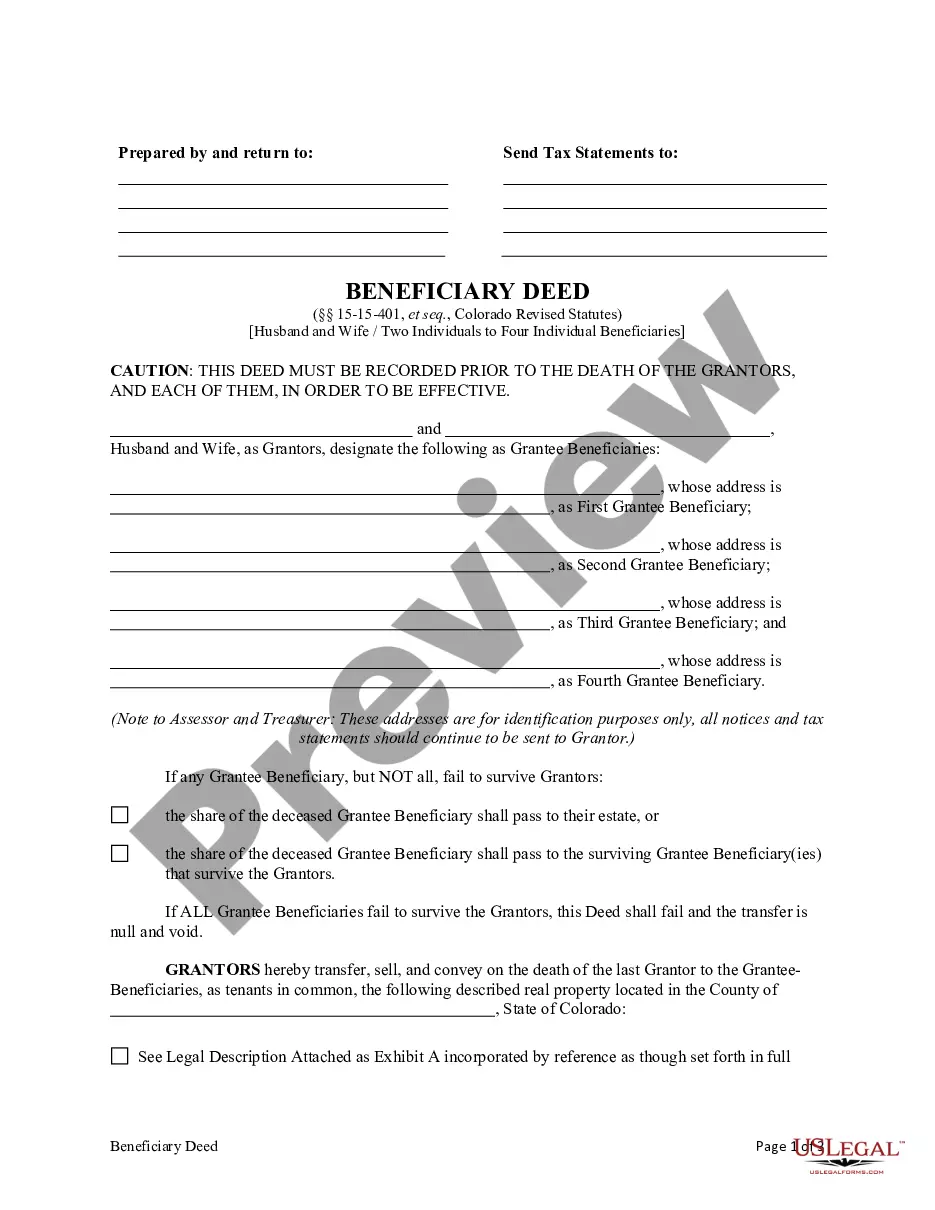

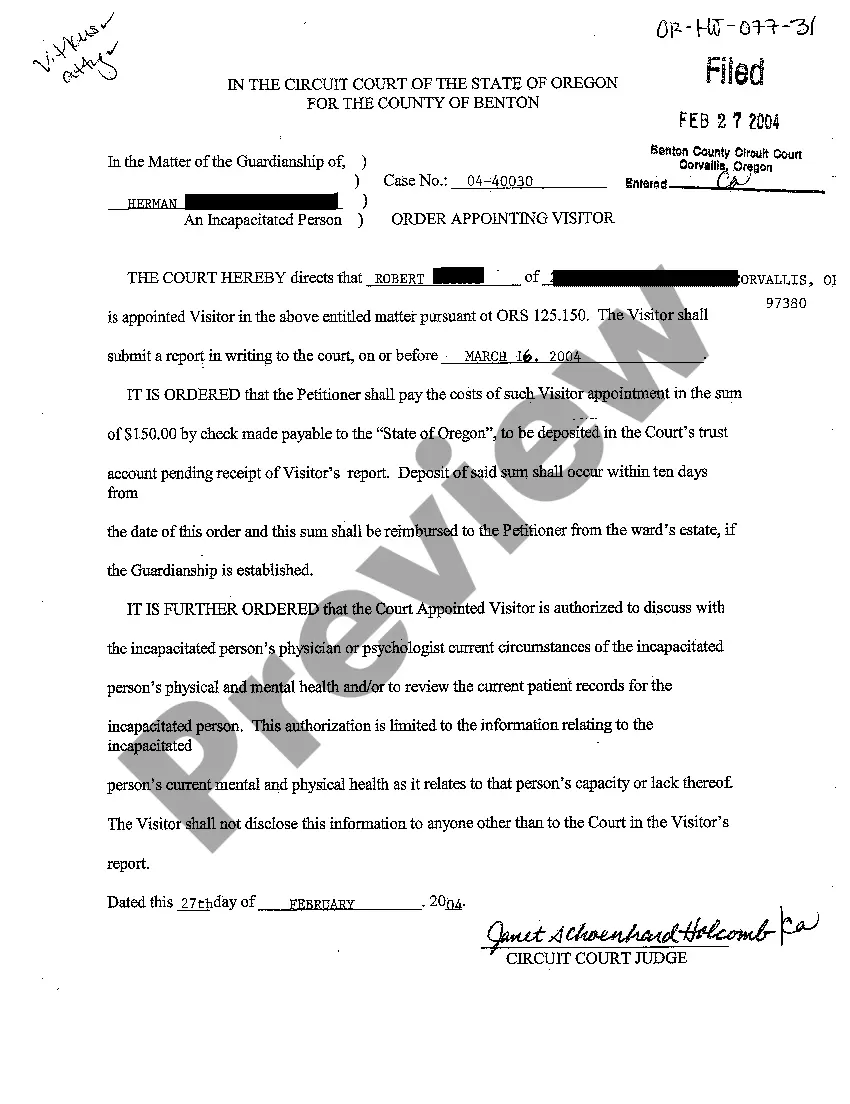

Illinois Private Placement of Common Stock is a method used by companies to raise capital through the sale of shares to a select group of private investors, rather than through a public offering on a stock exchange. This type of offering is exempt from registration with the Securities and Exchange Commission (SEC) under Regulation D, specifically Rule 506, which allows companies to sell securities to accredited investors. Private placement offerings are an attractive option for companies seeking to raise funds, as it provides a faster and more streamlined process compared to going public. It also allows companies to keep their financial information confidential and provides flexibility in terms of pricing and structure. In Illinois, private placement of common stock follows the general guidelines set by federal regulations. However, there may be certain state-specific requirements that companies must adhere to, such as filing a notice with the Secretary of State or complying with state Blue Sky laws. Different types of Illinois Private Placement of Common Stock may include: 1. Traditional Private Placement: This is the most common type of private placement, where companies sell shares of common stock to a select group of accredited investors, such as high-net-worth individuals, venture capital firms, or private equity funds. The number of investors and the offering amount may vary based on the needs of the company. 2. PIPE (Private Investment in Public Equity): This type of private placement occurs when a public company issues shares of its common stock to private investors in order to raise capital. PIPE transactions usually involve accredited investors who purchase stock at a discounted rate compared to the market price. 3. Regulation A+ Offering: While not strictly a private placement, Regulation A+ offerings can be categorized as a hybrid between a private and public offering. Under this type of offering, companies can sell shares of common stock to both accredited and non-accredited investors, up to a maximum offering amount set by the SEC. This allows small and medium-sized companies to raise capital from a larger pool of investors while still enjoying certain exemptions from full SEC registration. In conclusion, Illinois Private Placement of Common Stock