Illinois Personal Guaranty of Corporation Agreement to Pay Consultant is a legally binding document that outlines the terms and conditions between a corporation and a consultant. This agreement serves to provide a guarantee on the part of an individual (the guarantor) to be personally liable for the payment obligations of the corporation in the event of default or non-payment to the consultant. The purpose of the Illinois Personal Guaranty of Corporation Agreement to Pay Consultant is to ensure that the consultant is protected and has a secure method of recourse in case the corporation fails to meet its payment obligations. This agreement holds the guarantor responsible for the payment of any outstanding fees, expenses, or other charges owed to the consultant. Keywords: Illinois, personal guaranty, corporation, agreement, pay consultant, legally binding, terms and conditions, guarantee, individual, liability, payment obligations, default, non-payment, recourse, fees, expenses. There are various types of Illinois Personal Guaranty of Corporation Agreement to Pay Consultant, which are categorized based on the specific circumstances and requirements. Some commonly used types include: 1. Limited Personal Guaranty Agreement: This agreement limits the liability of the guarantor to a specific amount or a set period, protecting them from excessive exposure in case of default. 2. Continuing Personal Guaranty Agreement: In this type, the personal guarantee remains in effect until the consultant's services are fully compensated, providing ongoing protection against potential payment issues. 3. Joint and Several Personal Guaranty Agreement: This agreement involves multiple guarantors who are jointly and individually responsible for the corporation's payment obligations. Each guarantor can be held liable for the entire amount owed. 4. Individual Personal Guaranty Agreement: Here, a specific individual within the corporation assumes personal liability for payment, ensuring that the consultant has a dedicated party responsible for meeting the payment obligations. 5. Corporate Officer Personal Guaranty Agreement: This type of agreement holds a corporate officer personally liable for the corporation's payment to the consultant, ensuring accountability at a higher level within the organization. 6. Unlimited Personal Guaranty Agreement: In this agreement, the guarantor assumes unlimited liability and is responsible for the full amount owed to the consultant, irrespective of any limitations. It's important to consult with legal professionals or an attorney to ensure that the chosen Illinois Personal Guaranty of Corporation Agreement to Pay Consultant aligns with the specific requirements and circumstances of both the consultant and the corporation.

