Illinois Joint Filing of Rule 13d-1(f)(1) Agreement

Description

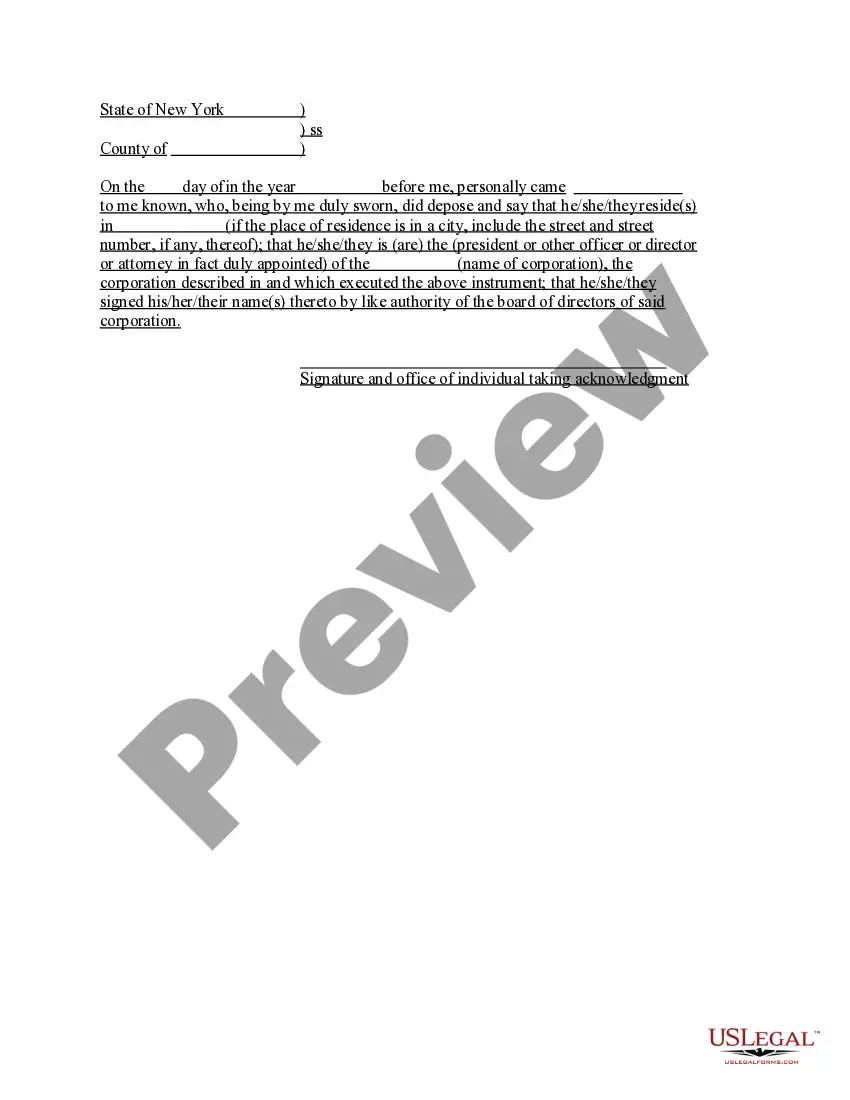

How to fill out Joint Filing Of Rule 13d-1(f)(1) Agreement?

US Legal Forms - one of several biggest libraries of authorized forms in the USA - gives a wide range of authorized papers web templates you can down load or print out. While using site, you can get thousands of forms for enterprise and individual purposes, sorted by groups, claims, or key phrases.You can find the most up-to-date versions of forms such as the Illinois Joint Filing of Rule 13d-1(f)(1) Agreement in seconds.

If you already possess a monthly subscription, log in and down load Illinois Joint Filing of Rule 13d-1(f)(1) Agreement from the US Legal Forms catalogue. The Download button will appear on every single develop you see. You gain access to all earlier delivered electronically forms inside the My Forms tab of the account.

In order to use US Legal Forms initially, listed below are simple guidelines to help you get started:

- Ensure you have picked out the correct develop for the metropolis/area. Click the Preview button to examine the form`s content material. See the develop outline to actually have chosen the right develop.

- When the develop doesn`t match your specifications, take advantage of the Look for area at the top of the screen to get the one who does.

- Should you be satisfied with the form, affirm your decision by clicking the Buy now button. Then, select the costs prepare you like and give your qualifications to sign up on an account.

- Procedure the purchase. Make use of your credit card or PayPal account to complete the purchase.

- Find the format and down load the form in your device.

- Make alterations. Fill up, revise and print out and signal the delivered electronically Illinois Joint Filing of Rule 13d-1(f)(1) Agreement.

Every format you included in your account lacks an expiration date and is your own property permanently. So, if you wish to down load or print out an additional copy, just proceed to the My Forms segment and click in the develop you want.

Gain access to the Illinois Joint Filing of Rule 13d-1(f)(1) Agreement with US Legal Forms, one of the most extensive catalogue of authorized papers web templates. Use thousands of skilled and express-specific web templates that satisfy your company or individual requirements and specifications.

Form popularity

FAQ

Joint filings are typically used by groups of affiliated stockholders such as venture capital funds and their general partners and managing entities, but can be used by unrelated stockholders as well. An agreement to file jointly can apply to more than one filing.

Exchange Act Sections 13(d) and 13(g), along with Regulation 13D-G, require an investor who beneficially owns more than 5 percent of a covered class of equity securities to publicly file either a Schedule 13D or a Schedule 13G, as applicable.

Form 13Ds are similar to 13Fs but are more stringent; an investor with a large stake in a company must report all changes in that position within just 10 days of any action, meaning that it's much easier for outsiders to see what's happening much closer to real time than in the case of a 13F.

CurrentTime-Based AmendmentsAnnual amendments: due 45 days after year-end if any change (other than change in % solely due to change in shares outstanding)Ownership-Based Amendments10 days after month-end if >10% Thereafter, 10 days after month-end if +/- 5% change in ownership1 more row ?

Securities Act Rule 13d-3 defines ?beneficial owner? as ?any person who, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise has or shares: (1) Voting power which includes the power to vote, or to direct the voting of, such security; and/or, (2) Investment power which ...

Schedule 13D is a form that must be filed with the U.S. Securities and Exchange Commission (SEC) when a person or group acquires more than 5% of a voting class of a company's equity shares. Schedule 13D must be filed within 10 days of the filer reaching a 5% stake.

Beneficial ownership reports If your company has registered a class of its equity securities under the Exchange Act, shareholders who acquire more than 5% of the outstanding shares of that class must file beneficial owner reports on Schedule 13D or 13G until their holdings drop below 5%.