Illinois Complex Will - Max. Credit Shelter Marital Trust to Children

Description

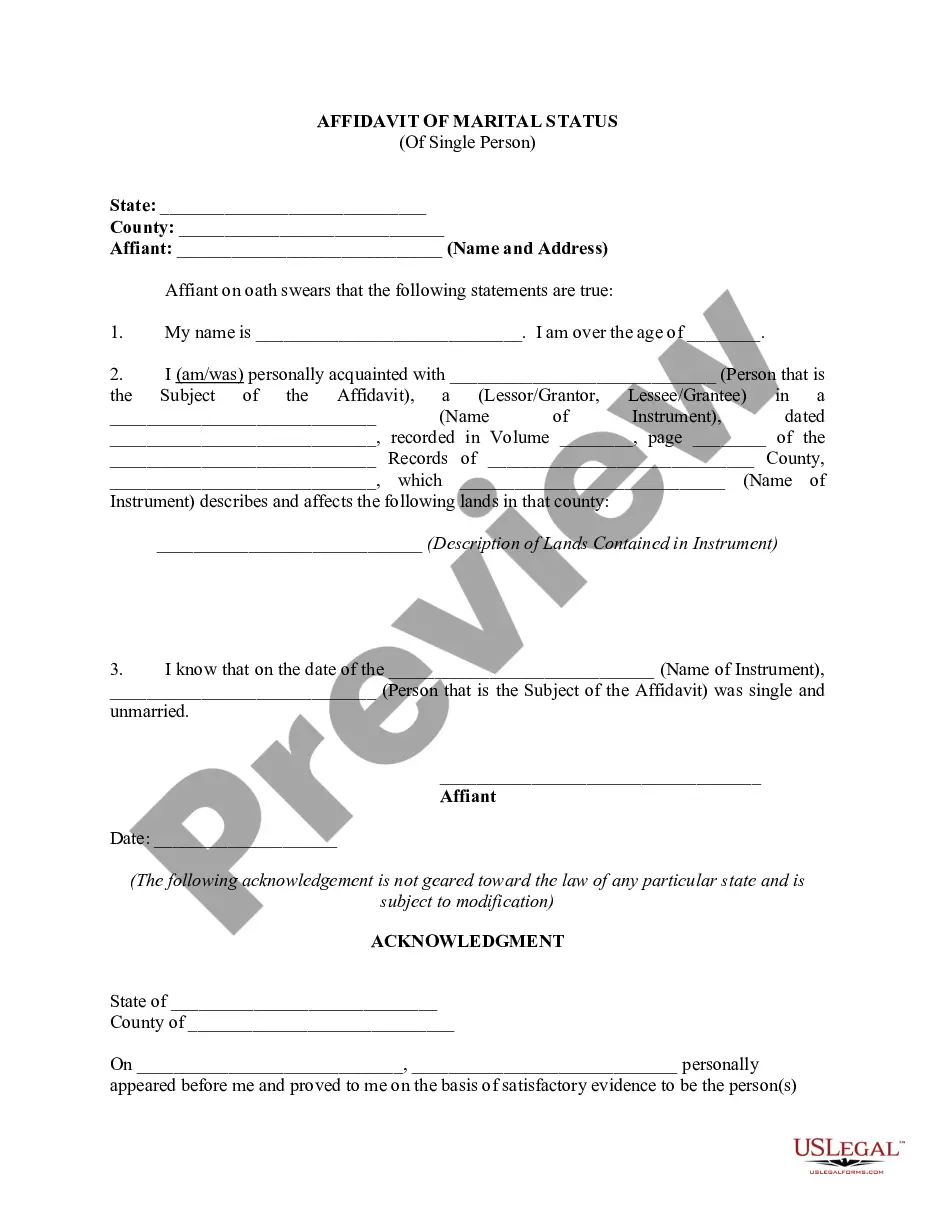

How to fill out Complex Will - Max. Credit Shelter Marital Trust To Children?

US Legal Forms - one of several biggest libraries of legitimate kinds in the United States - delivers an array of legitimate file layouts it is possible to download or produce. Making use of the web site, you may get thousands of kinds for organization and personal purposes, sorted by categories, states, or search phrases.You will find the latest versions of kinds such as the Illinois Complex Will - Max. Credit Shelter Marital Trust to Children within minutes.

If you already possess a registration, log in and download Illinois Complex Will - Max. Credit Shelter Marital Trust to Children through the US Legal Forms collection. The Acquire option will show up on every single form you look at. You have access to all in the past acquired kinds within the My Forms tab of your profile.

If you wish to use US Legal Forms for the first time, listed below are simple instructions to help you began:

- Ensure you have selected the right form for your town/area. Click the Preview option to analyze the form`s information. Look at the form outline to ensure that you have selected the proper form.

- If the form doesn`t satisfy your requirements, utilize the Research field near the top of the monitor to obtain the one who does.

- Should you be satisfied with the shape, validate your choice by visiting the Buy now option. Then, opt for the prices strategy you like and provide your qualifications to register on an profile.

- Method the financial transaction. Make use of your charge card or PayPal profile to perform the financial transaction.

- Find the file format and download the shape on your own product.

- Make modifications. Fill up, edit and produce and signal the acquired Illinois Complex Will - Max. Credit Shelter Marital Trust to Children.

Each and every web template you included with your bank account does not have an expiry day and it is your own property for a long time. So, in order to download or produce one more backup, just visit the My Forms section and click about the form you will need.

Gain access to the Illinois Complex Will - Max. Credit Shelter Marital Trust to Children with US Legal Forms, probably the most considerable collection of legitimate file layouts. Use thousands of expert and condition-certain layouts that meet your organization or personal demands and requirements.

Form popularity

FAQ

Credit Shelter Trust vs Marital Trust - Is a Marital Trust the Same as a Credit Shelter Trust? No. A Marital Trust is a type of Credit Shelter Trust. You and your spouse can use a Marital Trust to pass assets to a surviving spouse, children or grandchildren.

Also called an "A" trust, a marital trust goes into effect when the first spouse dies. Assets are moved into the trust upon death and the income that these assets generate go to the surviving spouse?under some arrangements, the surviving spouse can also receive principal payments.

A credit shelter trust (CST) is a trust created after the death of the first spouse in a married couple. Assets placed in the trust are generally held apart from the estate of the surviving spouse, so they may pass tax-free to the remaining beneficiaries at the death of the surviving spouse.

A credit shelter trust is a legal way to minimize Illinois estate taxes. The money in the trust is held by a trustee for the benefit of whoever the beneficiary named in the estate.

Upon the death of the surviving spouse, the trust transfers to the heirs, who are exempt from the estate tax that would have resulted from a combined inheritance. Disadvantages of a CST include formation costs and the surviving spouse's lack of control.

A 5 by 5 Power in Trust is a clause that lets the beneficiary make withdrawals from the trust on a yearly basis. The beneficiary can cash out $5,000 or 5% of the trust's fair market value each year, whichever is a higher amount.

Among the disadvantages are the following: As irrevocable trusts, once formed, they are exceedingly difficult to dissolve or amend. Only provides an estate tax exemption of up to $24.12 million in 2022 (or $25.84 million in 2023) Requires the transfer of assets into the trust, which can be a time-consuming procedure.