The Illinois Personal Guaranty — Guarantee of Contract for the Lease and Purchase of Real Estate is a legal document that is commonly used in real estate transactions in the state of Illinois. This agreement serves as a guarantee by an individual, referred to as the guarantor, to fulfill the obligations of another party, referred to as the tenant or purchaser, under a lease or purchase contract for real estate. In simple terms, a personal guaranty is a promise made by an individual to be responsible for the payment of rent or purchase prices, as well as any other obligations under the terms of the lease or purchase agreement, if the tenant or purchaser fails to fulfill their obligations. The guarantor becomes personally liable for the debt, meaning that the landlord or seller can pursue legal action to recover the outstanding amounts directly from the guarantor's personal assets. These personal guaranties are typically used in commercial real estate transactions when a tenant or purchaser is a corporation or a limited liability company (LLC) with limited financial resources or creditworthiness. By having a personal guaranty, the landlord or seller has an additional layer of security, knowing that if the business entity defaults on its obligations, they can pursue the guarantor for the outstanding amounts. There are different types of Illinois Personal Guaranty — Guarantee of Contract for the Lease and Purchase of Real Estate, depending on the specific nature of the transaction. Some common variations include: 1. Lease Personal Guaranty: This type of personal guaranty is used in lease agreements, where the guarantor assures the landlord that they will be responsible for all the rental payments and other obligations specified in the lease if the tenant fails to fulfill them. 2. Purchase Personal Guaranty: In this case, the guarantor guarantees the payment of the purchase price agreed upon in the contract of sale for real estate. If the purchaser defaults on the payment, the guarantor becomes liable for the outstanding amount. It is important for both guarantors and tenants or purchasers to carefully review and understand the terms and conditions of the personal guaranty agreements before signing. Seeking legal advice is highly recommended ensuring that their rights and obligations are fully protected.

