The Illinois Amended and Restated Agreement of Limited Partnership is a legal document that outlines the terms and conditions governing a limited partnership in the state of Illinois. It serves as the foundational document for the partnership, establishing the rights, responsibilities, and obligations of the partners involved. The agreement is designed to be flexible and can be customized to suit the needs of the specific partnership. It covers various aspects, including the partnership's purpose, duration, capital contributions, profit and loss allocation, decision-making processes, governance structure, and dispute resolution mechanisms. The Amended and Restated Agreement is typically drafted when changes need to be made to the original partnership agreement. These changes may result from modifications to the partnership's structure, admission or withdrawal of partners, changes in capital contributions, or amendments to the partnership's objectives and operations. Key provisions that may be included in the Illinois Amended and Restated Agreement of Limited Partnership include: 1. Name and Purpose: Clearly identifying the name and primary objectives of the partnership. 2. Capital Contributions: Detailing the amount and form of capital contributed by each partner and any additional contributions required. 3. Profit and Loss Allocation: Outlining how profits and losses will be distributed among the partners, including any special allocation provisions. 4. Governance: Describing the management structure and decision-making authority within the partnership, including the roles and responsibilities of general and limited partners. 5. Voting Rights: Specifying the rights of partners to vote on partnership matters, including any major decisions requiring unanimous consent. 6. Partner Withdrawal and Admission: Establishing the process and criteria for admitting new partners and allowing existing partners to withdraw from the partnership. 7. Independent Audits: Outlining procedures for conducting periodic financial audits of the partnership's books and records. 8. Dissolution and Liquidation: Detailing the circumstances and procedures for dissolving the partnership, as well as the distribution of assets upon dissolution. 9. Non-Compete and Confidentiality: Including provisions that restrict partners from engaging in activities that could compete with the partnership or disclose confidential information. 10. Dispute Resolution: Establishing mechanisms for resolving disputes among partners, including arbitration or mediation procedures. It is important to note that there may be different types or variations of the Illinois Amended and Restated Agreement of Limited Partnership, depending on the specific needs and requirements of the partnership. These variations may arise from differences in the partnership's industry, size, duration, or the particular preferences of the partners involved. It is advisable to consult with legal professionals familiar with Illinois state laws to ensure compliance and accuracy when drafting and amending such agreements.

