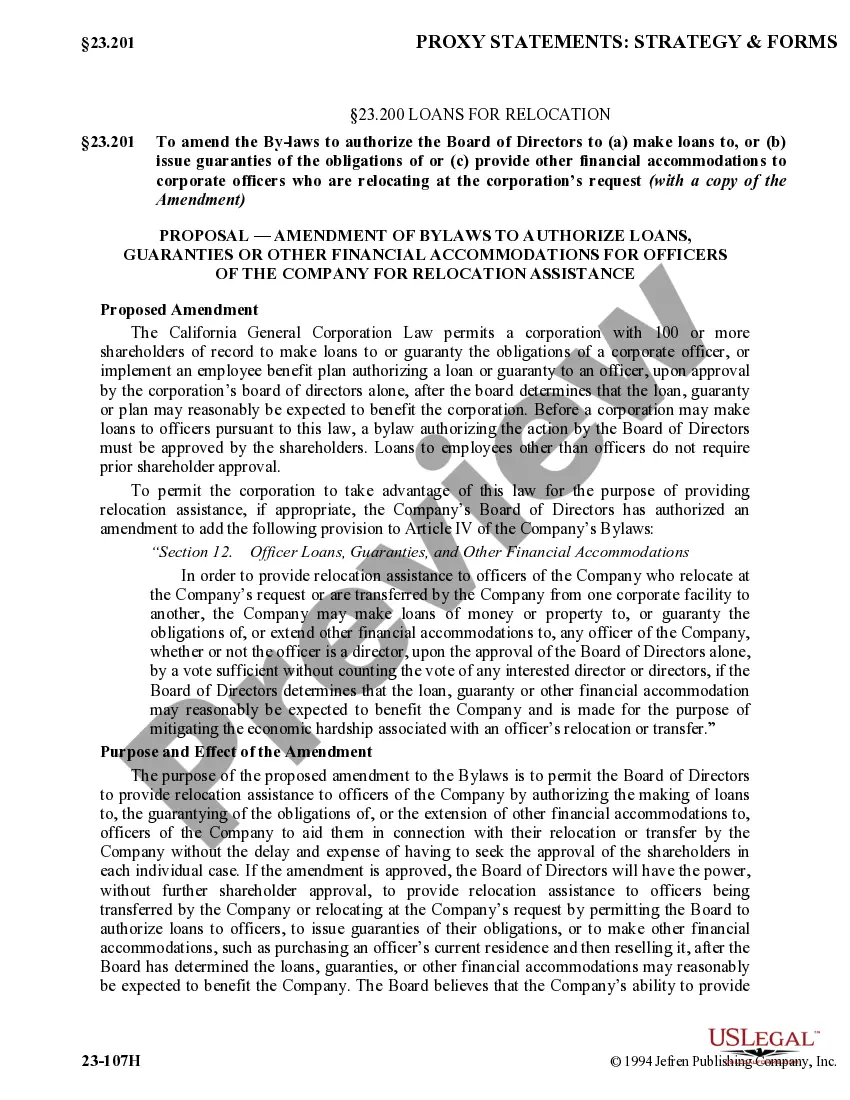

Illinois Executive Officer Restricted Stock Loan Plan is a specialized program offered by Merry Land and Investment, Inc. in the state of Illinois. This plan enables executive officers of the company to obtain loans using their company-issued restricted stocks as collateral. Through this program, executives can leverage the value of their restricted stocks to secure loans for personal or professional purposes. Merry Land and Investment, Inc. provides various types of Illinois Executive Officer Restricted Stock Loan Plans, each with its unique features and benefits. These plans offer flexibility and customization options, catering to the specific needs and circumstances of executive officers. Some different types of Illinois Executive Officer Restricted Stock Loan Plans offered by Merry Land and Investment, Inc. include: 1. Equity-based Loan Program: Under this plan, executive officers can borrow money against their restricted stock holdings. The loan amount is determined based on the market value of the stocks, allowing executives to access a substantial amount of capital. Interest rates for these loans are competitive, ensuring affordability for borrowers. 2. Performance-based Loan Program: Merry Land and Investment, Inc. also offers a performance-based loan program for executives who have restricted stocks tied to specific performance metrics. This plan allows executives to secure loans based on the achievement of predetermined performance targets. It incentivizes executives to meet or exceed these objectives while providing them with financial flexibility. 3. Tiered Loan Program: The tiered loan program by Merry Land and Investment, Inc. offers executives the option to access loans in multiple tiers or stages. As the executives' restricted stock holdings appreciate, they can gain access to additional loan amounts. This plan is particularly beneficial for executives looking to fund long-term projects or capitalize on market opportunities progressively. 4. Hybrid Loan Program: The hybrid loan program combines aspects of both equity-based and performance-based plans. Executive officers can avail loans using a combination of their restricted stock holdings and performance targets. This plan provides executives with the flexibility to diversify their loan portfolio and cater to different financial objectives. Marry Land and Investment, Inc.'s Illinois Executive Officer Restricted Stock Loan Plans offer numerous advantages. Firstly, executives can unlock the value of their restricted stocks, which may otherwise be illiquid. Furthermore, these loan programs provide the opportunity to finance personal investments, real estate acquisitions, educational expenses, or other professional ventures. The interest rates are competitive, and the repayment terms can be tailored to the executive's financial circumstances. In conclusion, the Illinois Executive Officer Restricted Stock Loan Plan by Merry Land and Investment, Inc. is a valuable financial solution for executive officers seeking to leverage their restricted stocks. With various types of plans available, executives can choose the most suitable option based on their objectives and circumstances. By offering flexible loan amounts, competitive interest rates, and customization options, Merry Land and Investment, Inc. aims to empower executives in Illinois to meet their financial goals with confidence.

Illinois Executive Officer Restricted Stock Loan Plan of Merry Land and Investment, Inc.

Description

How to fill out Executive Officer Restricted Stock Loan Plan Of Merry Land And Investment, Inc.?

Choosing the right legal papers template can be quite a struggle. Needless to say, there are a lot of themes available on the Internet, but how will you find the legal kind you need? Take advantage of the US Legal Forms internet site. The support delivers 1000s of themes, like the Illinois Executive Officer Restricted Stock Loan Plan of Merry Land and Investment, Inc., which can be used for organization and personal demands. Every one of the types are inspected by experts and meet state and federal requirements.

When you are currently registered, log in in your account and click on the Obtain button to get the Illinois Executive Officer Restricted Stock Loan Plan of Merry Land and Investment, Inc.. Use your account to check with the legal types you have purchased earlier. Proceed to the My Forms tab of your respective account and obtain another copy of your papers you need.

When you are a fresh consumer of US Legal Forms, allow me to share straightforward guidelines for you to follow:

- Initially, ensure you have selected the correct kind for your personal town/area. You are able to examine the shape making use of the Review button and browse the shape explanation to make sure this is basically the best for you.

- If the kind is not going to meet your needs, make use of the Seach industry to find the proper kind.

- When you are sure that the shape would work, click the Get now button to get the kind.

- Select the costs strategy you want and enter the necessary information. Build your account and purchase an order with your PayPal account or credit card.

- Choose the file formatting and download the legal papers template in your device.

- Full, modify and produce and indicator the received Illinois Executive Officer Restricted Stock Loan Plan of Merry Land and Investment, Inc..

US Legal Forms is definitely the biggest catalogue of legal types for which you can discover numerous papers themes. Take advantage of the service to download skillfully-manufactured files that follow condition requirements.