Illinois Demand for Payment of Account by Business to Debtor

Description

How to fill out Demand For Payment Of Account By Business To Debtor?

If you wish to compile, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms, available online.

Take advantage of the site’s simple and user-friendly search to locate the documents you need.

A variety of templates for business and personal purposes are categorized by groups and states, or keywords. Leverage US Legal Forms to locate the Illinois Demand for Payment of Account by Business to Debtor with just a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to each form you acquired within your account. Visit the My documents section and select a form to print or download again.

Compete and procure, and print the Illinois Demand for Payment of Account by Business to Debtor with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms client, Log In to your account and click the Get button to find the Illinois Demand for Payment of Account by Business to Debtor.

- You can also access forms you previously obtained within the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for your specific city/state.

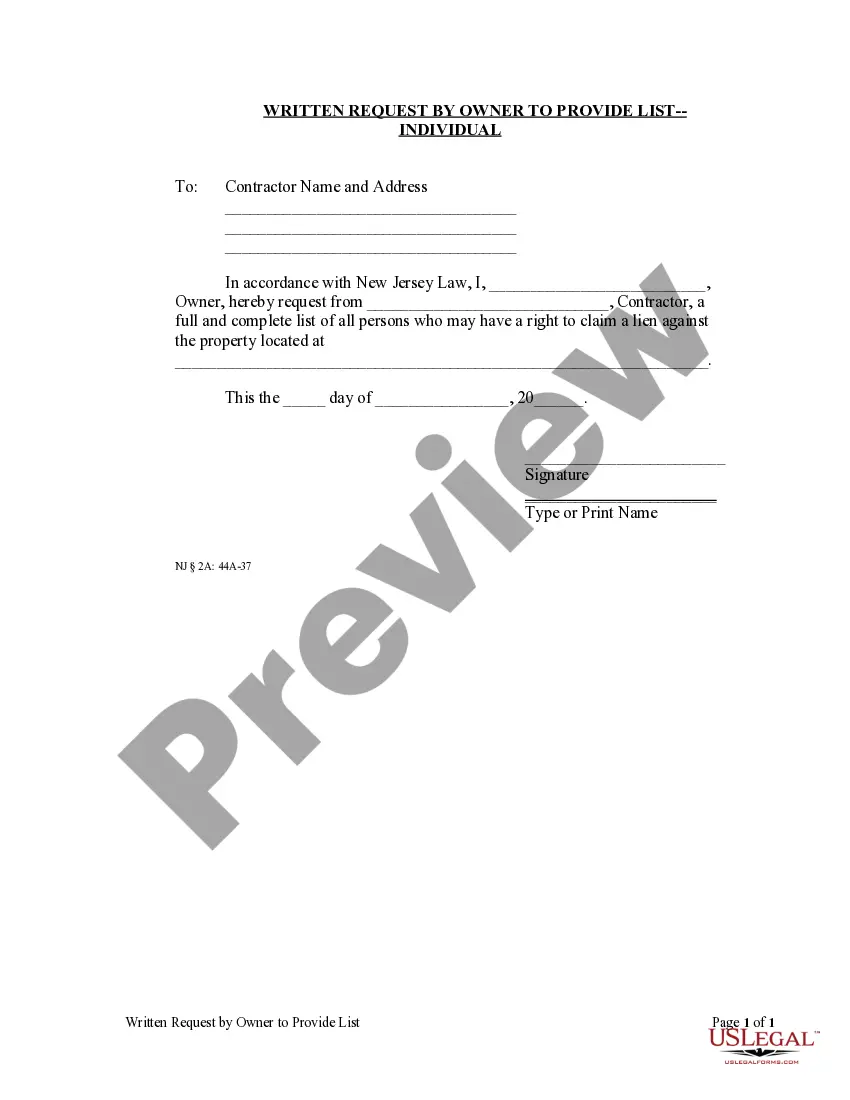

- Step 2. Use the Preview option to review the form's content. Don’t forget to read the description.

- Step 3. If you are unsatisfied with the form, utilize the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the required form, click the Get now button. Choose the payment plan you prefer and enter your details to create an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Illinois Demand for Payment of Account by Business to Debtor.

Form popularity

FAQ

In Illinois, creditors can seize funds from bank accounts typically within 30 days after a court judgment is issued. This timing may vary depending on the type of debt and specific circumstances. It's important to understand that an Illinois Demand for Payment of Account by Business to Debtor could lead a creditor to initiate legal action, making it crucial to address debts promptly.

We'd love to stay in touch!01I hope you're doing well.02I know I said you can pay me back anytime, but something has come up and I really need some cash.03I hope this message finds you in a better spot than you were in last month when you borrowed that sum of money from me.More items...?

Frequently Asked Questions (FAQ)Type your letter.Concisely review the main facts.Be polite.Write with your goal in mind.Ask for exactly what you want.Set a deadline.End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand.Make and keep copies.More items...

A 15-day demand letter for payment is a formal written request for settlement of a debt. This brief letter is often all it takes to get an opposing party to pay up but if not, it can serve as a critical piece of evidence if things end up in court.

A demand letter is a formal letter that demands the other person (or corporation) performs a legal obligation, such as fixing a problem, paying a sum of money, or honoring a contract. The letter describes the agreement between parties and gives the recipient a chance to fix the issue without being taken to court.

The Illinois Collection Agency Act requires debt collectors to get a license and regulates how they can communicate with debtors. In Illinois, both the federal Fair Debt Collection Practices Act (FDCPA) and the Illinois Collection Agency Act (ICAA) regulate debt collectors.

Three to five days is usually a sufficient amount of time.

In California, the statute of limitations for consumer debt is four years. This means a creditor can't prevail in court after four years have passed, making the debt essentially uncollectable. But there are tricks that can restart the debt clock.

Before a case being brought, 90% was settled. Only 5% was resolved before or after arbitration/mediation right away. So nine out of ten lawsuits are solved without a jury and a mediator without a trial without a prosecutor.

For example, in California employment law cases, you have 21 days to turn over certain employment records after receiving a demand letter. It is in your best interest to allow an attorney to handle these correspondences as well.