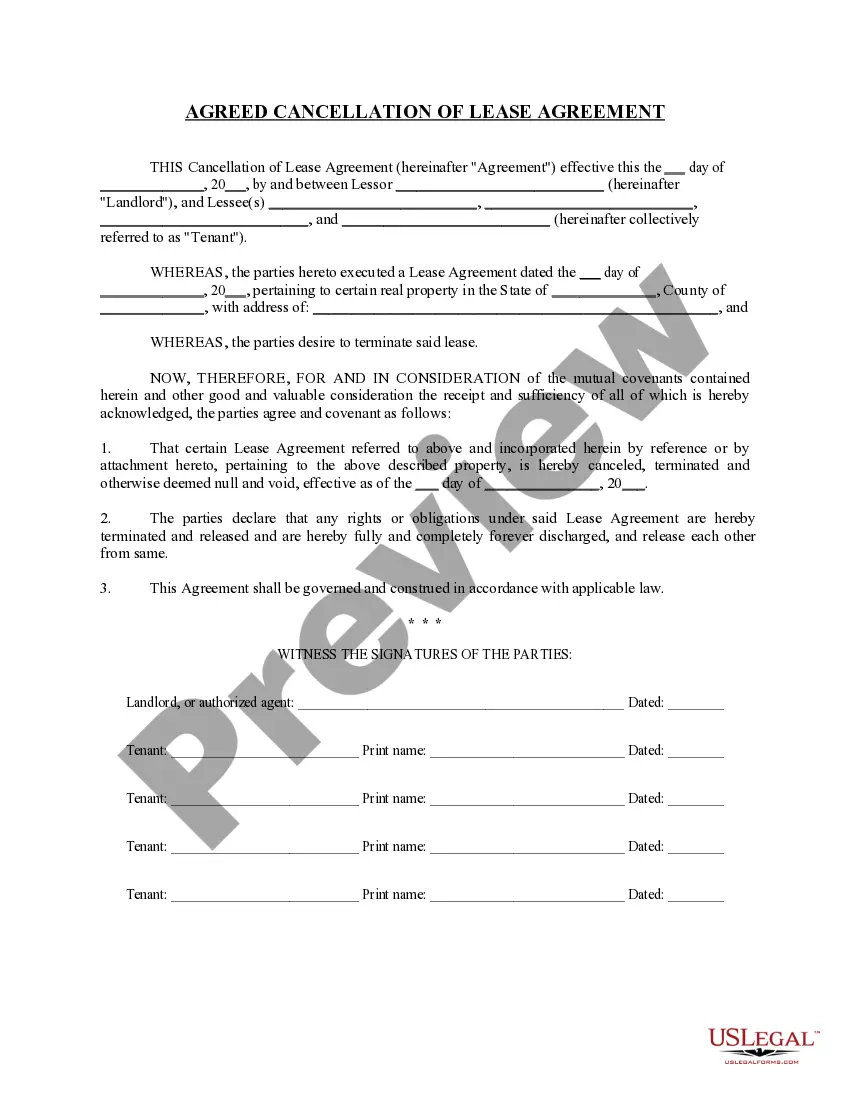

The Illinois Expense Limitation Agreement is a legal contract designed to establish financial boundaries and limitations for expenses in various contexts within the state of Illinois. This agreement is typically enacted between two or more parties, often involving government entities, organizations, or individuals. The primary purpose of the Illinois Expense Limitation Agreement is to ensure prudent financial management and accountability. By specifying the maximum budgetary limits and types of expenses that can be incurred, this agreement promotes transparency, efficiency, and the responsible allocation of resources. It serves as a safeguard against excessive spending or misuse of funds, helping to maintain fiscal discipline and sustainability. Keywords: Illinois, Expense Limitation Agreement, financial boundaries, limitations, expenses, legal contract, government entities, organizations, individuals, prudent financial management, accountability, maximum budgetary limits, types of expenses, transparency, efficiency, responsible allocation of resources, safeguard, excessive spending, misuse of funds, fiscal discipline, sustainability. Different types of Illinois Expense Limitation Agreements: 1. Government Expense Limitation Agreement: This type of agreement is commonly entered into by government entities at various levels, such as state, county, or municipal governments. It establishes guidelines for expenditure control, allowing government officials to efficiently manage taxpayer funds and prevent misuse or wastage. 2. Municipal Expense Limitation Agreement: Municipalities, cities, or towns within Illinois may adopt this particular agreement. It outlines a set of rules and regulations regarding expenses related to infrastructure development, public services, utility bills, employee wages, and other municipal expenditures. 3. Non-Profit Expense Limitation Agreement: Non-profit organizations operating within Illinois may utilize this agreement to establish financial boundaries for their activities. It ensures that donations and grants entrusted to the organization are utilized prudently, aligning expenses with the organization's mission and goals. 4. Educational Institution Expense Limitation Agreement: Educational institutions, such as schools, universities, and colleges, may have their own variation of the expense limitation agreement. This agreement defines expenditure limits concerning educational programs, faculty salaries, maintenance costs, research projects, and other educational expenditures. 5. Healthcare Expense Limitation Agreement: Healthcare providers, hospitals, and medical institutions in Illinois might adopt an expense limitation agreement that pertains specifically to healthcare-related expenses. It regulates expenses associated with patient care, medical supplies, pharmaceuticals, equipment, and facility maintenance, ensuring responsible financial management in the healthcare sector. 6. Business Expense Limitation Agreement: In the corporate and business realm, companies operating in Illinois may implement an expense limitation agreement to control their overall expenditure. This agreement typically covers categories like employee salaries, marketing expenses, business travel, supplies, and other costs incurred during day-to-day operations. These different types of Illinois Expense Limitation Agreements cater to specific sectors or entities, ensuring that financial resources are utilized efficiently, responsibly, and within the prescribed limits.