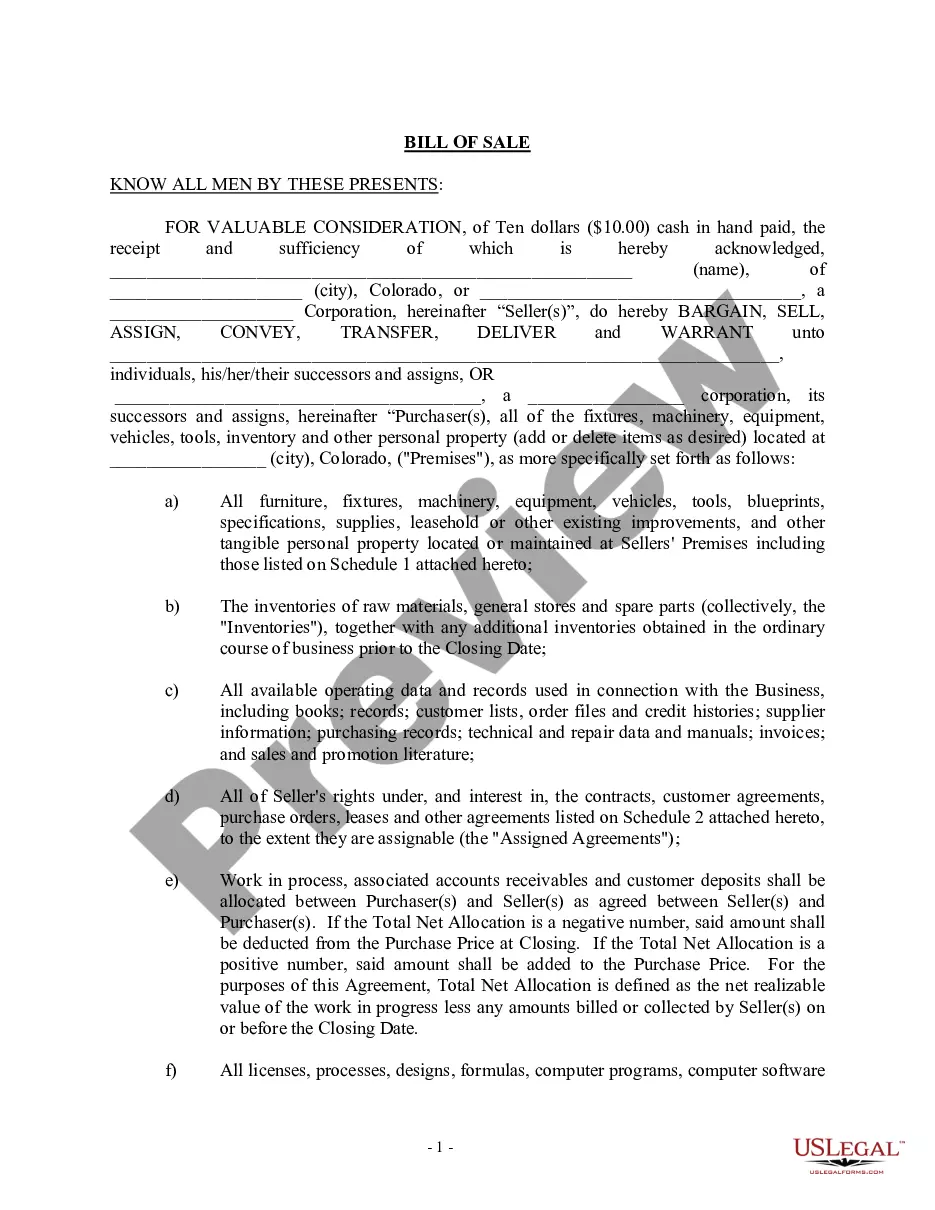

Illinois Personal Guaranty of Corporation Agreement to Pay Consultant

Description

How to fill out Illinois Personal Guaranty Of Corporation Agreement To Pay Consultant?

Choosing the best legal record design can be a struggle. Naturally, there are tons of templates accessible on the Internet, but how will you find the legal develop you will need? Utilize the US Legal Forms website. The services gives thousands of templates, such as the Illinois Personal Guaranty of Corporation Agreement to Pay Consultant, which can be used for company and personal demands. All the kinds are examined by specialists and satisfy federal and state specifications.

When you are previously authorized, log in to your account and click the Down load button to obtain the Illinois Personal Guaranty of Corporation Agreement to Pay Consultant. Utilize your account to search through the legal kinds you possess ordered in the past. Check out the My Forms tab of the account and obtain another backup in the record you will need.

When you are a whole new user of US Legal Forms, listed here are straightforward instructions so that you can stick to:

- Initial, make certain you have chosen the correct develop to your metropolis/area. You can examine the form while using Review button and browse the form information to ensure this is the right one for you.

- In case the develop will not satisfy your preferences, make use of the Seach industry to obtain the proper develop.

- When you are sure that the form would work, click the Purchase now button to obtain the develop.

- Choose the pricing plan you need and type in the essential information. Make your account and pay for the transaction utilizing your PayPal account or bank card.

- Select the data file structure and acquire the legal record design to your system.

- Comprehensive, modify and print out and indicator the received Illinois Personal Guaranty of Corporation Agreement to Pay Consultant.

US Legal Forms is definitely the largest collection of legal kinds where you will find various record templates. Utilize the service to acquire professionally-produced files that stick to state specifications.

Form popularity

FAQ

A personal guarantee is an individual's legal promise to repay credit issued to a business for which they serve as an executive or partner. Personal guarantees help businesses get credit when they aren't as established or have an inadequate credit history to qualify on their own.

In writing The guarantee must be evidenced in writing to be enforceable. Signed The document must be signed by the guarantor or their authorised agent. Their name can be written or printed. Secondary liability The document must establish that the guarantor has secondary liability for the debt.

Most lenders making loans to family-owned companies, LLPs or LLCs will insist on a personal guarantee. But if you waived your limited liability by giving a personal guarantee to a lender or a landlord, that doesn't mean that you've waived your protection for other liabilities.

A personal guaranty is not enforceable without consideration A contract is an enforceable promise. The enforceability of a contract comes from one party's giving of consideration to the other party. Here, the bank gives a loan (the consideration) in exchange for the guarantor's promise to repay it.

The guaranty shall continue in full force and effect and may only be terminated in a writing delivered to Y thirty days before termination of the guaranty and such termination shall not eliminate the guaranty as to sums already advanced.

If the corporate debtor refuses to pay, a personal guarantee agreement allows the bank to enforce that debt against other individuals. Often times it is the directors of the corporation that are asked to give personal guarantees, but at other times it may be an uninvolved third party, such as a spouse or a parent.

A personal guaranty is not enforceable without consideration A contract is an enforceable promise. The enforceability of a contract comes from one party's giving of consideration to the other party. Here, the bank gives a loan (the consideration) in exchange for the guarantor's promise to repay it.

If you sign a personal guarantee, you are personally liable for the loan balance or a portion thereof. If your business later defaults on the loan, anyone who signed the personal guarantee can be held responsible for the remaining balance, even after the lender forecloses on the loan collateral.

An otherwise valid and enforceable personal guarantee can be revoked later in several different ways. A guaranty, much like any other contract, can be revoked later if both the guarantor and the lender agree in writing. Some debts owed by personal guarantors can also be discharged in bankruptcy.

A personal guarantee is a provision a lender puts in a business loan agreement that requires owners to be personally responsible for their company's debt in case of default. Lenders often ask for personal guarantees because they have concerns over the credit history, age or financial stability of your business.