Illinois Complex Will — Income Trust for Spouse: A Comprehensive Guide In Illinois, a complex will with an income trust for a spouse is a legal document that allows individuals to protect their assets, ensure financial security for their surviving spouse, and minimize estate taxes upon their death. This type of will is specifically designed for individuals with substantial assets and those who wish to maintain control and provide for their spouse after their passing. Let's delve into the details of the Illinois Complex Will — Income Trust for Spouse, including its purpose, benefits, and potential variations. Purpose of an Illinois Complex Will — Income Trust for Spouse: The primary goal of an Illinois Complex Will — Income Trust for Spouse is to protect assets and provide a reliable source of income for the surviving spouse while minimizing estate taxes. This type of will ensures that the surviving spouse receives financial support throughout their lifetime, maintaining their quality of life and avoiding potential financial hardships. Benefits of an Illinois Complex Will — Income Trust for Spouse: 1. Asset Protection: By utilizing an income trust within the will, individuals can safeguard their assets from potential creditors or other third parties, ensuring that their intended beneficiaries, including the surviving spouse, receive their rightful share. 2. Continual Income Stream: The income trust established within the will guarantees a stable income source for the surviving spouse, ensuring their financial well-being even after the testator's death. This income can encompass interest income, dividends, rental income, or any other type of recurring income generated by the assets held within the trust. 3. Estate Tax Mitigation: An Illinois Complex Will with an income trust enables individuals to employ various tax planning strategies to minimize the potential estate tax liability upon their passing. This helps preserve a larger portion of the estate for the beneficiaries, including the surviving spouse. Different Types of Illinois Complex Will — Income Trust for Spouse: 1. Irrevocable Income Trust: This type of income trust cannot be altered or revoked once established, offering substantial asset protection benefits, estate tax advantages, and a consistent income stream. 2. Revocable Income Trust: Unlike an irrevocable income trust, this trust can be modified or revoked during the testator's lifetime, providing flexibility and control over the assets held within the trust. However, it may not offer the same level of asset protection or estate tax benefits as the irrevocable variant. 3. Marital Deduction Trust: This trust option allows individuals to take advantage of the marital deduction, reducing the estate taxes that may be due upon their death. The surviving spouse can benefit from the income generated by this trust during their lifetime while enjoying certain safeguards. 4. Qualified Terminable Interest Property (TIP) Trust: A TIP trust grants the surviving spouse income from the trust's assets while maintaining control over the ultimate distribution of those assets after the spouse's passing. This trust is especially useful for individuals with children from previous relationships or those seeking to protect their assets for designated beneficiaries. In conclusion, an Illinois Complex Will — Income Trust for Spouse provides individuals with the means to ensure financial security for their surviving spouse, asset protection, and estate tax planning. By choosing the appropriate type of trust structure, individuals can tailor their planning to meet their unique goals and circumstances. Consulting with an experienced estate planning attorney is crucial to understand the legal requirements and establish a comprehensive complex will that best suits one's needs.

