Illinois Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc.

Description

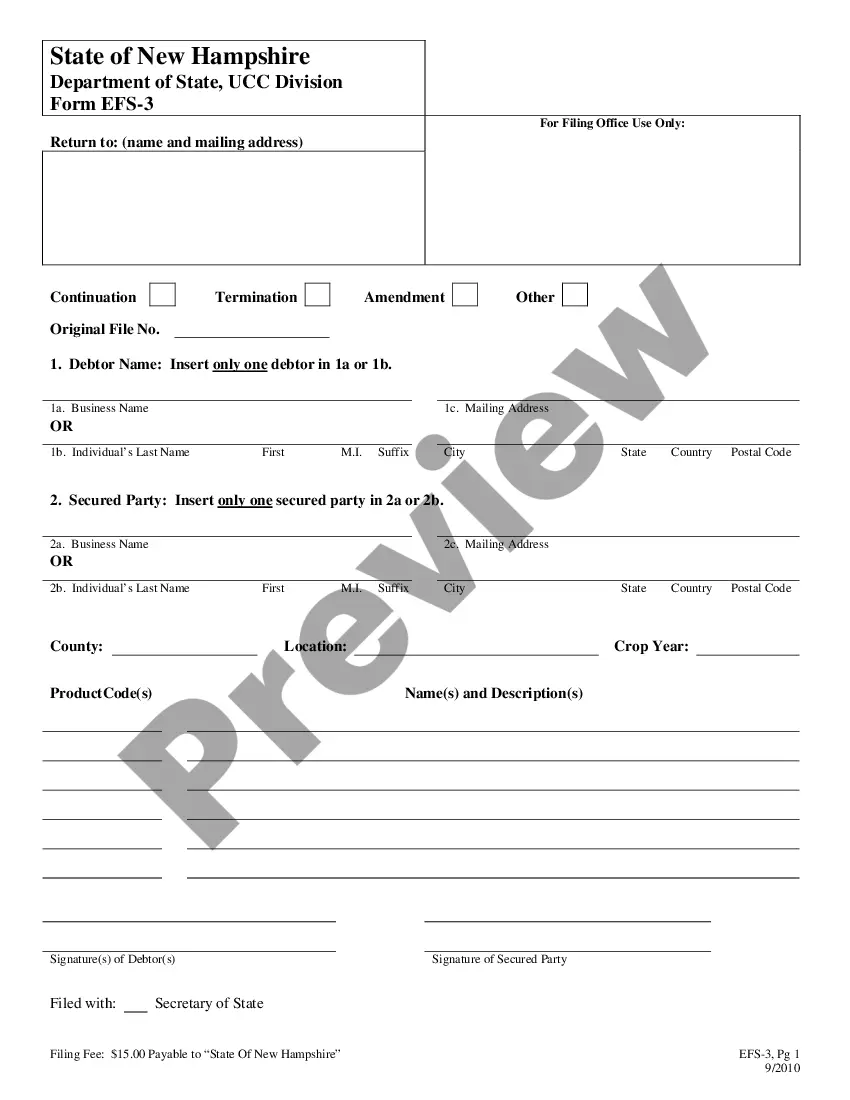

How to fill out Stock Option And Long Term Incentive Plan Of Golf Technology Holding, Inc.?

US Legal Forms - one of several largest libraries of lawful varieties in the USA - provides a wide array of lawful record web templates you are able to obtain or produce. Using the website, you can get thousands of varieties for organization and specific uses, sorted by classes, claims, or keywords.You can get the most up-to-date versions of varieties just like the Illinois Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc. in seconds.

If you already possess a monthly subscription, log in and obtain Illinois Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc. through the US Legal Forms catalogue. The Obtain button will appear on each and every type you perspective. You gain access to all earlier saved varieties within the My Forms tab of the accounts.

If you would like use US Legal Forms for the first time, listed here are straightforward guidelines to help you get started off:

- Make sure you have selected the proper type to your city/region. Go through the Preview button to check the form`s content material. Browse the type description to ensure that you have selected the correct type.

- When the type doesn`t satisfy your needs, use the Lookup area on top of the screen to discover the the one that does.

- When you are pleased with the shape, verify your selection by clicking the Acquire now button. Then, select the costs prepare you like and offer your references to sign up to have an accounts.

- Approach the transaction. Make use of charge card or PayPal accounts to finish the transaction.

- Choose the file format and obtain the shape on the gadget.

- Make modifications. Fill out, modify and produce and signal the saved Illinois Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc..

Each web template you added to your bank account lacks an expiry date and is your own property eternally. So, if you would like obtain or produce yet another version, just proceed to the My Forms section and click in the type you need.

Get access to the Illinois Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc. with US Legal Forms, the most comprehensive catalogue of lawful record web templates. Use thousands of skilled and condition-certain web templates that satisfy your company or specific requirements and needs.

Form popularity

FAQ

With the offering company's stocks to the employees, the ?rm achieves two objectives? to offer incentives to the employees and to motivate them to worl-c hard to contribute towards the increment of the value of the stocks owned by them. This way a stock option plan provides an incentive for executives.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income.

Long-term incentives are earned based on the achievement of goals over a longer period of time. The goals may be based on stock price or business performance. It's important to take a holistic approach to compensation ? if it's short- or long-term, cash vs. bonds, the kinds of vehicles you're using, and so forth.

ESOs are a form of equity compensation granted by companies to their employees and executives. Like a regular call option, an ESO gives the holder the right to purchase the underlying asset?the company's stock?at a specified price for a finite period of time.