An Illinois Indemnification Agreement is a legal document that outlines the terms and conditions under which Financial Security Assurance (FSA), ABCs, and American Business Credit (ABC) agree to indemnify each other in certain situations. This agreement provides a comprehensive framework for protecting all parties involved in various business transactions. The Illinois Indemnification Agreement among FSA, ABCs, and ABC is a crucial aspect of business dealings, especially in the financial and credit sectors. It helps establish trust and provides a mechanism to address potential risks and liabilities associated with their commercial activities. This agreement entails a detailed description of the scope of indemnification, outlining the specific circumstances and events that trigger the indemnity clause. This assists in clearly defining the responsibilities and obligations of each party involved, minimizing any ambiguity or confusion that may arise during the course of their relationship. The Illinois Indemnification Agreement may vary in types and purposes depending on the specific needs and objectives of the parties involved. Some common types of agreements in this context include: 1. General Indemnification Agreement: This type of agreement broadly covers indemnification provisions for various acts or omissions arising from the business activities between FSA, ABCs, and ABC. It typically includes provisions related to third-party claims, damages, losses, liabilities, and expenses. 2. Financial Indemnification Agreement: This agreement focuses specifically on indemnifying any losses or damages resulting from financial transactions, such as loans, credit facilities, or capital funding provided by FSA, ABCs, or ABC. It aims to ensure that all parties are protected from any financial risks that may arise. 3. Credit Indemnification Agreement: This type of agreement primarily pertains to indemnifying credit-related risks and liabilities between FSA, ABCs, and ABC. It safeguards the parties from potential losses or damages caused by credit defaults, loan repayments, or other credit-related issues. 4. Facility Indemnification Agreement: This agreement centers around indemnification in the context of specific facilities or physical assets utilized by FSA, ABCs, or ABC. It typically includes provisions related to property damages, accidents, or any other liabilities arising from the use of these facilities. It is important to note that the Illinois Indemnification Agreement is a legally binding document, and its terms and conditions should be thoroughly understood by all parties involved. Parties should consult legal professionals to ensure compliance with relevant laws, regulations, and industry standards. Keywords: Illinois, Indemnification Agreement, Financial Security Assurance, ABCs, American Business Credit, indemnify, business transactions, risks, liabilities, circumstances, obligations, trust, third-party claims, damages, losses, expenses, financial transactions, credit facilities, capital funding, credit default, loan repayment, physical assets, property damages, accidents, legally binding, compliance.

Illinois Indemnification Agreement among Financial Security Assurance, ABFS and American Business Credit

