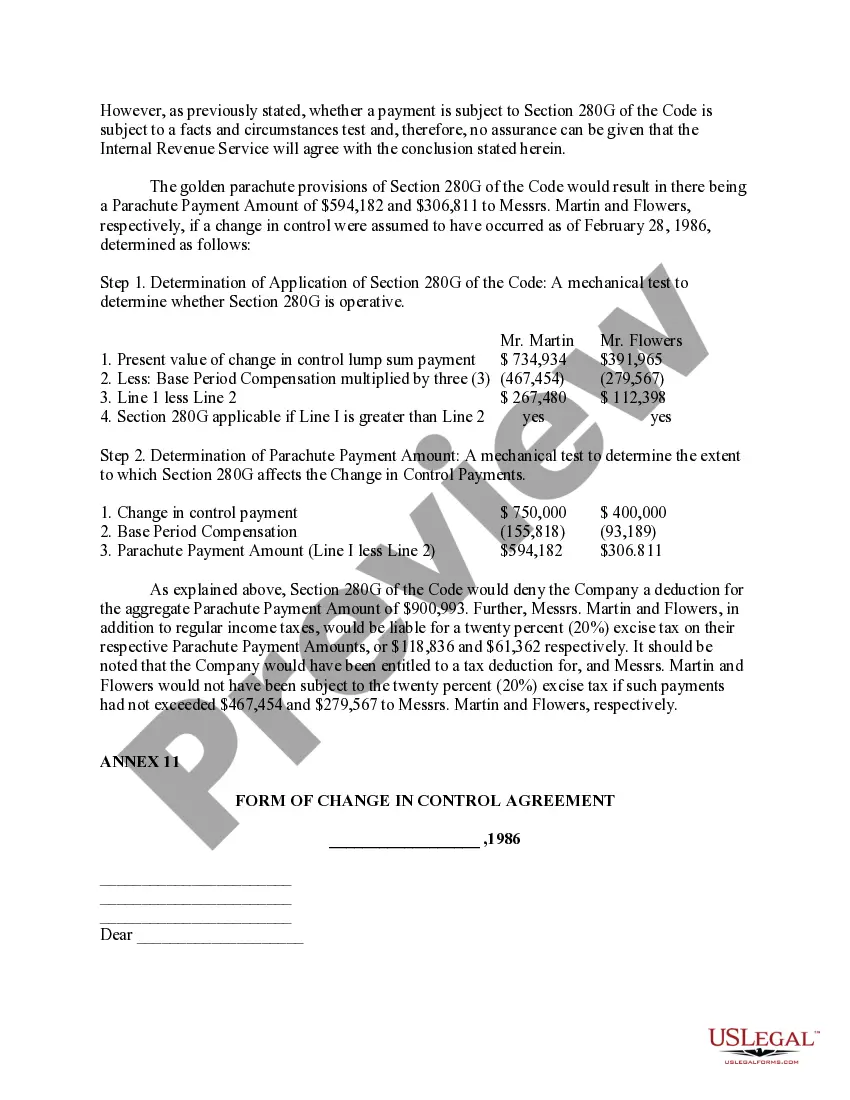

Illinois Ratification of Change in Control Agreements: An Illinois Ratification of Change in Control Agreement is a legal document that confirms and approves the modification or amendment made to a pre-existing change in control agreement between a company and its executives or key employees. This ratification ensures that the revised agreement is legally binding and provides security and protection to both parties involved. The purpose of this agreement is to outline the terms and conditions related to change in control events, such as mergers, acquisitions, or other significant corporate transactions. These events can have a substantial impact on an executive's employment, compensation, benefits, and other rights. Therefore, having a ratified agreement in place safeguards the interests of both the company and the executive. In Illinois, there are various types of Ratification of Change in Control Agreements, each tailored to different situations and circumstances. Some common types include: 1. Executive Change in Control Agreement: This type of agreement is typically entered into between a company and its top-level executives, such as CEOs or presidents. It outlines the provisions and benefits that will apply to the executive in the event of a change in control. 2. Employee Change in Control Agreement: This agreement is designed for key employees who play a crucial role in the organization's success. It ensures that they are protected and incentivized during change in control events, often providing them with severance packages, stock options, or other benefits. 3. Non-Compete Change in Control Agreement: In some cases, a change in control may trigger the enforcement of non-compete clauses. This agreement ensures that executives or employees cannot directly compete with the company for a specified period following the change in control, thereby safeguarding the company's interests. 4. Merger or Acquisition Change in Control Agreement: This agreement is specific to situations where a merger, acquisition, or similar transaction is taking place. It outlines the terms and conditions that will apply to executives or employees involved in the transaction, addressing issues such as termination, retention bonuses, and equity vesting. To proceed with the Illinois Ratification of Change in Control Agreement, it is advisable to consult with legal professionals who specialize in employment and corporate law. They can provide guidance on the specific terms and provisions to include in the agreement, ensuring compliance with Illinois state laws and regulations. Moreover, a copy of the form of the change in control agreement should be attached to the ratification document as evidence of the revised terms. In conclusion, the Illinois Ratification of Change in Control Agreement is a vital legal instrument that solidifies the changes made to pre-existing agreements related to change in control events. It serves as a means to protect both companies and executives during significant corporate transactions, ensuring a fair and transparent process.

Illinois Ratification of change in control agreements with copy of form of change in control agreement

Description

How to fill out Illinois Ratification Of Change In Control Agreements With Copy Of Form Of Change In Control Agreement?

