Illinois Employee Stock Option Plan of Manugistics Group, Inc.

Description

How to fill out Employee Stock Option Plan Of Manugistics Group, Inc.?

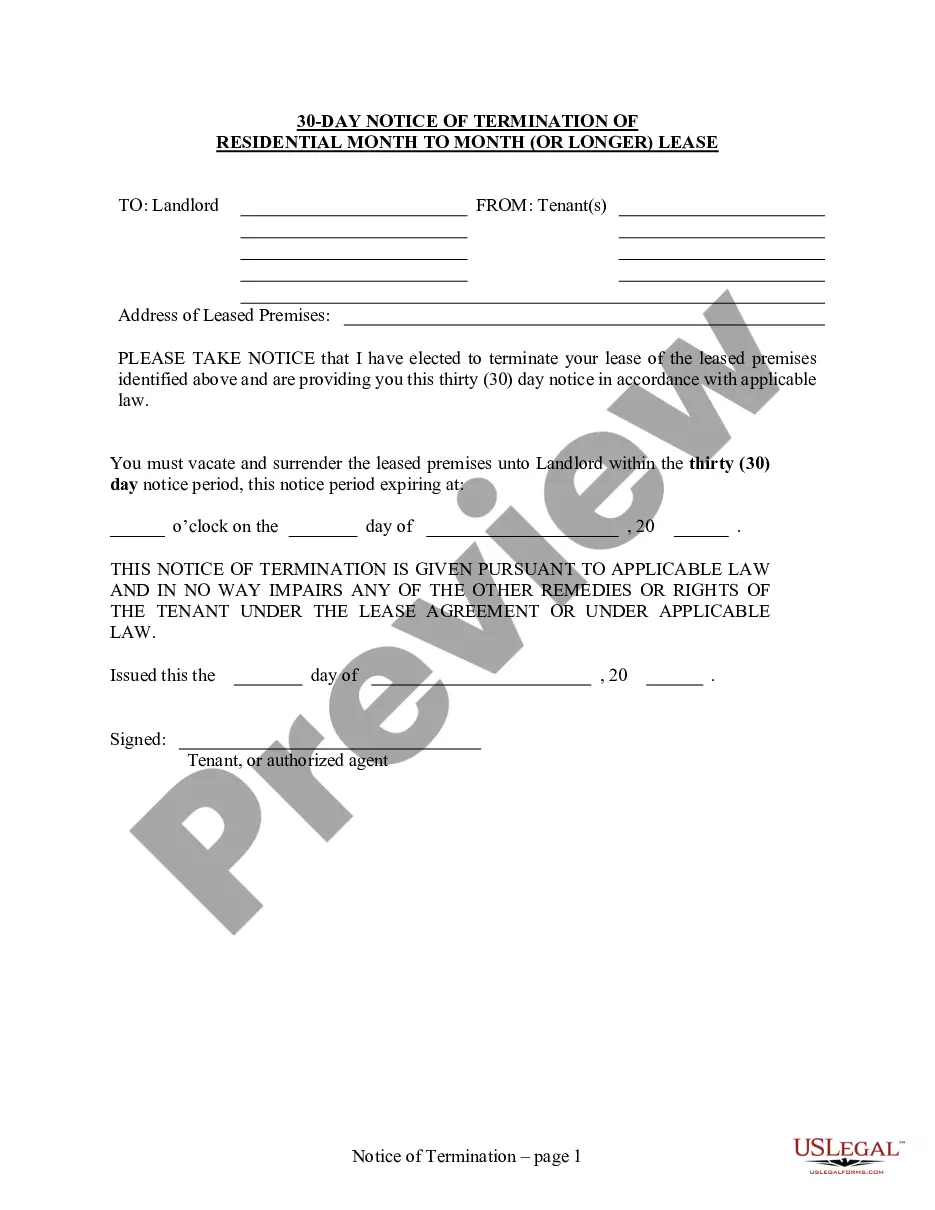

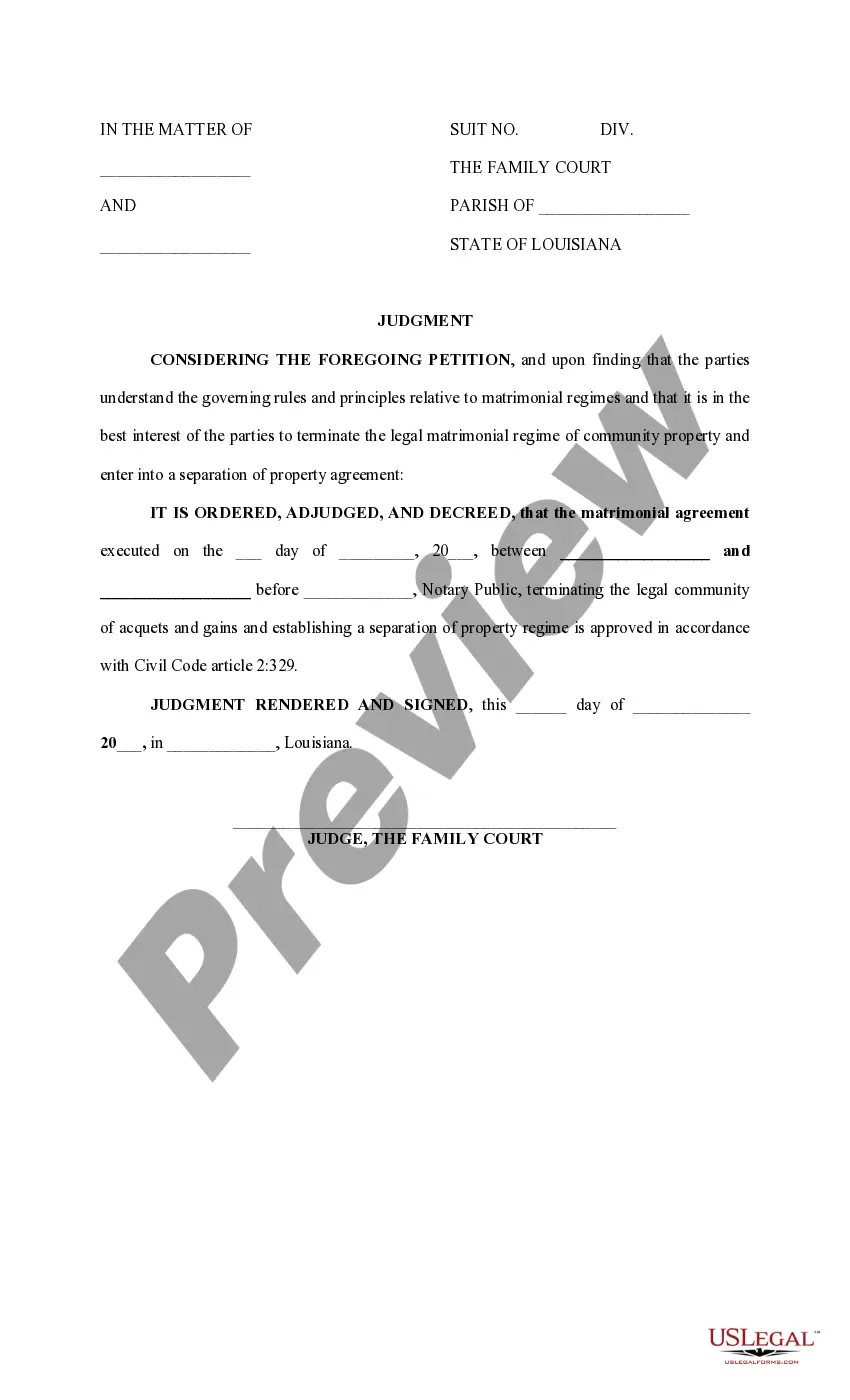

You are able to devote time on the web looking for the legitimate papers design that suits the state and federal specifications you need. US Legal Forms provides thousands of legitimate varieties that are reviewed by specialists. You can easily acquire or printing the Illinois Employee Stock Option Plan of Manugistics Group, Inc. from the support.

If you already have a US Legal Forms account, you can log in and then click the Obtain option. Afterward, you can full, change, printing, or sign the Illinois Employee Stock Option Plan of Manugistics Group, Inc.. Every legitimate papers design you get is your own permanently. To have an additional backup of any acquired develop, visit the My Forms tab and then click the related option.

Should you use the US Legal Forms website initially, follow the straightforward recommendations under:

- Very first, ensure that you have selected the proper papers design for the county/town of your liking. Look at the develop information to make sure you have selected the right develop. If available, take advantage of the Preview option to look from the papers design also.

- In order to discover an additional version of your develop, take advantage of the Lookup field to discover the design that suits you and specifications.

- Once you have discovered the design you want, just click Acquire now to proceed.

- Choose the rates prepare you want, enter your credentials, and sign up for an account on US Legal Forms.

- Comprehensive the deal. You should use your credit card or PayPal account to cover the legitimate develop.

- Choose the formatting of your papers and acquire it in your gadget.

- Make modifications in your papers if necessary. You are able to full, change and sign and printing Illinois Employee Stock Option Plan of Manugistics Group, Inc..

Obtain and printing thousands of papers themes utilizing the US Legal Forms site, that offers the greatest selection of legitimate varieties. Use skilled and express-particular themes to handle your business or specific requirements.

Form popularity

FAQ

Below are our 10 key steps for creating, building and maintaining an ESPP: Determine the plan's purpose. ... Conduct external and internal research. ... Establish a budget. ... Pick the right components for the company. ... Seek stakeholder buy-in. ... Prepare early for shareholder approval. ... Select a provider. ... Create a robust implementation plan.

