Title: Illinois Letter to Client — Failure to Pay Account and Proposed Withdrawal: A Comprehensive Guide Keywords: Illinois letter to client, failure to pay account, proposed withdrawal, legal procedure, debt collection, demand for payment, account statement, payment options, legal consequences. Introduction: In the state of Illinois, when a client fails to pay their outstanding account balance, it is crucial for businesses to promptly address the matter through official correspondence. This detailed guide aims to provide insight into the various types of Illinois Letters to Client — Failure to Pay Account and Proposed Withdrawal. Each type serves a specific purpose, such as demanding payment, proposing payment options, or warning of potential legal consequences. 1. Illinois Letter to Client — Demand for Payment: The Illinois Letter to Client — Demand for Payment is sent when a client fails to pay their bill despite previous reminders. This letter politely but firmly requests immediate settlement of the outstanding account balance. It includes the client's account statement, clearly outlining the amount owed, the due date, and any applicable interest or penalties. Additionally, this letter may highlight the potential consequences of non-payment, such as further legal action or damage to the client's credit rating. 2. Illinois Letter to Client — Proposal for Payment Arrangement: When a client is struggling to pay the full outstanding balance and requires an extended period or alternative payment terms, the Illinois Letter to Client — Proposal for Payment Arrangement becomes necessary. In this letter, the business proposes a mutually agreeable payment plan, suggesting installment options, revised due dates, or any other feasible arrangement. The letter emphasizes the importance of prompt response and cooperation to avoid further escalations. 3. Illinois Letter to Client — Final Notice of Impending Legal Action: Should prior attempts to collect payment prove futile, businesses can send an Illinois Letter to Client — Final Notice of Impending Legal Action. This formal communication notifies the client that if payment is not received within a specified timeframe, legal action will ensue. It reiterates the amount owed, emphasizes the consequences of disregarding the notice, and asserts the need for immediate remedial action. It may also suggest the possibility of collection agency involvement or filing a lawsuit in small claims court. 4. Illinois Letter to Client — Official Notification of Account Withdrawal: When a client continuously fails to make payments, a business may decide to terminate their relationship and withdraw their account privileges. The Illinois Letter to Client — Official Notification of Account Withdrawal serves this purpose. It informs the client of the business's decision to cease providing goods or services and outlines the rationale behind the withdrawal. This letter may signify that legal recourse will be pursued to recover any outstanding debt or damages. Conclusion: Effectively addressing non-payment issues is crucial for businesses operating in Illinois. By utilizing various types of Illinois Letters to Client — Failure to Pay Account and Proposed Withdrawal, businesses can assert their rights while encouraging prompt resolution. Choosing the appropriate letter type based on the situation can help foster a professional and effective approach towards recovering outstanding debts and protecting the business's financial interests.

