Illinois Self-Employed Independent Contractor Employment Agreement — Hair Salon or Barber Shop An Illinois Self-Employed Independent Contractor Employment Agreement is a legal document that establishes the working relationship between a hair salon or barber shop and a self-employed individual providing services as an independent contractor. This agreement outlines the terms and conditions of the engagement, ensuring both parties understand their rights and responsibilities. Keywords: Illinois, self-employed, independent contractor, employment agreement, hair salon, barber shop. There are several types of Illinois Self-Employed Independent Contractor Employment Agreements specifically designed for the Hair Salon or Barber Shop industry. Some of these variations include: 1. Booth Rent Agreement: This agreement establishes the terms under which a hairstylist or barber rents a designated booth space within a salon or shop to operate as an independent contractor. It outlines the rental fee, provisions for utilities, and responsibilities of both parties. 2. Commission-Based Contractor Agreement: This type of agreement is suitable for independent contractors who receive a commission on the services they provide. It clarifies the commission structure, payment terms, and other relevant details. 3. Salon Suite Lease Agreement: This agreement is specifically tailored for independent contractors who lease a separate suite or room within a salon or shop. It includes provisions related to lease duration, rent payment, and access to shared facilities. 4. Mobile Salon Independent Contractor Agreement: For those providing mobile salon or barber services, this agreement covers the specific requirements and responsibilities associated with operating and providing services outside traditional salon premises. 5. Salon Assistant Independent Contractor Agreement: This agreement is designed for self-employed individuals who work as assistants to salon or barber shop owners. It outlines the roles, responsibilities, compensation, and non-compete clauses specific to the assistant's duties. In order to ensure compliance with Illinois laws, it is essential to have a thorough and detailed Self-Employed Independent Contractor Employment Agreement tailored to the specific needs of a hair salon or barber shop. The agreement should cover areas such as payment terms, work schedule, liabilities, intellectual property rights, termination, and other relevant clauses. It is recommended to seek legal advice when drafting and finalizing an Illinois Self-Employed Independent Contractor Employment Agreement. This ensures that the agreement is in accordance with the state's laws and regulations and protects the interests of all parties involved.

