Illinois Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation

Description

How to fill out Agreement Of Merger Between Barber Oil Corporation And Stock Transfer Restriction Corporation?

If you wish to complete, download, or printing legal document templates, use US Legal Forms, the biggest assortment of legal varieties, which can be found on the Internet. Use the site`s simple and easy convenient search to discover the papers you want. Numerous templates for company and personal functions are sorted by classes and claims, or key phrases. Use US Legal Forms to discover the Illinois Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation with a number of clicks.

Should you be already a US Legal Forms consumer, log in in your profile and click on the Down load key to get the Illinois Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation. Also you can accessibility varieties you earlier downloaded from the My Forms tab of your profile.

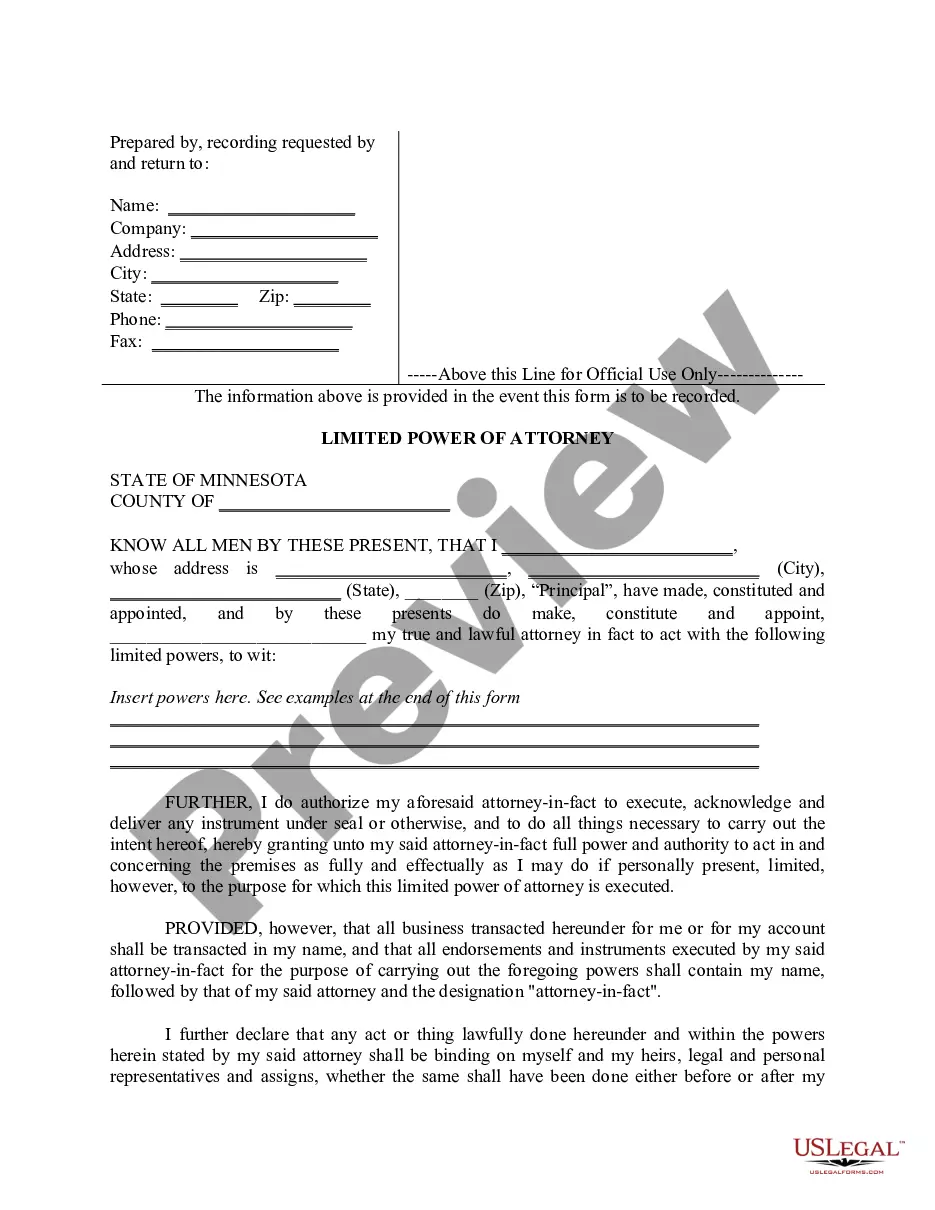

If you work with US Legal Forms initially, refer to the instructions below:

- Step 1. Be sure you have selected the form for that appropriate area/country.

- Step 2. Take advantage of the Preview solution to look over the form`s articles. Never neglect to see the description.

- Step 3. Should you be unhappy with the develop, make use of the Lookup field on top of the screen to get other variations from the legal develop design.

- Step 4. After you have found the form you want, go through the Get now key. Choose the pricing plan you choose and put your qualifications to sign up for the profile.

- Step 5. Procedure the transaction. You may use your bank card or PayPal profile to finish the transaction.

- Step 6. Find the file format from the legal develop and download it on your gadget.

- Step 7. Comprehensive, change and printing or indicator the Illinois Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation.

Every legal document design you buy is your own for a long time. You may have acces to every develop you downloaded inside your acccount. Click on the My Forms section and decide on a develop to printing or download yet again.

Compete and download, and printing the Illinois Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation with US Legal Forms. There are millions of professional and state-certain varieties you can utilize for your personal company or personal requirements.

Form popularity

FAQ

An agreement of merger is a legal document that establishes the terms and conditions to combine two or more businesses into one new entity. The business owners of the merging companies agree to sell all their stock and assets to the newly formed company for an agreed upon price.

Parts of merger and acquisition contracts ?Parties and recitals. ?Price, currencies, and structure. ?Representations and warranties. ?Covenants. ?Conditions. ?Termination provisions. ?Indemnification. ?Tax.

If the merger or acquisition requires a vote by shareholders, the agreement will be available in the proxy document, Schedule 14A (or sometimes an information statement, Schedule 14C). The proxy will include the terms of the merger and what shareholders can expect to receive as proceeds.

The Company and each of its subsidiaries is duly organized, validly existing and in good standing (with respect to jurisdictions that recognize the concept of good standing) under the laws of the jurisdiction of its organization and has all requisite corporate or similar power and authority to own, lease and operate ...

Merger Parties means, individually and collectively, the Company, the Shareholders, Merger Sub and Buyer.