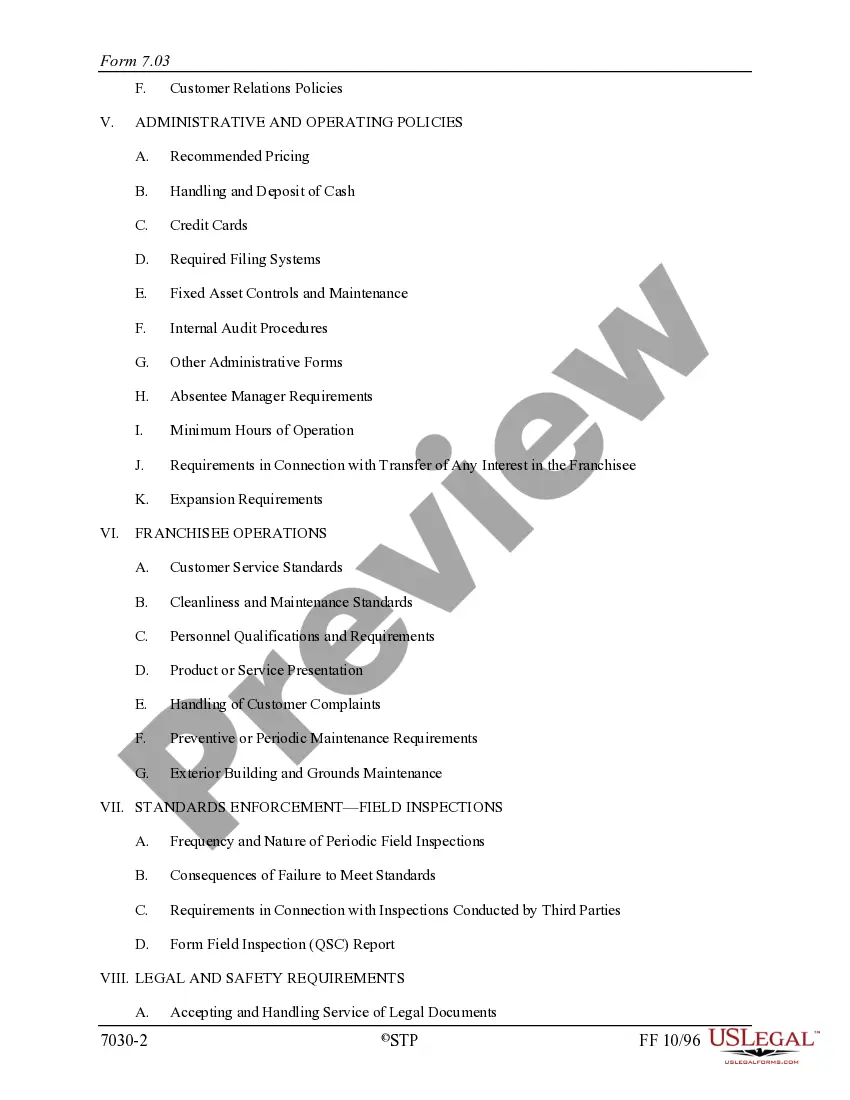

Illinois Operations Manual Checklist

Description

How to fill out Operations Manual Checklist?

Finding the right legal document template can be a struggle. Of course, there are plenty of templates available on the Internet, but how would you get the legal type you want? Take advantage of the US Legal Forms web site. The services provides 1000s of templates, like the Illinois Operations Manual Checklist, that can be used for company and private demands. All of the forms are examined by experts and satisfy state and federal demands.

In case you are already signed up, log in for your account and click on the Download switch to have the Illinois Operations Manual Checklist. Utilize your account to check through the legal forms you possess ordered formerly. Proceed to the My Forms tab of the account and obtain yet another copy from the document you want.

In case you are a whole new consumer of US Legal Forms, here are straightforward recommendations that you can stick to:

- Very first, ensure you have chosen the proper type for your personal metropolis/region. It is possible to look over the shape utilizing the Preview switch and study the shape explanation to ensure it is the right one for you.

- In the event the type does not satisfy your needs, take advantage of the Seach discipline to get the right type.

- Once you are positive that the shape is proper, click the Purchase now switch to have the type.

- Pick the pricing strategy you would like and enter the required details. Build your account and buy your order with your PayPal account or Visa or Mastercard.

- Opt for the data file file format and download the legal document template for your product.

- Comprehensive, edit and print out and signal the obtained Illinois Operations Manual Checklist.

US Legal Forms will be the greatest local library of legal forms that you can see various document templates. Take advantage of the service to download appropriately-made papers that stick to condition demands.

Form popularity

FAQ

Your main cost when starting an LLC in Illinois will be the state's LLC registration fee, which is $150. On top of that, you'll need to shell out $75 each year to file your Illinois annual report. You'll also have additional expenses to think about, like hiring a registered agent and purchasing business insurance.

Though Illinois does not require a statewide business license, your business is required to obtain a Certificate of Registration or License, sometimes referred to as a seller's permit, if it intends to sell or lease taxable goods or services within the state.

How long does it take to incorporate in Illinois? Regular processing of articles of incorporation takes about four weeks, plus an additional two or three days to mail the final documents. Regular filing time for an LLC (limited liability company) is between seven and ten business days.

In Illinois, most business are required to be registered and/or licensed by the IDOR. If you plan to hire employees, buy or sell products wholesale or retail, or manufacture goods, you must register with the IDOR. To obtain information contact: Illinois Department of Revenue.

Corporations are strict, and have legal obligations and formalities like electing a board of directors, holding shareholder meetings, and maintaining internal records such as meeting minutes and stock issuance. Conversely, LLCs only require a minimal amount of maintenance.

Form an Illinois Corporation: Name Your Corporation. Designate a Registered Agent. Submit Articles of Incorporation. Get an EIN. Write Corporate Bylaws. Hold an Organizational Meeting. Open a Corporate Bank Account. File State Reports & Taxes.

Your main cost when starting an LLC in Illinois will be the state's LLC registration fee, which is $150. On top of that, you'll need to shell out $75 each year to file your Illinois annual report. You'll also have additional expenses to think about, like hiring a registered agent and purchasing business insurance.

Though no action is required to legally create a sole proprietorship, you should follow four simple steps to start your business: Choose a business name. File an assumed name with your county clerk's office. Apply for licenses, permits, and zoning clearance. Obtain an employer identification number (EIN).