Illinois Response Letters

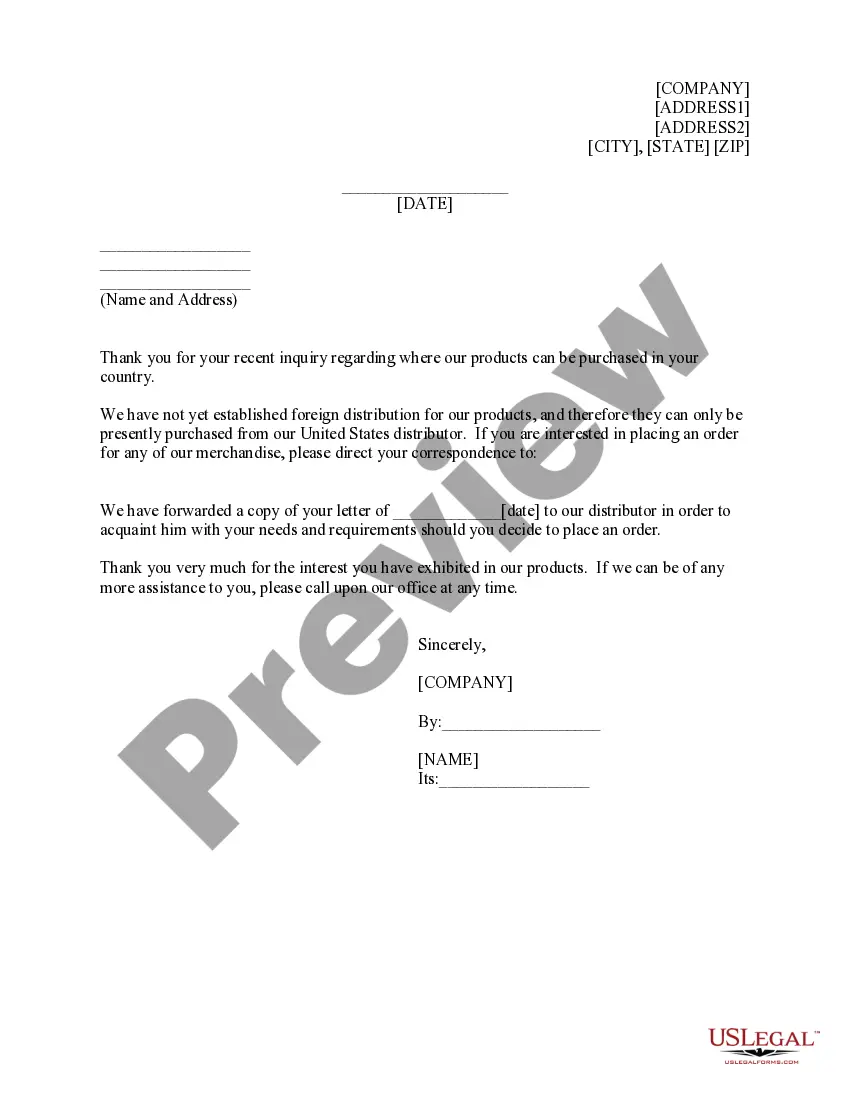

Description

How to fill out Response Letters?

It is possible to commit hrs on the web searching for the authorized record template that suits the federal and state needs you need. US Legal Forms offers 1000s of authorized varieties which are examined by professionals. It is simple to down load or produce the Illinois Response Letters from our assistance.

If you currently have a US Legal Forms accounts, it is possible to log in and click on the Obtain option. After that, it is possible to full, modify, produce, or indication the Illinois Response Letters. Each and every authorized record template you get is the one you have forever. To get an additional copy of the obtained develop, check out the My Forms tab and click on the related option.

If you are using the US Legal Forms website the first time, follow the basic guidelines beneath:

- First, be sure that you have chosen the proper record template for your region/city of your liking. See the develop information to ensure you have chosen the correct develop. If accessible, use the Preview option to search with the record template also.

- In order to discover an additional variation from the develop, use the Lookup field to find the template that meets your needs and needs.

- After you have discovered the template you want, click on Get now to proceed.

- Find the costs prepare you want, key in your qualifications, and register for an account on US Legal Forms.

- Full the deal. You can use your Visa or Mastercard or PayPal accounts to fund the authorized develop.

- Find the formatting from the record and down load it to the gadget.

- Make adjustments to the record if needed. It is possible to full, modify and indication and produce Illinois Response Letters.

Obtain and produce 1000s of record themes using the US Legal Forms Internet site, which offers the biggest variety of authorized varieties. Use professional and status-particular themes to tackle your company or person demands.

Form popularity

FAQ

To respond through MyTax Illinois, simply login to your existing account or create a new account at mytax.illinois.gov. Note: Activate your MyTax Account within 90 days of the date on your letter or notice. After this time period, you will be required to request a new Letter ID to activate your account.

MyTax Illinois, available at mytax.illinois.gov, is a free online account management program that offered by the state of Illinois to provide a centralized location for users to file returns, renew licenses, register for accounts, make payments, review correspondence, and generally manage their accounts.

When you first set up two-step verification, you can choose to receive this code by email to an address you provide or by using an authenticator app.

If no payment is enclosed, mail your return to: If a payment is enclosed, mail your return to: ILLINOIS DEPARTMENT OF REVENUE. ILLINOIS DEPARTMENT OF REVENUE. PO BOX 19041. PO BOX 19027. SPRINGFIELD IL 62794-9041. SPRINGFIELD IL 62794-9027.

Write to explain why you disagree and include any information and documents you want the IRS to consider. Mail your reply to the address shown in the letter along with the bottom tear-off portion of the letter, if provided. Keep copies of any correspondence with your tax records.

Ing to the Illinois Department of Revenue website, ?The Illinois Department of Revenue sends letters and notices to request additional information and support for information you report on your tax return or to inform you of a change made to your return, balance due, or overpayment amount.

You must file a Form IL-1040, Individual Income Tax Return, if you are an Illinois resident and: You were required to file a federal income tax return. You were not required to file a federal return, but your Illinois base income is greater than your exemption allowance.

Write both the destination and return addresses clearly or print your mailing label and postage. If your tax return is postmarked by the filing date deadline, the IRS considers it on time. Mail your return in a USPS® blue collection box or at a Postal location that has a pickup time before the deadline.