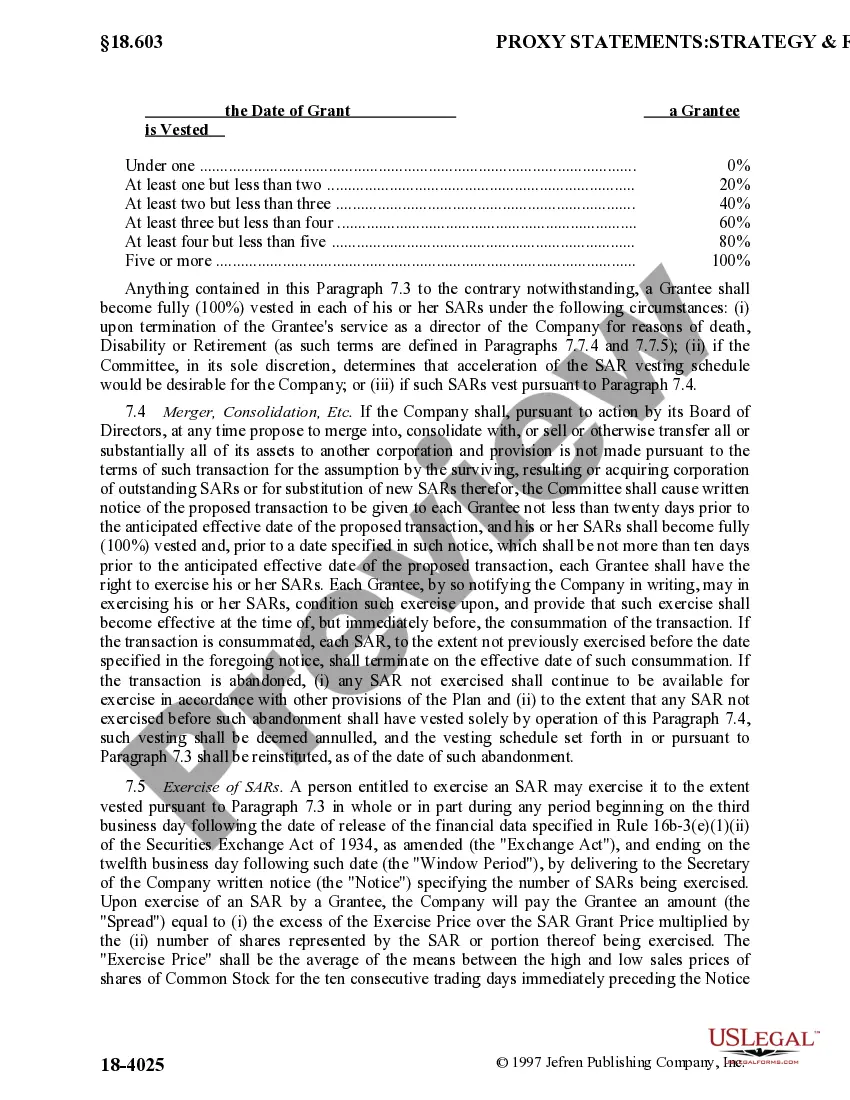

The Illinois Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. is a compensation program offered by the company specifically for its directors based in Illinois. It is designed to reward directors for their contributions and align their interests with the long-term success of the company. Under this plan, directors are granted stock appreciation rights (SARS) as a form of compensation. SARS provides the right to receive the appreciation in the value of a specified number of company shares over a certain period of time. These rights are typically granted at a predetermined exercise price equal to the fair market value of the company's stock on the date of grant. The Illinois Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. aims to incentivize directors to make decisions that positively impact the company's performance and shareholder value. By tying compensation to stock price appreciation, the plan encourages directors to focus on strategies and actions that will boost the company's financial success in the long run. This plan offers multiple types of stock appreciation rights, including: 1. Performance-Based SARS: These rights are granted based on the achievement of predetermined performance goals. Directors may earn SARS by meeting specific financial targets, revenue growth objectives, or other performance metrics outlined by the company. 2. Time-Vested SARS: These rights become exercisable over a period of time based on the director's continued service to the company. Directors typically earn a portion of the SARS each year and can exercise them once they have vested. 3. Change of Control SARS: In the event of a change of control, such as a merger or acquisition, these rights provide directors with the opportunity to benefit from the increase in stock value resulting from the transaction. This SARS may become immediately exercisable and allow directors to cash in on the change in company ownership. It is essential for directors to carefully review the terms and conditions outlined in the Illinois Directors Stock Appreciation Rights Plan to understand the specific rules related to each type of SAR. The plan will provide a comprehensive overview of grant dates, vesting schedules, exercise periods, and any other relevant details. In summary, the Illinois Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. offers a compensation structure that rewards directors for their contributions to the company's success. By granting various types of stock appreciation rights, the plan motivates directors to drive performance and create long-term value for shareholders.