Identification. An ESOP qualifies as a retirement plan, such as a 401 (k) or individual retirement account, while corporations use stock options as an employee benefit, like health insurance. In an ESOP, the company contributes to employee retirement plans with its own stock.

Making ESO Offers Declare the type of stock options employees will receive (ISOs or NSOs). Explain the value in terms of the number of shares rather than the percentage of the company. State that the board must approve all stock option grant amounts before the offer letter becomes valid.

Weighing your options Ultimately, it's best to remember that stock options are just that: Options. They don't compel anyone to do anything, but they can, in some cases, prove extremely valuable and help significantly increase an employee's wealth. If they're fortunate enough to be at a strong, growing company, that is.

An employee stock purchase plan allows you to buy company stock at a bargain price. Discounts usually range from 5% to 15%. For example, if you work and participate in Hilton's ESPP, you can buy Hilton stock at a 15% discount. If Hilton's stock is trading at $130/share, they'll buy it at $110.50/share for you.

With stock-based compensation, employees in an early-stage business are offered stock options in addition to their salaries. The percentage of a company's shares reserved for stock options will typically vary from 5% to 15% and sometimes go up as high as 20%, depending on the development stage of the company.

Stock options allow employees to buy a piece of your company at a discount in exchange for their dedication and commitment. As a small business, you can consider offering stock options as a great way to compensate employees and help build a hardworking and innovative staff.

Benefits of an ESOP Over 401K ESOPs offer far more benefits than 401ks. For this reason, satisfaction?both from employees and employers?with ESOPs tends to be far higher than that of 401ks. ESOPs most-effectively reward workers both for their increased productivity but also for their continued employment.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. ESOPs are most commonly used to facilitate succession planning, allowing a company owner to sell his or her. shares and transition flexibly out of the business.