Illinois Letter to Client - Failure to pay account and proposed withdrawal

Description

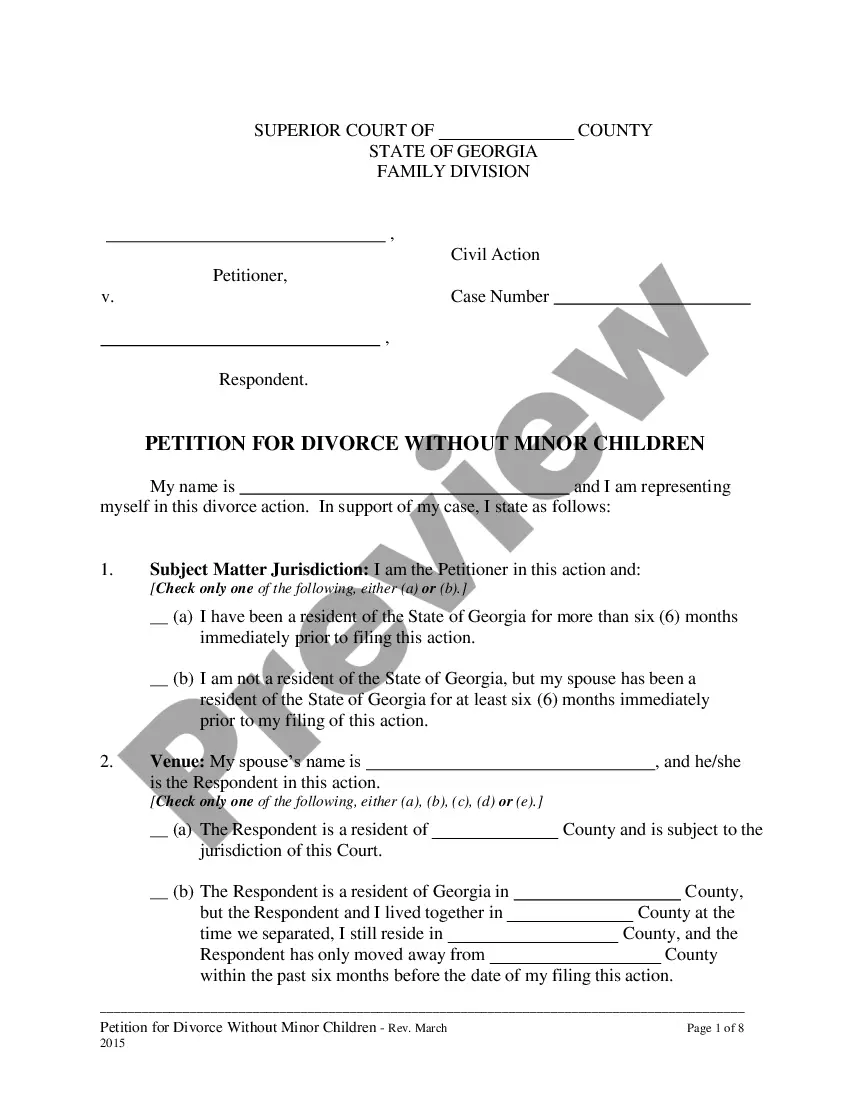

How to fill out Illinois Letter To Client - Failure To Pay Account And Proposed Withdrawal?

US Legal Forms - one of several biggest libraries of authorized kinds in the USA - provides an array of authorized document templates you may download or print out. While using site, you will get a huge number of kinds for business and individual purposes, categorized by groups, says, or search phrases.You can find the latest variations of kinds just like the Illinois Letter to Client - Failure to pay account and proposed withdrawal within minutes.

If you currently have a membership, log in and download Illinois Letter to Client - Failure to pay account and proposed withdrawal through the US Legal Forms library. The Down load button can look on each and every develop you view. You gain access to all previously downloaded kinds from the My Forms tab of your accounts.

If you want to use US Legal Forms for the first time, listed below are straightforward instructions to help you get started out:

- Be sure to have chosen the best develop for the area/area. Go through the Review button to check the form`s content material. Read the develop outline to ensure that you have selected the proper develop.

- When the develop does not satisfy your requirements, take advantage of the Research industry towards the top of the monitor to get the one who does.

- Should you be satisfied with the form, verify your choice by clicking the Get now button. Then, choose the pricing plan you want and offer your qualifications to sign up for an accounts.

- Process the deal. Make use of your credit card or PayPal accounts to finish the deal.

- Select the format and download the form on your own system.

- Make modifications. Complete, modify and print out and indicator the downloaded Illinois Letter to Client - Failure to pay account and proposed withdrawal.

Each and every design you included with your bank account lacks an expiration particular date and is your own for a long time. So, in order to download or print out one more backup, just proceed to the My Forms portion and then click in the develop you want.

Gain access to the Illinois Letter to Client - Failure to pay account and proposed withdrawal with US Legal Forms, probably the most extensive library of authorized document templates. Use a huge number of professional and status-certain templates that fulfill your organization or individual needs and requirements.