Illinois Directors Stock Appreciation Rights Plan of American Annuity Group, Inc.

Description

How to fill out Illinois Directors Stock Appreciation Rights Plan Of American Annuity Group, Inc.?

US Legal Forms - one of many greatest libraries of authorized types in the States - offers a variety of authorized papers layouts you are able to obtain or print. Making use of the website, you will get a huge number of types for company and individual purposes, sorted by classes, claims, or keywords.You can find the latest versions of types just like the Illinois Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. in seconds.

If you currently have a registration, log in and obtain Illinois Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. in the US Legal Forms local library. The Download key will show up on every kind you look at. You gain access to all formerly saved types in the My Forms tab of the profile.

If you wish to use US Legal Forms the first time, here are simple guidelines to get you started:

- Be sure you have picked the best kind for your city/state. Click on the Preview key to analyze the form`s articles. Browse the kind outline to ensure that you have chosen the correct kind.

- In case the kind doesn`t satisfy your specifications, make use of the Look for field on top of the monitor to find the the one that does.

- Should you be pleased with the form, validate your choice by clicking on the Buy now key. Then, opt for the prices prepare you favor and supply your qualifications to sign up on an profile.

- Process the transaction. Make use of bank card or PayPal profile to complete the transaction.

- Select the formatting and obtain the form on the system.

- Make adjustments. Complete, edit and print and sign the saved Illinois Directors Stock Appreciation Rights Plan of American Annuity Group, Inc..

Every web template you put into your account does not have an expiry time which is your own property forever. So, if you wish to obtain or print an additional backup, just proceed to the My Forms segment and then click about the kind you want.

Get access to the Illinois Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. with US Legal Forms, one of the most extensive local library of authorized papers layouts. Use a huge number of expert and condition-specific layouts that fulfill your small business or individual requirements and specifications.

Form popularity

FAQ

The part of the change in the value of the stocks held by a business over any period which is due to price changes.

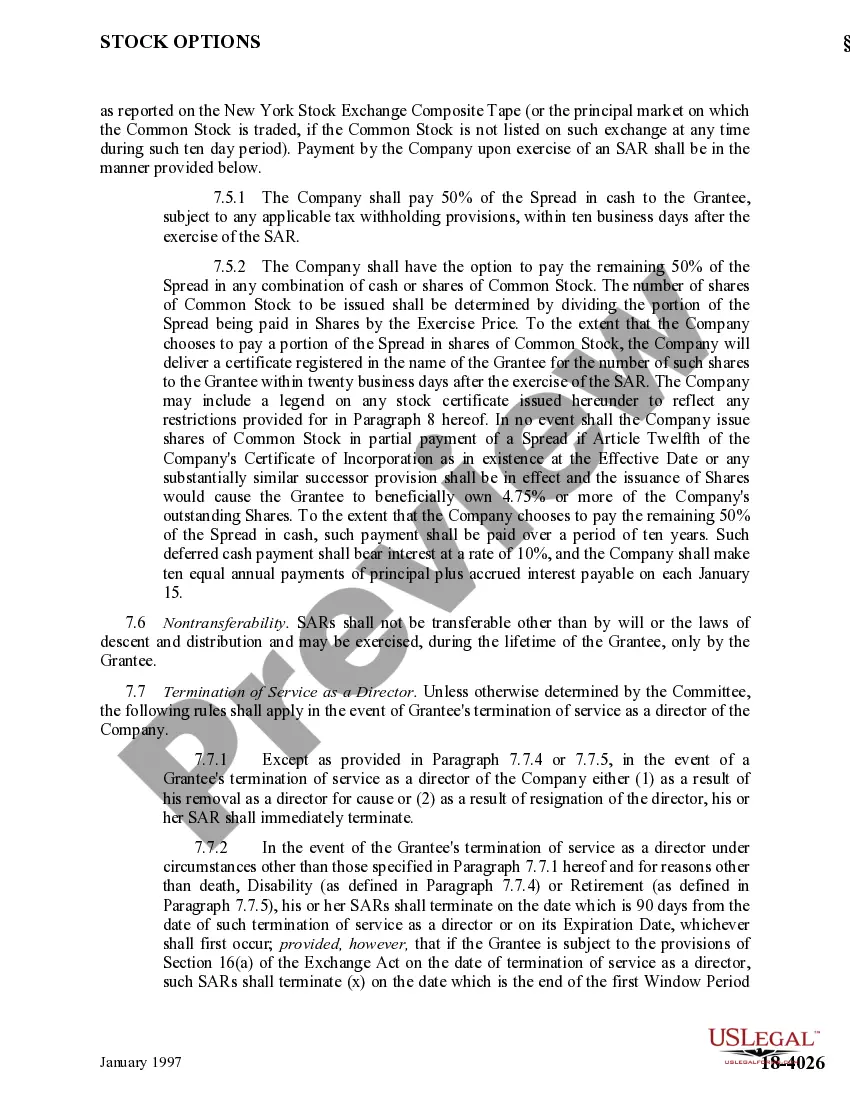

A stock appreciation right is a form of incentive or deferred compensation that ties part of your income to the performance of your company's stock. It gives you the right to the monetary equivalent of the appreciation in the value of a specified number of shares over a specified period of time.