Illinois Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate

Description

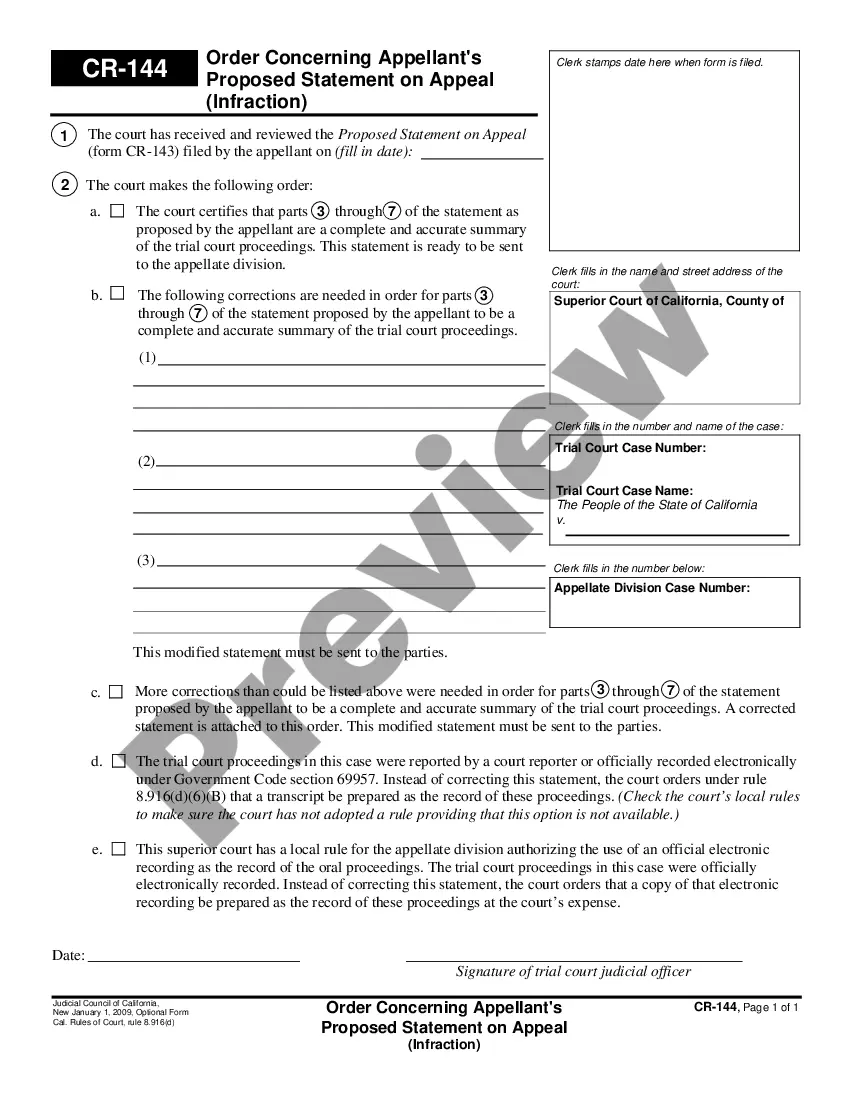

How to fill out Illinois Personal Guaranty - Guarantee Of Contract For The Lease And Purchase Of Real Estate?

If you wish to complete, acquire, or printing authorized document layouts, use US Legal Forms, the largest collection of authorized types, that can be found on-line. Use the site`s simple and handy lookup to find the documents you will need. Various layouts for company and person reasons are sorted by categories and says, or search phrases. Use US Legal Forms to find the Illinois Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate in just a couple of click throughs.

When you are previously a US Legal Forms customer, log in to your profile and click on the Download switch to find the Illinois Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate. You may also access types you previously acquired within the My Forms tab of your respective profile.

Should you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form to the right town/nation.

- Step 2. Make use of the Preview option to check out the form`s content. Never forget to learn the information.

- Step 3. When you are not happy together with the kind, make use of the Look for discipline at the top of the display to discover other models in the authorized kind template.

- Step 4. After you have identified the form you will need, select the Get now switch. Select the prices prepare you choose and put your credentials to sign up on an profile.

- Step 5. Process the financial transaction. You may use your charge card or PayPal profile to perform the financial transaction.

- Step 6. Select the format in the authorized kind and acquire it on your own product.

- Step 7. Complete, modify and printing or indicator the Illinois Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

Every authorized document template you purchase is your own property forever. You possess acces to every single kind you acquired with your acccount. Click on the My Forms section and pick a kind to printing or acquire yet again.

Contend and acquire, and printing the Illinois Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate with US Legal Forms. There are many expert and status-particular types you may use for your company or person demands.

Form popularity

FAQ

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

A guarantee agreement definition is common in real estate and financial transactions. It concerns the agreement of a third party, called a guarantor, to provide assurance of payment in the event the party involved in the transaction fails to live up to their end of the bargain.

Rolling guaranty: this can be a 12 month, 24 month or some other number of months, rolling guaranty. It means that the total exposure is the number of months regardless of how many months are remaining in the lease (unless the remaining months are less than the rolling months.

A corporate guaranty is one usually signed by a parent or more developed affiliated company. It is a comfort to a landlord to have an extra set of assets to go after should its tenant default.

A personal guarantee is a provision a lender puts in a business loan agreement that requires owners to be personally responsible for their company's debt in case of default. Lenders often ask for personal guarantees because they have concerns over the credit history, age or financial stability of your business.

The Guarantor undertakes to pay compensation up to a certain amount to the Beneficiary in case the Applicant/Instructing Party fails to deliver the goods or to carry out certain work. This type of Guarantee is often issued for 5-10% of the contract value, although the percentage varies case by case.

In construction lending, a Carry Guaranty is a standard and typical requirement whereby a Guarantor will guaranty the payment by Borrower of all costs incurred in connection with the operation, maintenance and management of the Property (or some subset of the same) for the term of the Loan (or, if the Property is

Guarantor contracts are unenforceable unless they meet these two requirements. Note that it's not necessary to have a formal, written contract. The memorandum should simply prove that an oral contract was made and prove any material terms of that contract.

A lease guarantee is a contract signed by the tenant, landlord and the third party. It stipulates the financial obligations of all the parties involved and safeguards them from future risks.