Illinois Plan of Liquidation

Description

How to fill out Plan Of Liquidation?

Are you currently inside a situation that you need to have documents for both organization or person uses just about every time? There are a variety of legal file templates available on the Internet, but discovering types you can trust isn`t effortless. US Legal Forms delivers 1000s of develop templates, such as the Illinois Plan of Liquidation, that happen to be created in order to meet federal and state needs.

If you are currently familiar with US Legal Forms web site and get a free account, just log in. Next, you may download the Illinois Plan of Liquidation design.

If you do not come with an accounts and would like to begin using US Legal Forms, follow these steps:

- Discover the develop you require and make sure it is for the right metropolis/area.

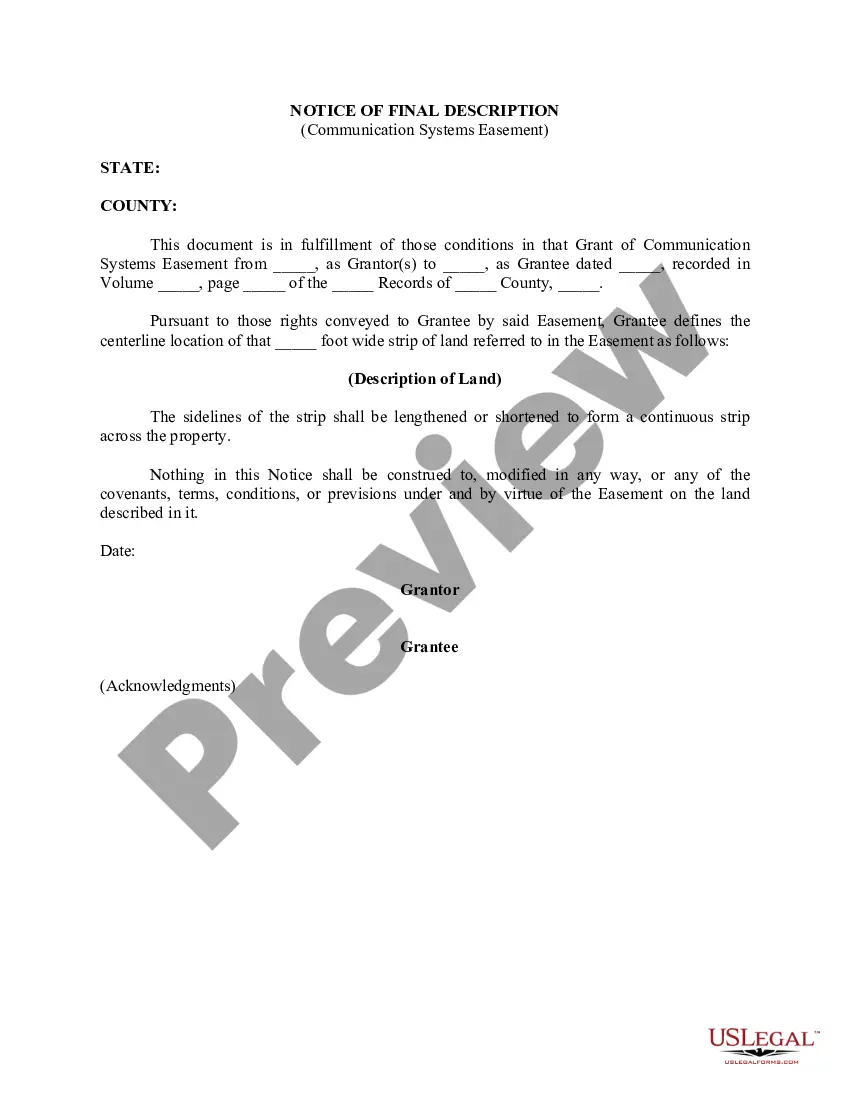

- Take advantage of the Preview button to review the form.

- Look at the description to actually have selected the appropriate develop.

- In the event the develop isn`t what you`re seeking, utilize the Look for field to discover the develop that fits your needs and needs.

- If you discover the right develop, just click Acquire now.

- Pick the rates program you want, fill out the required information to generate your money, and purchase your order with your PayPal or credit card.

- Pick a handy document file format and download your copy.

Get all the file templates you have purchased in the My Forms food list. You may get a more copy of Illinois Plan of Liquidation at any time, if needed. Just click the necessary develop to download or print out the file design.

Use US Legal Forms, probably the most extensive variety of legal forms, in order to save time as well as stay away from faults. The assistance delivers expertly manufactured legal file templates which can be used for a variety of uses. Produce a free account on US Legal Forms and start producing your daily life a little easier.

Form popularity

FAQ

How do you dissolve an Illinois Corporation? To dissolve your corporation in Illinois, you submit in duplicate the completed BCA 12.20, Articles of Dissolution form by mail or in person to the Secretary of State along with the filing fee.

The quick answer. Liquidate means a formal closing down by a liquidator when there are still assets and liabilities to be dealt with. Dissolving a company is where the business is struck off the register at Companies House because it is now inactive.

The liquidating corporation distributes all of its assets to its shareholders, the assets are distributed in one or a series of distributions, the distributions are in redemption of all of the corporation's stock, the distributions are made pursuant to a plan of liquidation.

A plan of liquidation and dissolution that can be used for the dissolution of a Delaware corporation wholly owned by a US parent corporation when the parties intend to qualify the dissolution as a tax-free liquidation under Sections 332 and 337 of the Internal Revenue Code.

To dissolve/terminate your domestic LLC in Illinois, you must submit the completed form LLC-35-15, Statement of Termination in duplicate to the Illinois Secretary of State by mail or in person along with the filing fee.

A plan of dissolution is a written description of how an entity intends to dissolve, or officially and formally close the business. A plan of dissolution will include a description of how any remaining assets and liabilities will be distributed.

A plan of dissolution is a written description of how an entity intends to dissolve, or officially and formally close the business. A plan of dissolution will include a description of how any remaining assets and liabilities will be distributed.

Involuntary Dissolution is the result of an administrative action taken by the filing office or tax administrator in a state. The company is generally notified of the impending dissolution and after a specified period of time is marked inactive on the filing offices records.