Illinois Complex Will - Income Trust for Spouse

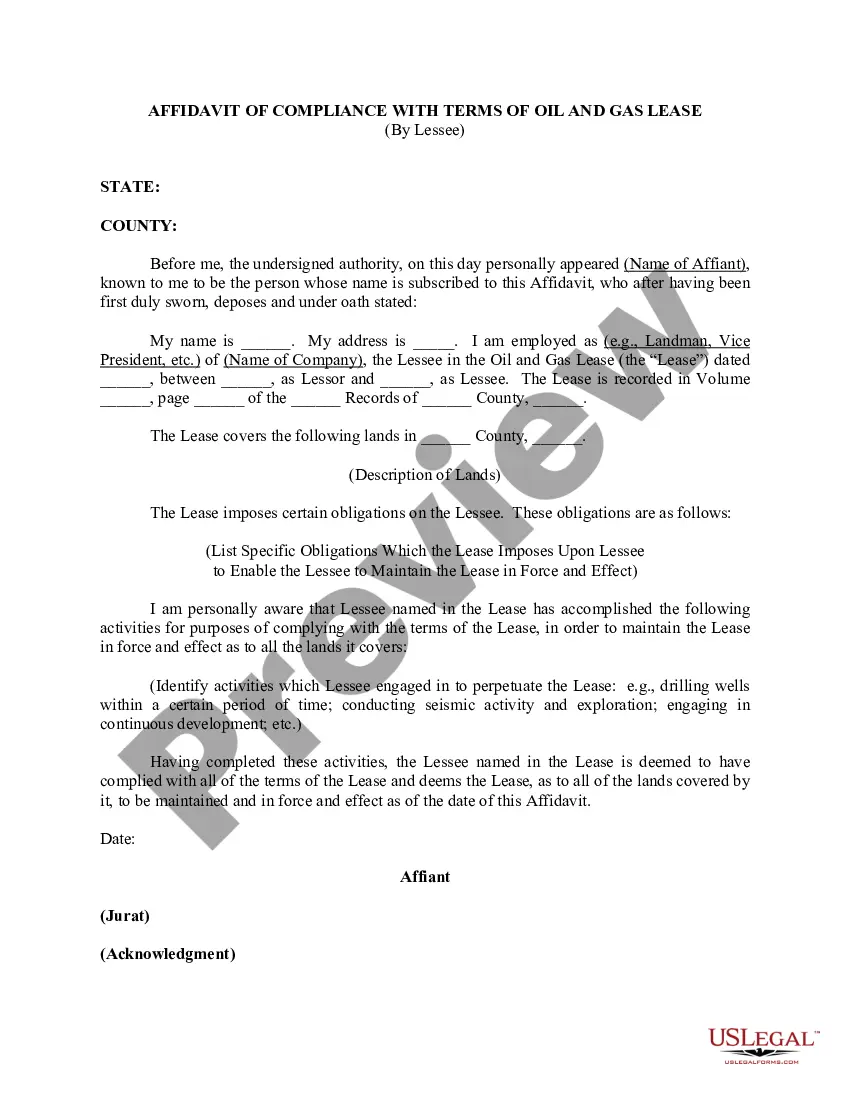

Description

How to fill out Illinois Complex Will - Income Trust For Spouse?

If you want to total, obtain, or produce authorized file layouts, use US Legal Forms, the largest collection of authorized kinds, that can be found on the web. Utilize the site`s easy and handy lookup to discover the files you will need. Numerous layouts for organization and individual uses are sorted by types and says, or key phrases. Use US Legal Forms to discover the Illinois Complex Will - Income Trust for Spouse within a handful of clicks.

When you are previously a US Legal Forms customer, log in for your profile and then click the Down load key to find the Illinois Complex Will - Income Trust for Spouse. Also you can access kinds you previously delivered electronically in the My Forms tab of your respective profile.

If you work with US Legal Forms initially, refer to the instructions below:

- Step 1. Make sure you have chosen the form for that right metropolis/nation.

- Step 2. Use the Review solution to look over the form`s content. Don`t overlook to read the description.

- Step 3. When you are not satisfied with all the kind, utilize the Lookup area near the top of the display screen to get other versions in the authorized kind template.

- Step 4. When you have identified the form you will need, click on the Purchase now key. Pick the costs prepare you favor and add your references to sign up for the profile.

- Step 5. Method the transaction. You should use your Мisa or Ьastercard or PayPal profile to complete the transaction.

- Step 6. Select the file format in the authorized kind and obtain it in your system.

- Step 7. Full, change and produce or indication the Illinois Complex Will - Income Trust for Spouse.

Each authorized file template you buy is your own property permanently. You might have acces to every kind you delivered electronically within your acccount. Go through the My Forms segment and choose a kind to produce or obtain yet again.

Contend and obtain, and produce the Illinois Complex Will - Income Trust for Spouse with US Legal Forms. There are many professional and express-specific kinds you may use for your personal organization or individual requirements.