Illinois Expense Limitation Agreement

Description

How to fill out Illinois Expense Limitation Agreement?

US Legal Forms - among the largest libraries of legitimate kinds in the USA - provides a wide range of legitimate record layouts you may download or print out. Using the site, you can find thousands of kinds for company and specific uses, categorized by types, suggests, or search phrases.You will discover the most recent versions of kinds such as the Illinois Expense Limitation Agreement within minutes.

If you already possess a monthly subscription, log in and download Illinois Expense Limitation Agreement through the US Legal Forms collection. The Download switch will appear on each and every develop you see. You get access to all earlier downloaded kinds within the My Forms tab of your own accounts.

If you wish to use US Legal Forms initially, listed here are straightforward recommendations to obtain started out:

- Be sure you have chosen the right develop for your city/region. Click the Review switch to review the form`s content material. See the develop description to actually have chosen the proper develop.

- When the develop does not fit your specifications, use the Look for field near the top of the display screen to discover the the one that does.

- When you are satisfied with the shape, affirm your selection by clicking on the Acquire now switch. Then, choose the rates plan you favor and give your references to sign up to have an accounts.

- Method the transaction. Make use of your bank card or PayPal accounts to complete the transaction.

- Find the formatting and download the shape on your own system.

- Make alterations. Load, change and print out and indication the downloaded Illinois Expense Limitation Agreement.

Each template you included with your account lacks an expiry date which is your own forever. So, if you want to download or print out one more duplicate, just proceed to the My Forms portion and then click around the develop you will need.

Obtain access to the Illinois Expense Limitation Agreement with US Legal Forms, one of the most considerable collection of legitimate record layouts. Use thousands of expert and express-specific layouts that fulfill your company or specific needs and specifications.

Form popularity

FAQ

? Personal Exemption ? Effective for tax years beginning on or after January 1, 2023, the personal exemption allowance for individuals will increase to $2,625 per person.

Illinois Schedule 80/20 serves the following purposes: ? to figure the amount of deductions the domestic unitary member must add back to its income; ? to allow the taxpayer to figure the correct amount of allowable, valid deductions; and ? to allow any affiliated company with an Illinois filing requirement to take a ...

Pay using: MyTax Illinois. If you have a MyTax Illinois account, click here and log in. ... Credit Card. Check or money order (follow the payment instructions on the form or voucher associated with your filing) ACH Credit - ACH credit is NOT the preferred payment option for most taxpayers.

Write the total number of additional allowances you elect to claim on Line 9 and on Form IL-W-4, Line 2. withheld from your pay. On Line 3 of Form IL-W-4, write the additional amount you want your employer to withhold. Cut here and give the certificate to your employer.

Make sure your check or money order includes the following information: Your name and address. Daytime phone number. Social Security number (the SSN shown first if it's a joint return) or employer identification number. Tax year. Related tax form or notice number.

Individuals Include a copy of your notice, bill, or payment voucher. Make your check, money order, or cashier's check payable to Franchise Tax Board. Write either your FTB ID, SSN, or ITIN, and tax year on your payment. Mail to: Franchise Tax Board PO Box 942867. Sacramento CA 94267-0001.

Make your check payable to the Illinois Department of Revenue. Write your Social Security number, your spouse's Social Security number if filing jointly, and the tax year in the lower left-hand corner of your payment. Note: You may electronically pay your taxes no matter how you file.

If no payment is enclosed, mail your return to: If a payment is enclosed, mail your return to: ILLINOIS DEPARTMENT OF REVENUE. ILLINOIS DEPARTMENT OF REVENUE. PO BOX 19041. PO BOX 19027. SPRINGFIELD IL 62794-9041. SPRINGFIELD IL 62794-9027.