Description

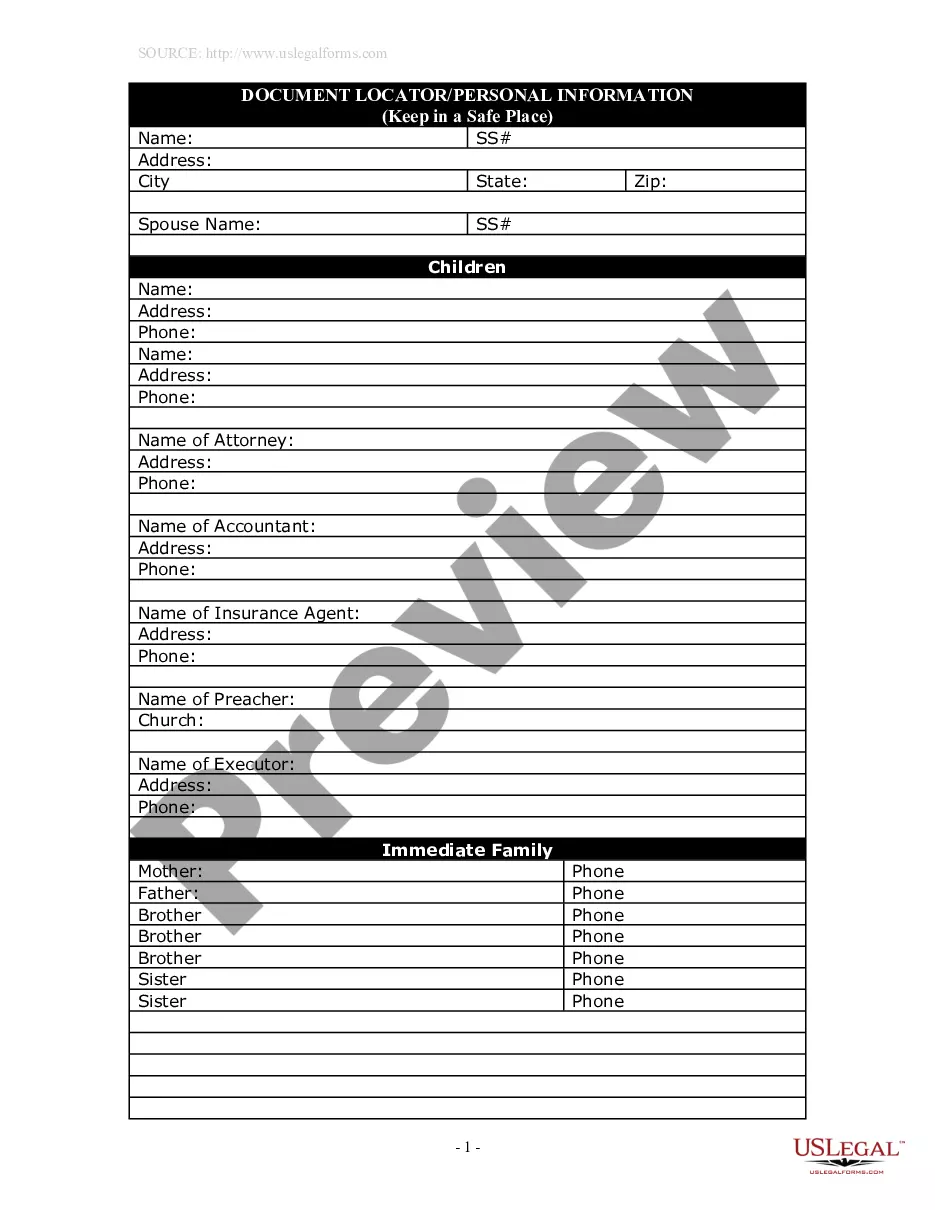

How to fill out Illinois Indemnification Agreement Among Financial Security Assurance, ABFS And American Business Credit?

If you have to full, acquire, or produce authorized file web templates, use US Legal Forms, the greatest assortment of authorized forms, that can be found on the Internet. Make use of the site`s simple and easy hassle-free look for to obtain the papers you want. A variety of web templates for business and personal reasons are categorized by groups and suggests, or search phrases. Use US Legal Forms to obtain the Illinois Indemnification Agreement among Financial Security Assurance, ABFS and American Business Credit with a number of mouse clicks.

Should you be already a US Legal Forms client, log in to the bank account and click on the Acquire switch to find the Illinois Indemnification Agreement among Financial Security Assurance, ABFS and American Business Credit. You can even accessibility forms you formerly acquired from the My Forms tab of the bank account.

If you are using US Legal Forms the first time, follow the instructions under:

- Step 1. Ensure you have selected the form for the correct town/region.

- Step 2. Take advantage of the Preview option to check out the form`s information. Do not overlook to read through the explanation.

- Step 3. Should you be not satisfied using the form, take advantage of the Research discipline towards the top of the display screen to find other versions in the authorized form template.

- Step 4. After you have found the form you want, select the Buy now switch. Select the costs program you favor and put your accreditations to register to have an bank account.

- Step 5. Method the purchase. You may use your Мisa or Ьastercard or PayPal bank account to complete the purchase.

- Step 6. Find the formatting in the authorized form and acquire it on your system.

- Step 7. Complete, edit and produce or signal the Illinois Indemnification Agreement among Financial Security Assurance, ABFS and American Business Credit.

Every single authorized file template you get is the one you have eternally. You may have acces to each form you acquired with your acccount. Click the My Forms section and choose a form to produce or acquire once more.

Compete and acquire, and produce the Illinois Indemnification Agreement among Financial Security Assurance, ABFS and American Business Credit with US Legal Forms. There are many skilled and status-certain forms you may use to your business or personal demands.

Form popularity

FAQ

The word indemnity means security or protection against a financial liability. It typically occurs in the form of a contractual agreement made between parties in which one party agrees to pay for losses or damages suffered by the other party.

Although similar to a hold harmless agreement, an indemnity agreement is an arrangement whereby one party agrees to pay the other party for any damages regardless of who is at fault.

A contract by which one party promises to save the other from loss caused to him by the conduct of the promisor himself, or by the conduct of any other person, is called a contract of indemnity.

Indemnity Agreement: Although similar to a hold harmless agreement, an indemnity agreement is an arrangement whereby one party agrees to pay the other party for any damages regardless of who is at fault.

For example, A promises to deliver certain goods to B for Rs. 2,000 every month. C comes in and promises to indemnify B's losses if A fails to so deliver the goods. This is how B and C will enter into contractual obligations of indemnity.