Illinois Voting Trust Certificate

Description

How to fill out Voting Trust Certificate?

You are able to invest time online looking for the legitimate file format that meets the federal and state specifications you want. US Legal Forms supplies a huge number of legitimate kinds that are analyzed by experts. It is possible to down load or print out the Illinois Voting Trust Certificate from the services.

If you already possess a US Legal Forms bank account, it is possible to log in and click the Download option. Afterward, it is possible to comprehensive, edit, print out, or indicator the Illinois Voting Trust Certificate. Each and every legitimate file format you get is your own eternally. To obtain one more copy for any acquired kind, proceed to the My Forms tab and click the related option.

Should you use the US Legal Forms website initially, stick to the simple recommendations beneath:

- Very first, be sure that you have chosen the correct file format to the region/metropolis of your choosing. Read the kind explanation to make sure you have chosen the correct kind. If available, utilize the Preview option to check throughout the file format also.

- In order to locate one more edition from the kind, utilize the Search discipline to find the format that meets your requirements and specifications.

- Once you have discovered the format you want, simply click Purchase now to carry on.

- Find the costs prepare you want, type in your accreditations, and register for your account on US Legal Forms.

- Complete the transaction. You can use your Visa or Mastercard or PayPal bank account to pay for the legitimate kind.

- Find the structure from the file and down load it in your gadget.

- Make changes in your file if required. You are able to comprehensive, edit and indicator and print out Illinois Voting Trust Certificate.

Download and print out a huge number of file layouts using the US Legal Forms website, which offers the most important collection of legitimate kinds. Use skilled and condition-certain layouts to deal with your business or specific demands.

Form popularity

FAQ

A voting trust is an arrangement whereby the shares in a company of one or more shareholders and the voting rights attached thereto are legally transferred to a trustee, usually for a specified period of time (the "trust period").

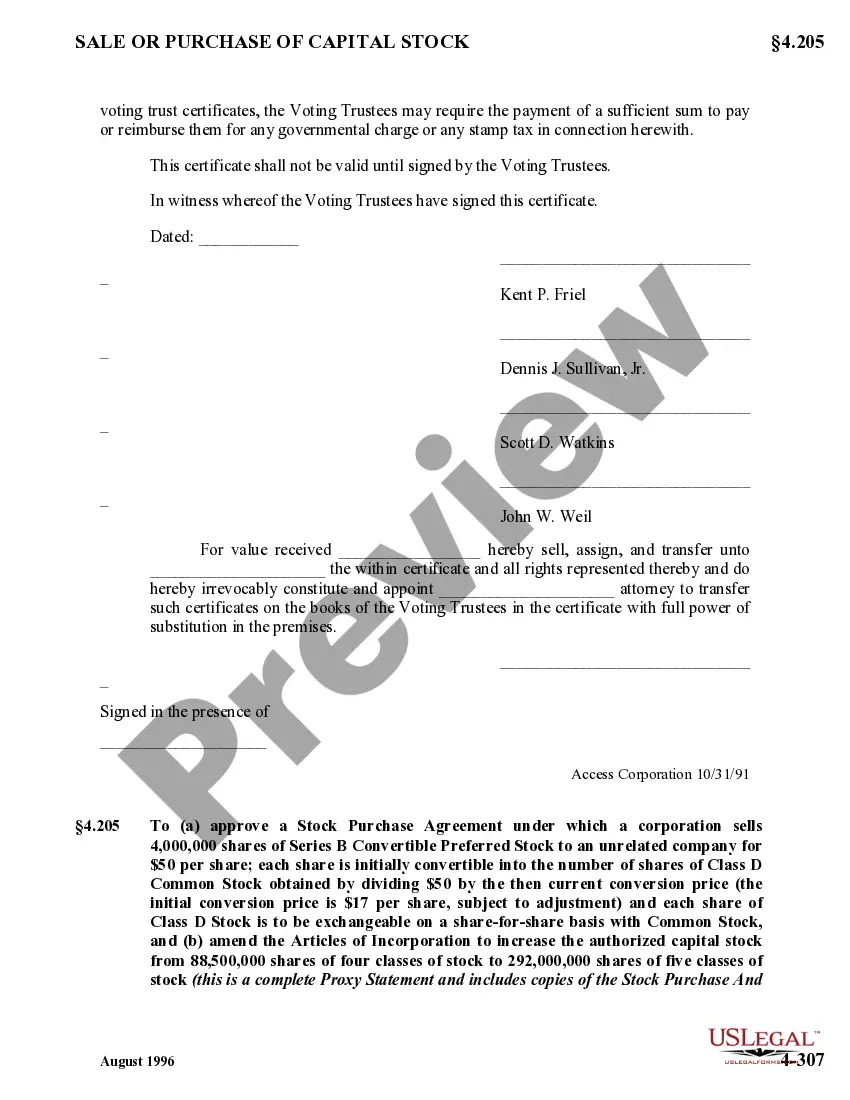

A voting trust certificate is a document used to give temporary voting control over a corporation to one or several individuals. It is issued to a shareholder and represents the normal rights of any other stockholder, such as receiving quarterly dividends in exchange for their common shares.

The trustee model of representation is a model of a representative democracy, frequently contrasted with the delegate model of representation. In this model, constituents elect their representatives as 'trustees' for their constituency.

A voting trust is a contract between shareholders in which their shares and voting rights are temporarily transferred to a trustee. A voting agreement is a contract in which shareholders agree to vote a certain way on specific issues without giving up their shares or voting rights.

A trust formed when individual shareholders transfer both the legal title and voting rights in their shares to a trustee. The trustee then controls a unified voting block - with a stronger voice on matters of corporate governance than the individual shareholders could have on their own.

A voting trust can be revocable or irrevocable; typically they are irrevocable for a period of years, or for life of the key person, or until the company is sold. But any other arrangement that suits the objectives and is within the law can be made as well.

A Voting Agreement is an agreement between stockholders of a company, often entered into in connection with a preferred stock financing, which dictates how the parties to the agreement will vote on particular matters.

Voting trust certificates are "securities" as that term is defined by Section 2(1) of the Securities Act of 1933,37 and by many similar provisions under the various state securities laws.