Illinois Declaration Concerning Debtors' Schedules - Form 6SIG - Post 2005

Description

How to fill out Declaration Concerning Debtors' Schedules - Form 6SIG - Post 2005?

You are able to devote hrs on the Internet searching for the legal record format that fits the federal and state needs you require. US Legal Forms offers 1000s of legal types that are analyzed by professionals. It is simple to obtain or produce the Illinois Declaration Concerning Debtors' Schedules - Form 6SIG - Post 2005 from your assistance.

If you have a US Legal Forms account, you may log in and then click the Obtain key. Following that, you may complete, revise, produce, or signal the Illinois Declaration Concerning Debtors' Schedules - Form 6SIG - Post 2005. Every legal record format you get is yours forever. To get yet another version of any obtained develop, visit the My Forms tab and then click the related key.

If you use the US Legal Forms web site the very first time, adhere to the simple recommendations below:

- Initially, ensure that you have chosen the correct record format to the county/town of your liking. See the develop explanation to make sure you have selected the right develop. If readily available, take advantage of the Preview key to look through the record format at the same time.

- If you wish to locate yet another edition in the develop, take advantage of the Lookup discipline to discover the format that fits your needs and needs.

- When you have located the format you desire, click on Purchase now to continue.

- Find the pricing prepare you desire, type your credentials, and register for an account on US Legal Forms.

- Comprehensive the transaction. You may use your Visa or Mastercard or PayPal account to purchase the legal develop.

- Find the format in the record and obtain it to your device.

- Make alterations to your record if needed. You are able to complete, revise and signal and produce Illinois Declaration Concerning Debtors' Schedules - Form 6SIG - Post 2005.

Obtain and produce 1000s of record layouts using the US Legal Forms Internet site, which provides the most important assortment of legal types. Use skilled and condition-particular layouts to deal with your organization or personal requires.

Form popularity

FAQ

Debtors are individuals or businesses that owe money, whether to banks or other individuals. Debtors are often called borrowers if the money owed is to a bank or financial institution, however, they are called issuers if the debt is in the form of securities.

Unsecured creditors. Where should a company undergoing reorganization report the gains and losses resulting from the reorganization? On the income statement, separate from other gains and losses.

Statement of Financial Affairs (?SOFA?) The SOFA is a bankruptcy form that focuses on the financial situation that caused the debtor to become insolvent. The court, trustee, creditors and debtor's advisors will use the SOFA to look more closely at the debtor's business and financial situation.

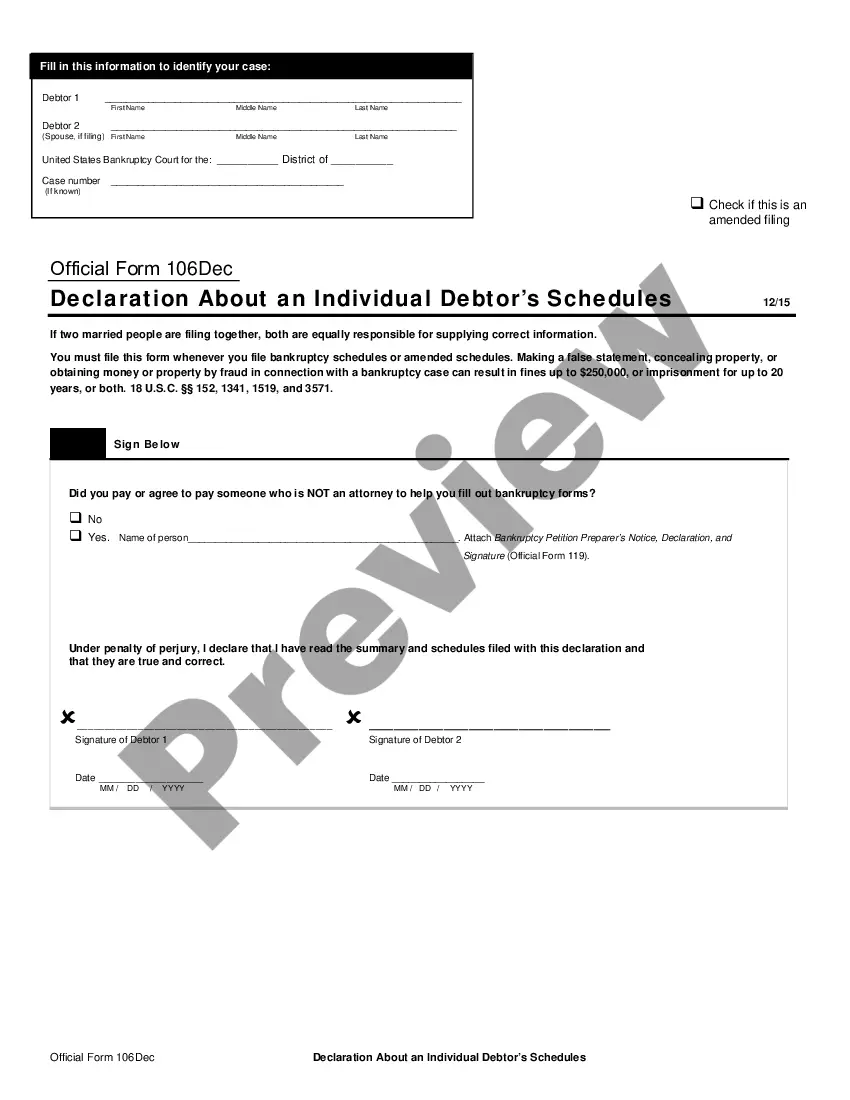

This is an Official Bankruptcy Form. Official Bankruptcy Forms are approved by the Judicial Conference and must be used under Bankruptcy Rule 9009.

Official Form 106Sum. Summary of Your Assets and Liabilities and Certain Statistical Information. 12/15. Be as complete and accurate as possible. If two married people are filing together, both are equally responsible for supplying correct information.

Official Form 106Dec. Declaration About an Individual Debtor's Schedules. 12/15. If two married people are filing together, both are equally responsible for supplying correct information. You must file this form whenever you file bankruptcy schedules or amended schedules.

Statement of Financial Af·?fairs. : a written statement filed by a debtor in bankruptcy that contains information regarding especially financial records, location of any accounts, prior bankruptcy, and recent or current debt. called also statement of affairs.

Form 7, the Statement of Financial Affairs, contains a series of questions which direct the debtor to answer by furnishing information. If the answer to a question is "None," or the question is not applicable, an affirmative statement to that effect is required.