Illinois Information Sheet - When are Entertainment Expenses Deductible and Reimbursable

Description

How to fill out Information Sheet - When Are Entertainment Expenses Deductible And Reimbursable?

Are you presently in a circumstance where you frequently require documentation for either organizational or personal motives.

There are numerous legal document templates available online, but finding ones you can trust is challenging.

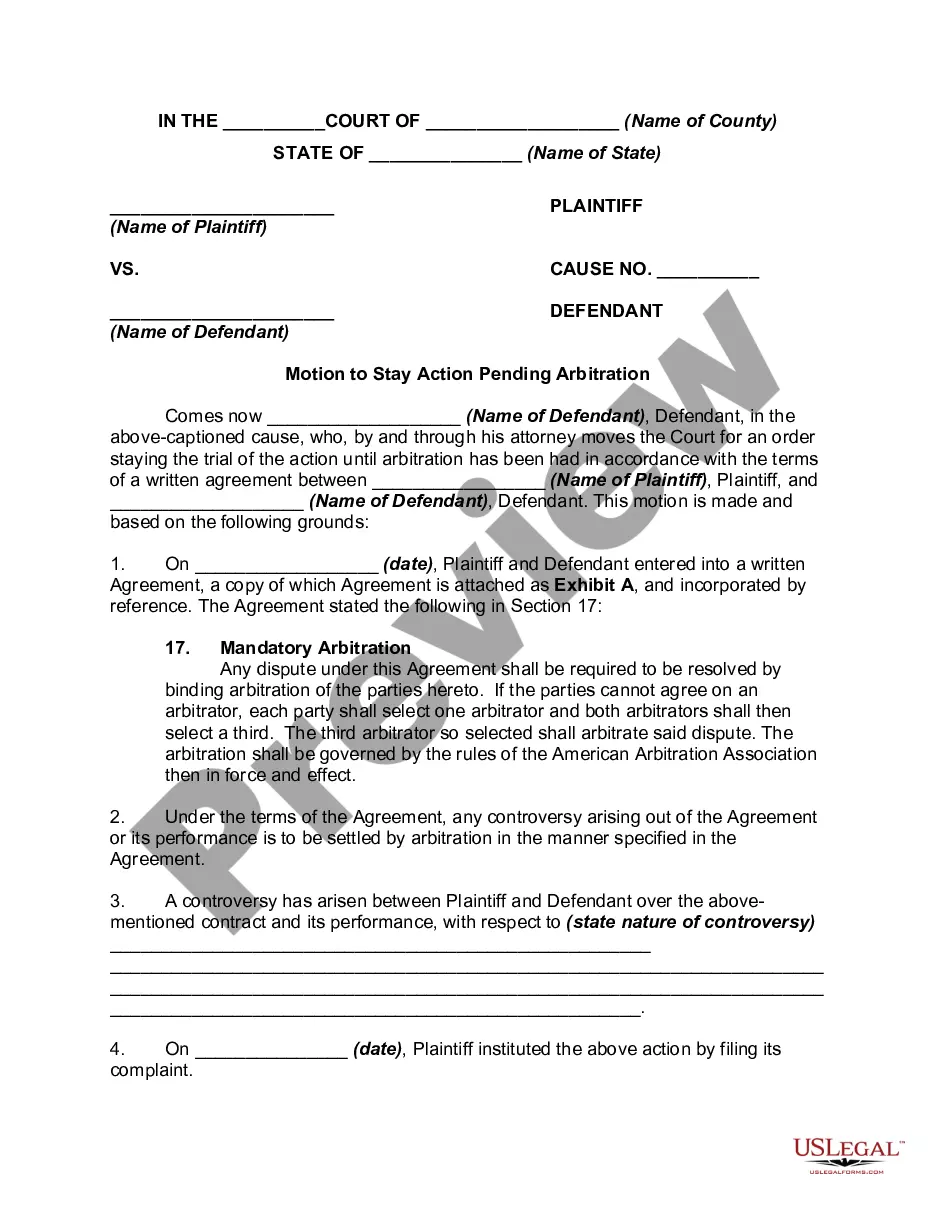

US Legal Forms offers thousands of form templates, such as the Illinois Information Sheet - When are Entertainment Expenses Deductible and Reimbursable, designed to meet state and federal requirements.

If you find the correct form, simply click Purchase now.

Choose the payment plan you prefer, provide the required information to create your account, and complete your purchase using PayPal or credit card. Select a suitable document format and download your copy.

- If you are already familiar with the US Legal Forms site and possess an account, just Log In.

- Afterwards, you can download the Illinois Information Sheet - When are Entertainment Expenses Deductible and Reimbursable template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Choose the form you need and ensure it is for the correct city/area.

- Use the Preview button to review the form.

- Check the description to verify that you have selected the appropriate form.

- If the form isn't what you are seeking, use the Search area to find the form that meets your needs.

Form popularity

FAQ

While the IRS does allow employers to reimburse employee expenses through payroll, some tax implications can come with doing it this way. For example, if the reimbursement is not made as part of an accountable plan, it will be taxable to the employee as wages.

The new year brought a new concern for Illinois employers: a mandatory expense reimbursement law. As of January 1, 2019, Illinois employers must reimburse all necessary expenditures their employees incur in the scope of employment directly related to services performed by the employer.

Certain states including California, Illinois and Massachusetts do mandate that employers reimburse employees for mileage and vehicle expenses related to work. Each year, the IRS sets its mileage reimbursement rate. In 2020, the standard mileage rate is $0.575 per mile.

If the employer does not have an accountable plan, then any reimbursements, even those that are ordinary and necessary, are taxable income.

The cost of work-related travel, including transportation, lodging, meals, and entertainment that meet the criteria outlined in IRS Publication 463, Travel, Entertainment, Gift, and Car Expenses, are generally reimbursable expenses.

Illinois Law Now Requires Employers to Reimburse Employee Business Expenses. Effective January 1, 2019, Illinois law requires employers to reimburse employees for qualifying expenses and losses incurred by employees in the course of their employment.

The cost of work-related travel, including transportation, lodging, meals, and entertainment that meet the criteria outlined in IRS Publication 463, Travel, Entertainment, Gift, and Car Expenses, are generally reimbursable expenses.

Yes. You can deduct the employer reimbursed expenses which is included in your taxable wages. In general, there are two methods of reimbursing employees for expenses. Accountable plan and Non-accountable plan.

How to record reimbursementsKeep your receipts. It's important to keep an accurate record of your expenses.Add reimbursement costs to client bill. Add up all expenses for the project and add this amount to the client's bill.Bill client up to agreed-upon limits. Issue the bill promptly.Know before you go.

Yes. You can deduct the employer reimbursed expenses which is included in your taxable wages. In general, there are two methods of reimbursing employees for expenses. Accountable plan and Non-accountable plan.