The Illinois approval process for the authorization of preferred stock is a regulatory requirement that allows corporations in the state to issue and sell preferred stock to investors. This process provides corporations with a means to raise additional capital and offers investors a unique investment opportunity. Preferred stock represents an ownership stake in a company but differs from common stock in certain key aspects. One type of Illinois approval of authorization of preferred stock is Cumulative Preferred Stock. This type of stock ensures that any missed dividend payments accumulate and must be paid out in the future before any dividends can be distributed to common stockholders. Cumulative Preferred Stock provides investors with more security and a higher likelihood of receiving dividends, making it an attractive option for risk-averse investors. Another type is Convertible Preferred Stock, which provides investors with the option to convert their preferred shares into a specified number of common shares at a predetermined conversion ratio. This feature grants investors the potential to capitalize on future growth in the company and participate in any increase in stock value. Convertible Preferred Stock is often sought after by investors who believe in the long-term success of the company and want the opportunity to benefit from its future success. Additionally, there is Participating Preferred Stock, which grants preferred shareholders the right to receive dividends along with common stockholders, even beyond the specified dividend rate. This type of preferred stock allows investors to potentially earn greater dividends if the company performs exceptionally well. Participating Preferred Stock provides investors with a higher income potential, attracting those seeking enhanced returns on their investment. Illinois state regulations require corporations seeking to authorize preferred stock to follow a specific process. This process involves submitting relevant documentation to the appropriate state authority, such as the Illinois Secretary of State or the State Securities Department. The documentation typically includes details about the company, the proposed preferred stock issuance, the terms of the preferred stock, and any other relevant information. Once the required documentation is submitted, the state authority will review the application to ensure compliance with Illinois regulations. This review process aims to protect investors and ensure transparency in corporate activities. Upon successful completion of this approval process, corporations can proceed with issuing and selling their preferred stock to interested investors. In summary, the Illinois approval of authorization of preferred stock is a crucial step for corporations in the state to raise capital through the issuance of preferred shares. Different types of preferred stock, such as Cumulative Preferred Stock, Convertible Preferred Stock, and Participating Preferred Stock, provide unique benefits and cater to different investor preferences. Following the established regulatory process ensures compliance and transparency, facilitating a fair and secure environment for both corporations and investors involved in preferred stock transactions.

Illinois Approval of authorization of preferred stock

Description

How to fill out Illinois Approval Of Authorization Of Preferred Stock?

Have you been in the situation where you need files for either company or individual reasons nearly every day? There are a lot of lawful file layouts available online, but getting kinds you can trust isn`t simple. US Legal Forms delivers 1000s of type layouts, just like the Illinois Approval of authorization of preferred stock, which can be written in order to meet federal and state needs.

When you are presently familiar with US Legal Forms web site and possess your account, simply log in. Next, it is possible to acquire the Illinois Approval of authorization of preferred stock web template.

Should you not have an account and want to begin using US Legal Forms, abide by these steps:

- Find the type you need and ensure it is to the proper metropolis/state.

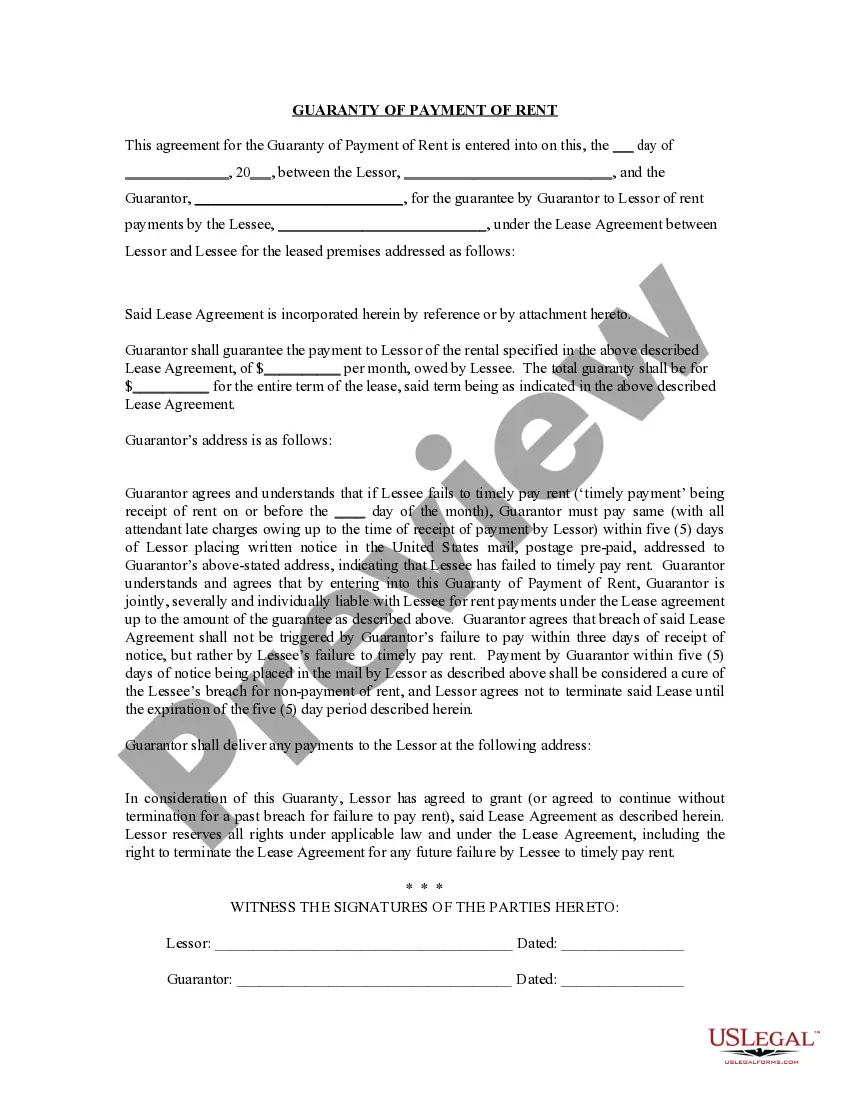

- Use the Review switch to examine the shape.

- Browse the description to actually have selected the appropriate type.

- When the type isn`t what you are seeking, make use of the Lookup discipline to find the type that meets your requirements and needs.

- If you discover the proper type, click on Purchase now.

- Opt for the costs strategy you would like, complete the required information and facts to create your money, and purchase the transaction with your PayPal or bank card.

- Decide on a convenient file file format and acquire your copy.

Find all of the file layouts you possess bought in the My Forms food list. You can obtain a more copy of Illinois Approval of authorization of preferred stock any time, if required. Just click the necessary type to acquire or print the file web template.

Use US Legal Forms, probably the most considerable variety of lawful types, in order to save efforts and steer clear of mistakes. The service delivers skillfully made lawful file layouts that you can use for a range of reasons. Make your account on US Legal Forms and start creating your life easier.