sure that you have chosen the best file format to the county/area of your choice. Browse the kind description to ensure you have selected the correct kind. If available, take advantage of the Review button to search throughout the file format at the same time.

- If you wish to discover one more variation from the kind, take advantage of the Search discipline to find the format that suits you and requirements.

- Upon having found the format you need, simply click Acquire now to carry on.

- Select the rates program you need, type in your accreditations, and register for a free account on US Legal Forms.

- Complete the deal. You may use your bank card or PayPal bank account to purchase the authorized kind.

- Select the file format from the file and download it in your device.

- Make alterations in your file if needed. It is possible to comprehensive, modify and sign and printing Illinois Job Offer Letter for Accountant.

Download and printing 1000s of file themes utilizing the US Legal Forms site, that provides the most important assortment of authorized types. Use skilled and express-certain themes to take on your company or personal requires.

Form popularity

FAQ

If you have already signed an employment contract, read through it carefully to make sure there will be no legal repercussions to rejecting the job. For example, some contracts say that you have a specific window of time during which you can reject the job or that you have to give a certain number of days' notice.

In general, offer letters are less formal than employment contracts, which typically set terms and conditions of employment that are legally binding. It's also vital for employers to understand that they aren't required by federal law to send an offer letter to new hires.

You can write an employment offer letter yourself or you can hire an attorney either to write it for you or to review one you have written.

Although an offer letter and an employment contract have similarities, they are very different. An offer letter has very basic terms and conditions of employment, generally subject to completion of a successful background check and/or medical exam, and states that employment is at-will.

An employment verification letter (EVL) is generally requested by an organization, such as a bank or landlord, to verify your current (or previous) job status and other details about your employment.

With that, every job offer letter should include the following terms:A job title and description.Important dates.Compensation, benefits, and terms.Company policies and culture.A statement of at-will employment.An employee confidentiality agreement and noncompete clause.A list of contingencies.

Can you back out of the job offer? Yes. Technically, anyone can turn down a job offer, back out of a job already started, or renege on an acceptance at any point. Most states operate with what is called at will employment. This means the employee and the employer are not in a binding contract.

A job offer is now acceptable proof of income The program is based on an ordinary fixed-rate or adjustable-rate mortgage (ARM), and mortgage rates are the same as for any other conventional mortgage type. There are no special clauses with the Offer Letter mortgage, and no hidden fees.

It IS a legally binding contract between employer and employee. It includes specific details about employment. It may make specific stipulations on employment conditions that differ from at will Employers and employees cannot break the contract without consequences.

Another common proof of income is a recent offer of employment on company letterhead. This is forward-looking and indicates the salary or hourly rate. Be careful: offer letters are often conditional upon things like drug tests, which the applicant may not yet have passed. Offer letters may also have expiration dates.