US Legal Forms - among the greatest libraries of legal forms in America - gives a wide range of legal file themes you may down load or printing. While using internet site, you will get a large number of forms for business and personal functions, sorted by classes, suggests, or search phrases.You can get the latest models of forms like the Illinois Ratification of change in control agreements with copy of form of change in control agreement in seconds.

If you have a subscription, log in and down load Illinois Ratification of change in control agreements with copy of form of change in control agreement from the US Legal Forms local library. The Acquire option can look on every form you look at. You have access to all earlier downloaded forms within the My Forms tab of your own account.

If you would like use US Legal Forms for the first time, allow me to share easy directions to obtain started off:

- Be sure to have selected the right form for your area/area. Select the Preview option to review the form`s content. See the form information to ensure that you have chosen the correct form.

- In case the form doesn`t satisfy your needs, make use of the Look for industry near the top of the screen to obtain the one which does.

- If you are satisfied with the shape, affirm your choice by visiting the Acquire now option. Then, pick the costs plan you like and offer your qualifications to register on an account.

- Method the transaction. Make use of your charge card or PayPal account to complete the transaction.

- Pick the formatting and down load the shape on your product.

- Make changes. Complete, modify and printing and indicator the downloaded Illinois Ratification of change in control agreements with copy of form of change in control agreement.

Every web template you added to your bank account lacks an expiry time and it is yours for a long time. So, if you wish to down load or printing yet another duplicate, just go to the My Forms portion and then click in the form you need.

Obtain access to the Illinois Ratification of change in control agreements with copy of form of change in control agreement with US Legal Forms, probably the most substantial local library of legal file themes. Use a large number of expert and express-distinct themes that meet your small business or personal requirements and needs.

Form popularity

FAQ

In employment contracts, a change of control clause entitles the employee to a specified payment or enhanced notice period if their employer is taken over and the takeover results in dismissal by their employer or a material reduction in the employee's responsibilities leading to constructive dismissal within a ...

A party may try to ensure that the other party seeks consent to make the change and maintain the agreement, or provide some form of payment as compensation for the change, while retaining the right to terminate the agreement.

Not all change of control provisions are triggered by the same action. For example, a change of control may be triggered by a sale of more than 50% of a party's stock, a sale of substantially all the assets of a party or a change in most of the board members of a party.

A change of control is a change in a company's ownership or management that results in the decision-making capacity of that entity being exercised by a different group of shareholders and/or directors.

Change in control agreements are contracts that outline pay and benefits an executive will receive in the event of a change in company ownership. They are also sometimes known as ?golden parachutes,? as they provide protection for executives if they are forced out after a company takeover.