Illinois Amended and Restated Agreement of Limited Partnership

Description

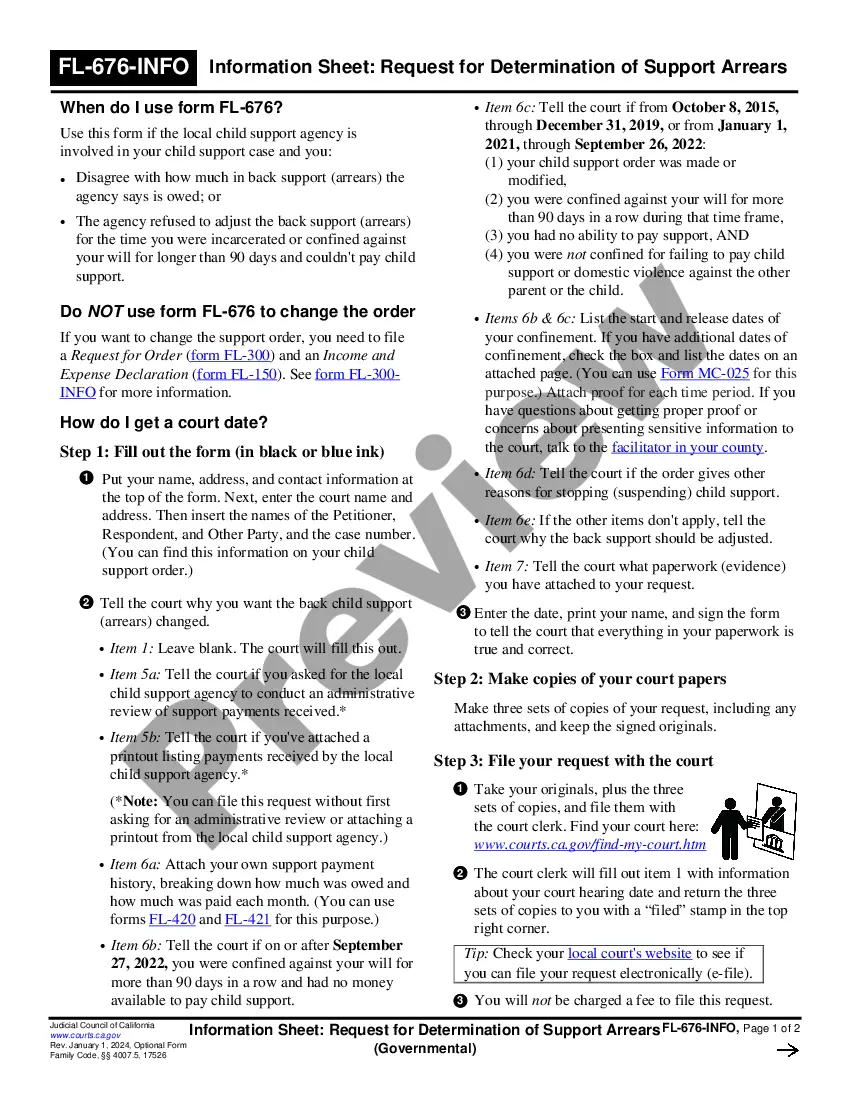

How to fill out Illinois Amended And Restated Agreement Of Limited Partnership?

If you want to comprehensive, download, or print out legal papers templates, use US Legal Forms, the greatest selection of legal kinds, that can be found on the web. Use the site`s simple and handy look for to get the papers you need. Different templates for enterprise and personal reasons are sorted by categories and suggests, or keywords. Use US Legal Forms to get the Illinois Amended and Restated Agreement of Limited Partnership with a few mouse clicks.

When you are already a US Legal Forms customer, log in to your accounts and click on the Obtain button to find the Illinois Amended and Restated Agreement of Limited Partnership. You may also entry kinds you earlier delivered electronically in the My Forms tab of your own accounts.

If you work with US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have selected the form for that correct city/land.

- Step 2. Use the Preview solution to look through the form`s articles. Don`t overlook to see the description.

- Step 3. When you are unhappy together with the kind, utilize the Look for discipline at the top of the screen to discover other models in the legal kind web template.

- Step 4. After you have found the form you need, select the Acquire now button. Choose the costs plan you like and add your accreditations to sign up for an accounts.

- Step 5. Procedure the deal. You can use your bank card or PayPal accounts to complete the deal.

- Step 6. Pick the format in the legal kind and download it in your gadget.

- Step 7. Total, modify and print out or indicator the Illinois Amended and Restated Agreement of Limited Partnership.

Each and every legal papers web template you purchase is the one you have permanently. You may have acces to every kind you delivered electronically within your acccount. Select the My Forms area and choose a kind to print out or download again.

Compete and download, and print out the Illinois Amended and Restated Agreement of Limited Partnership with US Legal Forms. There are many specialist and status-distinct kinds you can use to your enterprise or personal needs.

Form popularity

FAQ

You can cancel/dissolve a Domestic Limited Liability Limited Partnership by filing a Statement of Dissolution . You can also terminate a Domestic LLLP by filing a Statement of Termination . Or you can withdraw a Foreign Limited Liability Limited Partnership by filing a Withdrawal of Registration of a Foreign LLLP .

To change information of record for your LP, fill out this form, and submit for filing along with: ? A $30 filing fee. ? A separate, non-refundable $15 service fee also must be included, if you drop off the completed form. pages if you need more space or need to include any other matters.

The requirements for forming limited partnerships vary from state to state. In Illinois, the Uniform Limited Partnership Act governs the creation and management of limited partnerships. The Illinois Secretary of State is responsible for the registration of limited partnerships.

Drafting and Filing An amendment to a partnership agreement is a legal document that includes specific information about the action, such as a statement that the amendment is made by unanimous consent, a statement that the undersigned agree to the amendment and an explanation of the amendment.

Has your limited partnership reached its limit? If you're ready to dissolve your business, you need to file dissolution papers, settle your debts, and distribute assets to the partners. Like with any business venture, general and limited partners might be tasked with closing their business.

Illinois does not require individuals to file formal notice of a partnership's dissolution. However, it is advisable to file a Statement of Dissolution with the Secretary of State's office. This can help protect both partners from legal liability for any debts or actions that occur after the partnership is dissolved.

As far as the state of Illinois is concerned, there is a process for officially dissolving your business. You will need to file a document called Articles of Dissolution with the Secretary of State. If you fail to notify the state and simply stop renewing your registration, Illinois will dissolve the business for you.

5 steps to dissolve a partnership. Dissolving a partnership includes reviewing your agreement, discussing the situation with your partner, preparing dissolution papers, closing accounts, and then communicating the change to relevant parties.