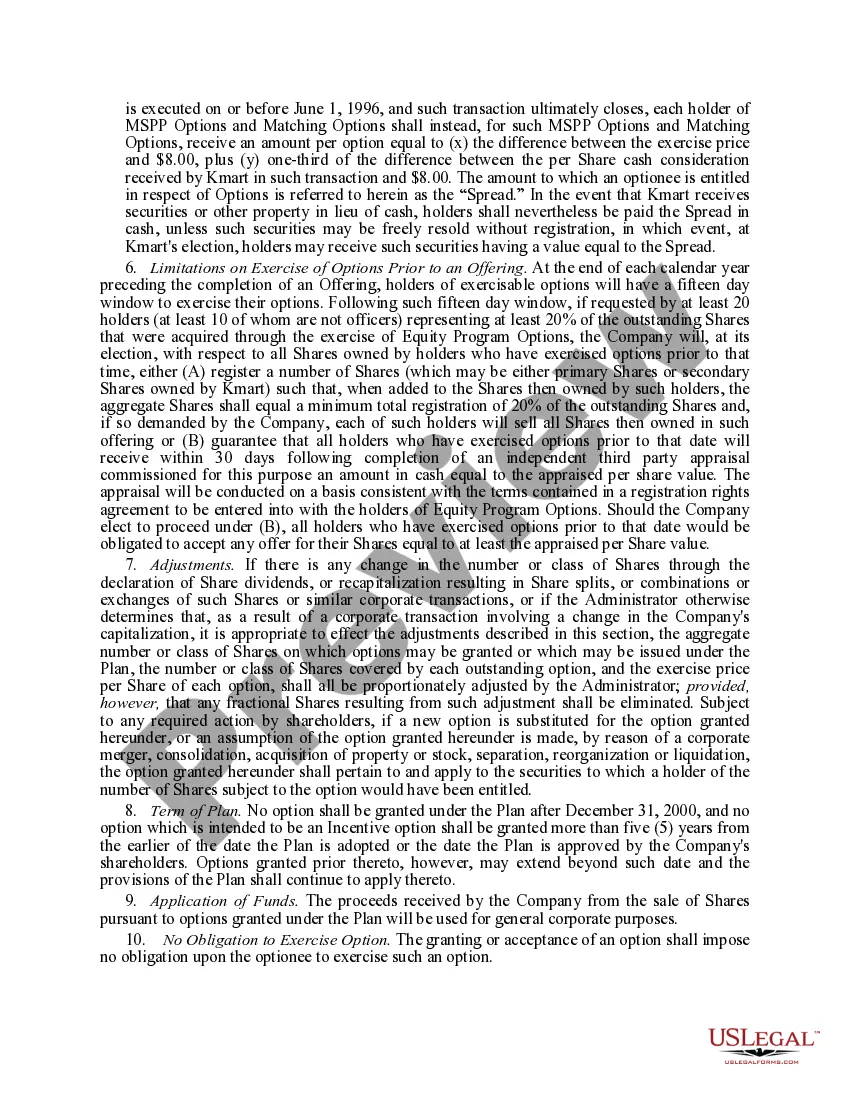

Illinois Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options

Description

How to fill out Stock Option Plan Stock Option Plan Which Provides For Grant Of Incentive Stock Options, Nonqualified Stock Options, And Exchange Options?

Choosing the best authorized papers format can be quite a struggle. Needless to say, there are a lot of templates accessible on the Internet, but how would you obtain the authorized develop you will need? Take advantage of the US Legal Forms web site. The service delivers a large number of templates, like the Illinois Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options, which you can use for company and personal demands. Each of the varieties are inspected by professionals and satisfy state and federal needs.

Should you be presently registered, log in to the bank account and click on the Download option to have the Illinois Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options. Use your bank account to look from the authorized varieties you may have ordered earlier. Check out the My Forms tab of the bank account and have yet another copy from the papers you will need.

Should you be a whole new end user of US Legal Forms, listed below are easy directions that you can follow:

- First, ensure you have chosen the correct develop to your town/region. You can look over the form using the Review option and study the form outline to ensure this is basically the best for you.

- When the develop is not going to satisfy your preferences, use the Seach industry to obtain the appropriate develop.

- Once you are certain that the form would work, click the Purchase now option to have the develop.

- Choose the costs prepare you desire and enter the essential information and facts. Design your bank account and pay money for the order making use of your PayPal bank account or bank card.

- Select the submit structure and acquire the authorized papers format to the gadget.

- Complete, modify and print and signal the obtained Illinois Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options.

US Legal Forms is the greatest catalogue of authorized varieties where you can find numerous papers templates. Take advantage of the service to acquire appropriately-made files that follow condition needs.

Form popularity

FAQ

What Is a Non-Qualified Stock Option (NSO)? A non-qualified stock option (NSO) is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option.

A stock option may be worth exercising if the current stock price (also known as the fair market value or FMV*) is more than the exercise price.

For example, if you're based in the US, you can offer ISOs to your domestic employees. However, as you cannot use an EOR to offer ISOs to foreign employees, you would need to offer an alternative, such as NSOs, RSUs, or VSOs.

Non-qualified stock options require payment of income tax of the grant price minus the price of the exercised option. NSOs might be provided as an alternative form of compensation. Prices are often similar to the market value of the shares.

Profits made from exercising qualified stock options (QSO) are taxed at the capital gains tax rate (typically 15%), which is lower than the rate at which ordinary income is taxed. Gains from non-qualified stock options (NQSO) are considered ordinary income and are therefore not eligible for the tax break.

The income related to the option exercise should be included in the Form W-2 you receive from your employer or 1099-NEC from the company if you are a non-employee. Any capital gain or loss amount may also be reportable on your US Individual Income Tax Return (Form 1040), Schedule D and Form 8949 in the year of sale.

Generally, ISO stock is awarded only to top management and highly-valued employees. ISOs also are called statutory or qualified stock options.

Non-qualified stock options are issued at a grant price. The grant price is the price at which you can buy the company stock. Your options come with a vesting schedule. During the time between the grant date of your options and the day they vest, you can't exercise your option.