SARs are taxed the same way as non-qualified stock options (NSOs). There are no tax consequences of any kind on either the grant date or when they are vested. However, participants must recognize ordinary income on the spread at the time of exercise. 2 Most employers will also withhold supplemental federal income tax.

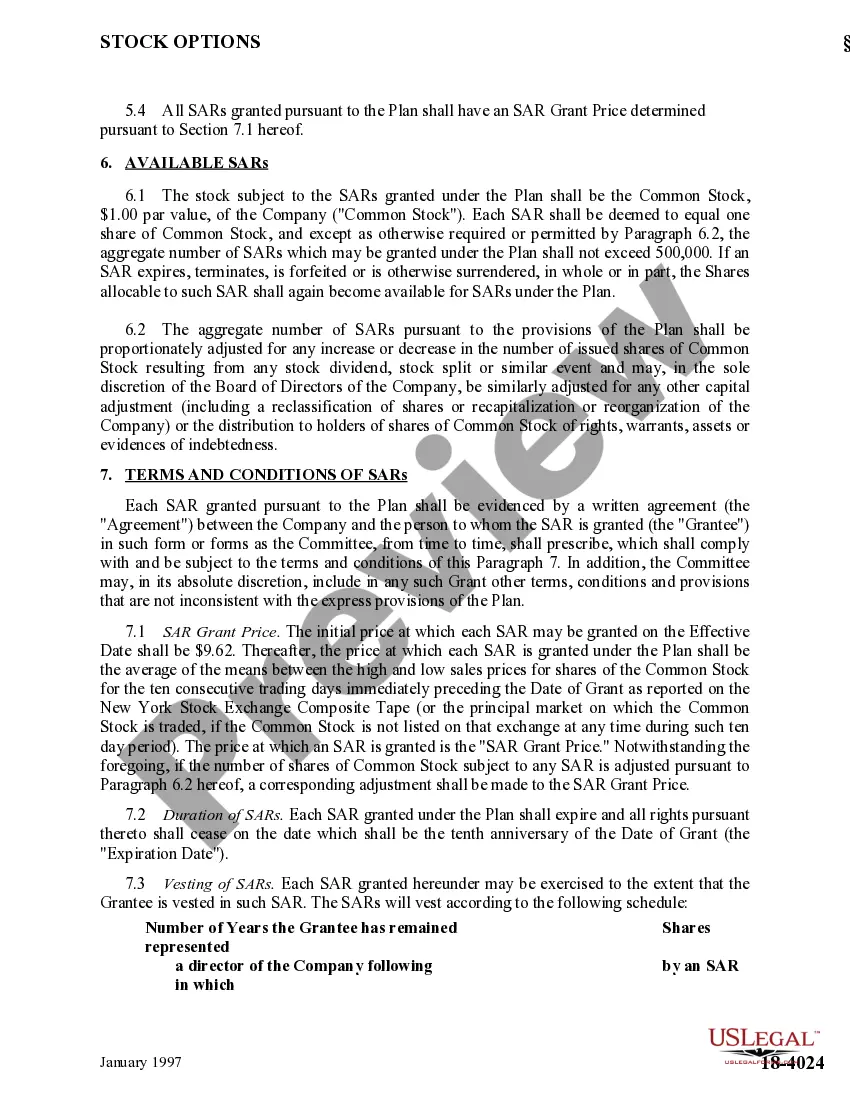

?SARs? means stock appreciation rights entitling the holder thereof to receive a cash payment in an amount equal to the appreciation in the Common Shares over a specified period, as set forth in this Plan and in the applicable Grant Agreement.

For example, let's say you were granted stock appreciation rights on 10 shares of your company ABC's stock, valued at $10 per share. Over time, the share price increases from $10 to $12. This means you'd receive $2 per share since that was the increased value.

A Stock Appreciation Right (SAR) refers to the right to be paid compensation equivalent to an increase in the company's common stock price over a base or the value of appreciation of the equity shares currently being traded on the public market.

A stock appreciation right (SAR) entitles an employee to the appreciation in value of a specified number of shares of employer stock over an ?exercise price? or ?grant price? over a specified period of time. The base price generally is equal to the underlying stock's fair market value on the date of grant.

Stock Appreciation Right (SAR) entitles an employee, who is a shareholder in a company, to a cash payment proportionate to the appreciation of stock traded on a public exchange market. SAR programs provide companies with the flexibility to structure the compensation scheme in a way that suits their beneficiaries.