Illinois Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop

Description

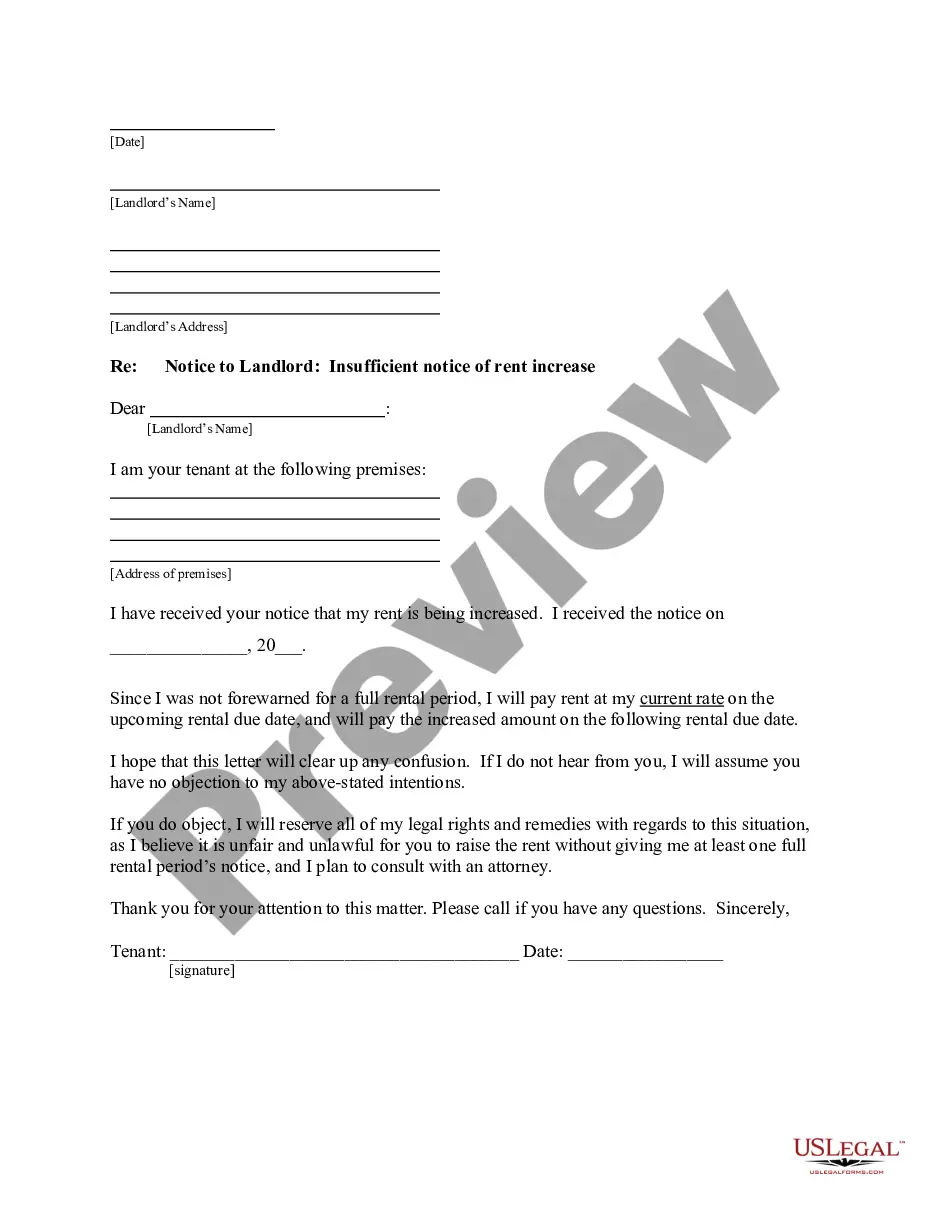

How to fill out Illinois Self-Employed Independent Contractor Employment Agreement - Hair Salon Or Barber Shop?

You are able to invest time on the web attempting to find the legal file template which fits the state and federal requirements you need. US Legal Forms gives a huge number of legal varieties which can be evaluated by specialists. You can easily acquire or print the Illinois Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop from your services.

If you already possess a US Legal Forms profile, it is possible to log in and click on the Download key. After that, it is possible to complete, modify, print, or sign the Illinois Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop. Every legal file template you acquire is the one you have permanently. To get another backup associated with a obtained develop, check out the My Forms tab and click on the corresponding key.

If you work with the US Legal Forms site the first time, keep to the easy directions under:

- Initial, ensure that you have selected the right file template to the county/area that you pick. Browse the develop description to ensure you have selected the proper develop. If available, make use of the Review key to appear through the file template at the same time.

- If you want to discover another version of your develop, make use of the Search industry to obtain the template that fits your needs and requirements.

- After you have located the template you desire, simply click Get now to continue.

- Choose the rates plan you desire, enter your qualifications, and register for a free account on US Legal Forms.

- Full the deal. You can use your Visa or Mastercard or PayPal profile to cover the legal develop.

- Choose the file format of your file and acquire it to your device.

- Make alterations to your file if needed. You are able to complete, modify and sign and print Illinois Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop.

Download and print a huge number of file themes using the US Legal Forms Internet site, which provides the greatest variety of legal varieties. Use specialist and state-distinct themes to tackle your business or personal demands.

Form popularity

FAQ

Taxgirl says: Barbers and beauticians are generally independent contractors. Occasionally, you'll come across those that may be classed as employees but due to the nature of the business, you tend to see more classed as independent contractors.

Under the new test for independent contractor vs employee status in California, it is illegal to classify a barber or hair stylist as an independent contractor unless the salon can prove that: (1) the hair stylist is free the hair salon's control; (2) the job of cutting or styling hair falls outside the salon's usual

You earn money as a contractor, consultant, freelancer, or other independent worker. You income is reported on 1099-MISC (Box 7), 1099-K (Box 1a), or you receive cash, check or credit card sales transactions, instead of a W-2.

California's contractor laws state that an independent contractor is a person or business who provides a specific service to another company in exchange for compensation. It further says that the independent contractor is under managerial control for results and not how he or she accomplishes the work.

This blog post was written for all the salons/spas in our industry that classify workers as 1099. This includes stylists, estheticians, nail techs, massage therapists, support staff, etc. I use the term worker because a 1099 worker IS NOT an employee.

Hairdressers are Exempt from AB5 Because a hairdresser would normally be considered to be performing services that are within the usual course of a salon's business, the salon (or hiring entity) can never truly meet part B of the ABC test.

Many stylists are independent contractors. Some contractors are legally employees, either because the salon owner doesn't know better or because misclassifying workers saves them money.

Barbers usually serve male clients for shampoos, haircuts, and shaves. Some fit hairpieces and perform facials. Hairdressers, or hairstylists, provide coloring, chemical hair treatments, and styling in addition to shampoos and cuts, and serve both female and male clients.

The contract specifies the basis of the appointment and your expectations; it ensures that the employee clearly understands them prior to starting work. What should be included? A contract is a binding document on both parties and should be carefully worded.