is a capital-raising method that allows companies to sell shares to private investors without going through a public offering. Different types of offerings, such as traditional private placements, PIPE transactions, and Regulation A+ offerings, provide flexibility and options for companies to access capital, depending on their specific needs and circumstances.

Illinois Private placement of Common Stock

Description

How to fill out Illinois Private Placement Of Common Stock?

Choosing the right authorized record format might be a battle. Of course, there are a lot of layouts available on the Internet, but how do you get the authorized kind you require? Take advantage of the US Legal Forms web site. The assistance gives 1000s of layouts, like the Illinois Private placement of Common Stock, that can be used for enterprise and private requirements. Every one of the forms are checked out by specialists and meet up with federal and state specifications.

If you are previously signed up, log in to the account and click on the Down load button to obtain the Illinois Private placement of Common Stock. Make use of account to search from the authorized forms you may have ordered earlier. Check out the My Forms tab of your account and have another version in the record you require.

If you are a new customer of US Legal Forms, listed below are simple guidelines that you can follow:

- First, make certain you have chosen the correct kind for your personal area/region. You can examine the form using the Review button and study the form information to make sure it is the best for you.

- In the event the kind fails to meet up with your expectations, utilize the Seach industry to get the right kind.

- Once you are sure that the form is suitable, click the Acquire now button to obtain the kind.

- Select the pricing prepare you need and enter the necessary information. Design your account and pay money for an order using your PayPal account or bank card.

- Pick the document formatting and download the authorized record format to the system.

- Total, modify and print out and signal the acquired Illinois Private placement of Common Stock.

US Legal Forms will be the biggest collection of authorized forms for which you can see various record layouts. Take advantage of the company to download skillfully-created documents that follow condition specifications.