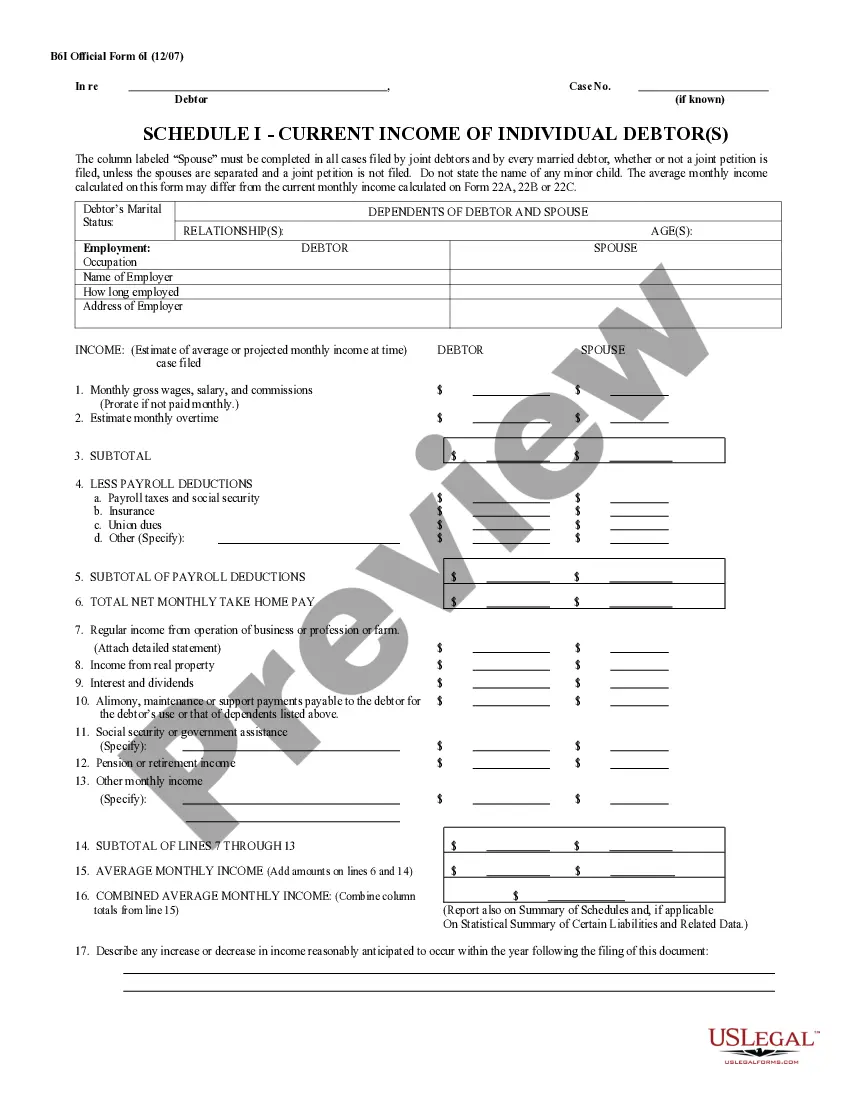

Illinois Summary of Schedules - Form 6CONTSUM - Post 2005

Description

How to fill out Summary Of Schedules - Form 6CONTSUM - Post 2005?

Finding the right legal file design can be quite a struggle. Obviously, there are plenty of web templates available on the net, but how would you discover the legal kind you require? Use the US Legal Forms web site. The services gives 1000s of web templates, like the Illinois Summary of Schedules - Form 6CONTSUM - Post 2005, which can be used for business and private requirements. All the forms are checked by experts and satisfy federal and state specifications.

In case you are presently signed up, log in for your account and then click the Download key to obtain the Illinois Summary of Schedules - Form 6CONTSUM - Post 2005. Make use of your account to look through the legal forms you have bought earlier. Check out the My Forms tab of your respective account and have one more duplicate in the file you require.

In case you are a fresh user of US Legal Forms, here are straightforward directions so that you can stick to:

- Initially, ensure you have chosen the correct kind for the town/state. You are able to examine the shape using the Preview key and look at the shape outline to make certain this is the right one for you.

- If the kind is not going to satisfy your requirements, utilize the Seach discipline to obtain the proper kind.

- Once you are sure that the shape would work, go through the Purchase now key to obtain the kind.

- Pick the rates program you would like and type in the required info. Build your account and pay for the transaction using your PayPal account or bank card.

- Opt for the file formatting and down load the legal file design for your system.

- Complete, modify and printing and signal the acquired Illinois Summary of Schedules - Form 6CONTSUM - Post 2005.

US Legal Forms may be the largest collection of legal forms for which you can find different file web templates. Use the service to down load professionally-produced paperwork that stick to express specifications.

Form popularity

FAQ

Official Form 106Dec. Declaration About an Individual Debtor's Schedules. 12/15. If two married people are filing together, both are equally responsible for supplying correct information. You must file this form whenever you file bankruptcy schedules or amended schedules.

This is an Official Bankruptcy Form. Official Bankruptcy Forms are approved by the Judicial Conference and must be used under Bankruptcy Rule 9009.

A creditor schedule is a statement that details the balances of the creditor control account and compares them with the individual creditor balances. A debtor schedule compares the individual customer balances with the balances of the debtor control account.

Assets are what a business owns, and liabilities are what a business owes. Both are listed on a company's balance sheet, a financial statement that shows a company's financial health. Assets minus liabilities equal equity?or the company's net worth.

What Does Debtor Mean? Debtors are individuals or businesses that owe money. Debtors can owe money to banks, or individuals and companies. Debtors owe a debt that must be paid at some time in the future.

If your total monthly income over the course of the next 60 months is less than $7,475 then you pass the means test and you may file a Chapter 7 bankruptcy. If it is over $12,475 then you fail the means test and don't have the option of filing Chapter 7.

Schedules of Assets and Liabilities means the "Schedule of All Liabilities of Debtor and Statement of All Property of Debtor" Filed by the Debtors, as the same have been or may be amended from time to time prior to the Effective Date.

An individual who is authorized to act on behalf of a non-individual debtor, such as a corporation or partnership, must sign and submit this form for the schedules of assets and liabilities, any other document that requires a declaration that is not included in the document, and any amendments of those documents.