Illinois Registration Rights Agreements between Alexander and Alexander Services, Inc. and Purchasers are legally binding documents that outline the rights and obligations related to the registration of securities issued by Alexander and Alexander Services, Inc. The agreement grants certain privileges and protections to the Purchasers, enabling them to sell or transfer their securities in compliance with applicable securities laws. The registration process ensures transparency and provides investors with essential information before making investment decisions. Key provisions typically included in an Illinois Registration Rights Agreement are: 1. Registration of Securities: The agreement addresses the process of registering the securities with the Securities and Exchange Commission (SEC). It defines the conditions, timelines, and responsibilities for filing registration statements and amendments. 2. Demand Registration Rights: This provision allows Purchasers to request that Alexander and Alexander Services, Inc. register their securities for public sale. The agreement specifies the minimum number or percentage of securities required to exercise this right, along with any limitations on its frequency. 3. Piggyback Registration Rights: In case Alexander and Alexander Services, Inc. decides to register additional securities of their own for public offering, this provision grants the Purchasers the right to include their securities in the registration statement. It ensures the Purchasers have an opportunity to sell their securities without conducting a separate registration process. 4. S-3 and Shelf Registration Rights: If Alexander and Alexander Services, Inc. qualifies for SEC Form S-3 eligibility or has a shelf registration statement, the agreement may allow Purchasers to utilize these streamlined registration methods, avoiding additional expenses and delays. 5. Registration Expenses: The agreement outlines how the costs associated with registration will be allocated between Alexander and Alexander Services, Inc. and the Purchasers. It may include provisions for reimbursement of legal, accounting, and other registration-related expenses. 6. Indemnification: To protect the Purchasers from liabilities arising out of the registration process, this provision requires Alexander and Alexander Services, Inc. to provide indemnification in case of any material misstatements, omissions, or violations of securities laws. 7. Lock-Up Agreements: In certain cases, Purchasers may be required to agree to a lock-up period during which they are restricted from selling or transferring their securities. This provision helps stabilize the market and prevents substantial fluctuations in the security's value immediately after registration. Different types of Illinois Registration Rights Agreements between Alexander and Alexander Services, Inc. and Purchasers may include variations in the specific terms and conditions based on factors such as the number of securities being registered, the nature of the securities, and the preferences of the parties involved. In conclusion, an Illinois Registration Rights Agreement is a crucial legal document that establishes the rights and responsibilities of both Alexander and Alexander Services, Inc. and the Purchasers regarding the registration of securities. By delineating the registration process and providing necessary protections, this agreement ensures transparency, facilitates fair trading, and strengthens the relationship between the issuing company and its investors.

Illinois Registration Rights Agreement between Alexander and Alexander Services, Inc. and Purchasers

Description

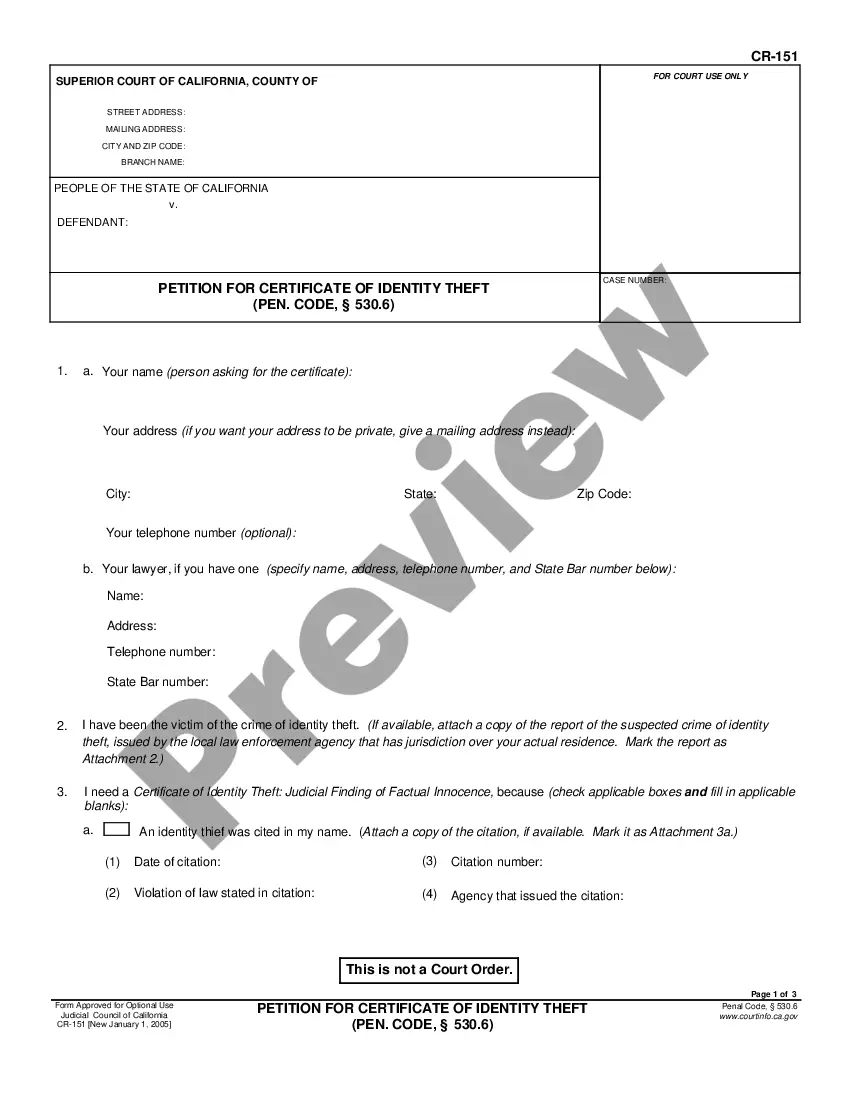

How to fill out Illinois Registration Rights Agreement Between Alexander And Alexander Services, Inc. And Purchasers?

Have you been in a situation in which you require documents for possibly business or individual purposes virtually every time? There are a lot of legal record web templates available online, but getting kinds you can trust is not effortless. US Legal Forms provides a large number of form web templates, such as the Illinois Registration Rights Agreement between Alexander and Alexander Services, Inc. and Purchasers, which can be published to fulfill federal and state requirements.

When you are presently knowledgeable about US Legal Forms website and have your account, just log in. After that, you can acquire the Illinois Registration Rights Agreement between Alexander and Alexander Services, Inc. and Purchasers design.

Unless you provide an bank account and wish to start using US Legal Forms, adopt these measures:

- Find the form you require and make sure it is for your proper city/state.

- Utilize the Review key to examine the shape.

- Look at the description to ensure that you have selected the appropriate form.

- When the form is not what you`re searching for, utilize the Look for area to discover the form that meets your needs and requirements.

- If you discover the proper form, just click Purchase now.

- Select the prices program you desire, fill out the desired information and facts to generate your money, and pay money for an order with your PayPal or credit card.

- Decide on a practical document file format and acquire your duplicate.

Discover all of the record web templates you have purchased in the My Forms food selection. You can aquire a extra duplicate of Illinois Registration Rights Agreement between Alexander and Alexander Services, Inc. and Purchasers at any time, if required. Just go through the needed form to acquire or printing the record design.

Use US Legal Forms, the most comprehensive selection of legal kinds, in order to save time and prevent errors. The assistance provides skillfully produced legal record web templates which can be used for a variety of purposes. Make your account on US Legal Forms and begin making your lifestyle a little easier.