Statutory Guidelines [Appendix A(6) Revenue Procedure 93-34] regarding rules under which a designated settlement fund described in section 468B(d)(2) of the Internal Revenue Code or a qualified settlement fund described in section 1.468B-1 of the Income Tax Regulations will be considered "a party to the suit or agreement" for purposes of section 130.

Illinois Revenue Procedure 93-34

Description

How to fill out Revenue Procedure 93-34?

Are you currently in a place the place you need to have paperwork for sometimes company or specific uses virtually every working day? There are plenty of lawful file layouts available online, but locating versions you can rely on is not effortless. US Legal Forms delivers thousands of kind layouts, like the Illinois Revenue Procedure 93-34, which can be composed to meet federal and state specifications.

Should you be currently acquainted with US Legal Forms site and also have a merchant account, simply log in. Next, it is possible to download the Illinois Revenue Procedure 93-34 web template.

Unless you have an profile and would like to begin using US Legal Forms, follow these steps:

- Discover the kind you will need and make sure it is for the proper metropolis/state.

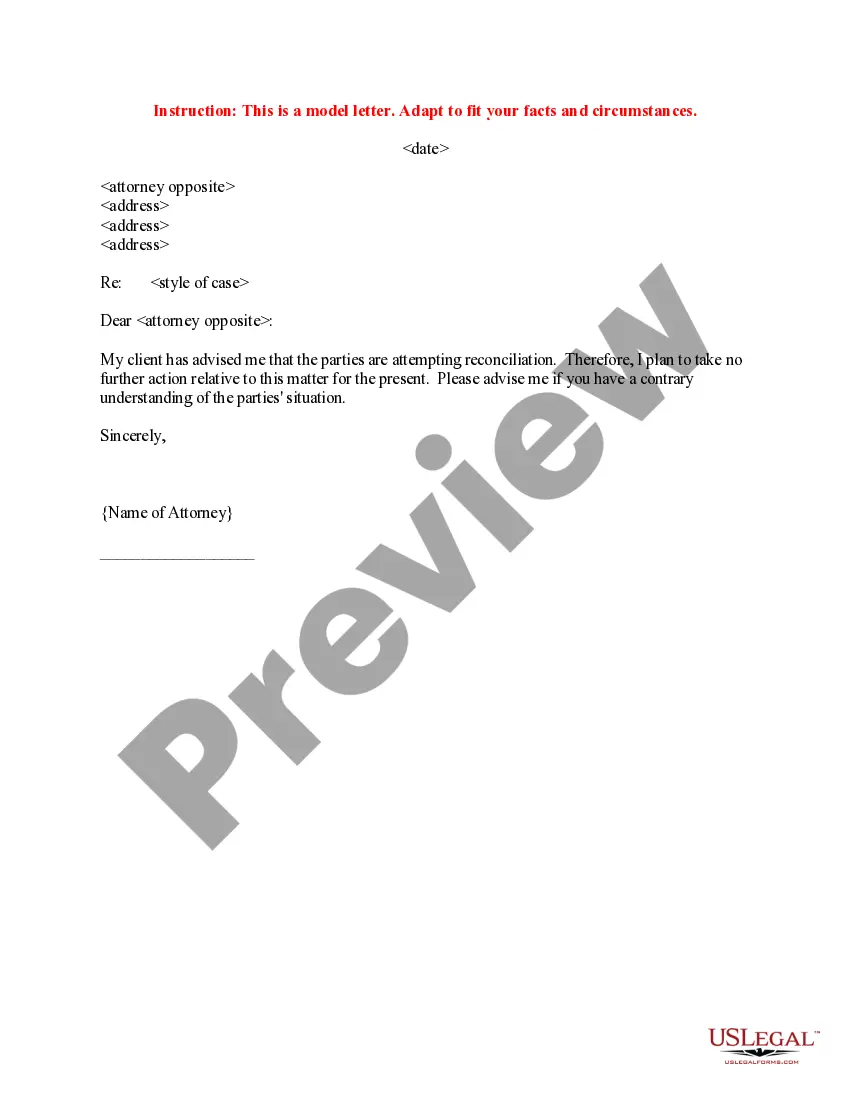

- Take advantage of the Preview key to examine the shape.

- Browse the information to actually have chosen the correct kind.

- When the kind is not what you are looking for, take advantage of the Search area to obtain the kind that suits you and specifications.

- When you discover the proper kind, click Get now.

- Pick the costs plan you desire, complete the specified information and facts to make your money, and purchase the order making use of your PayPal or bank card.

- Pick a convenient file structure and download your duplicate.

Get each of the file layouts you may have bought in the My Forms menus. You can aquire a further duplicate of Illinois Revenue Procedure 93-34 anytime, if possible. Just select the required kind to download or print the file web template.

Use US Legal Forms, by far the most considerable collection of lawful types, in order to save some time and stay away from faults. The support delivers expertly made lawful file layouts which you can use for a selection of uses. Generate a merchant account on US Legal Forms and initiate producing your life a little easier.