Illinois Administration Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Association

Description

How to fill out Administration Agreement Between First American Insurance Portfolios, Inc. And U.S. Bank National Association?

Are you inside a position in which you require documents for both enterprise or personal uses virtually every time? There are a lot of authorized record themes available online, but finding ones you can trust isn`t easy. US Legal Forms offers thousands of form themes, like the Illinois Administration Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Association, that happen to be created to satisfy federal and state demands.

In case you are presently familiar with US Legal Forms site and also have a free account, simply log in. After that, it is possible to acquire the Illinois Administration Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Association format.

If you do not offer an profile and wish to start using US Legal Forms, follow these steps:

- Obtain the form you want and ensure it is for the appropriate area/state.

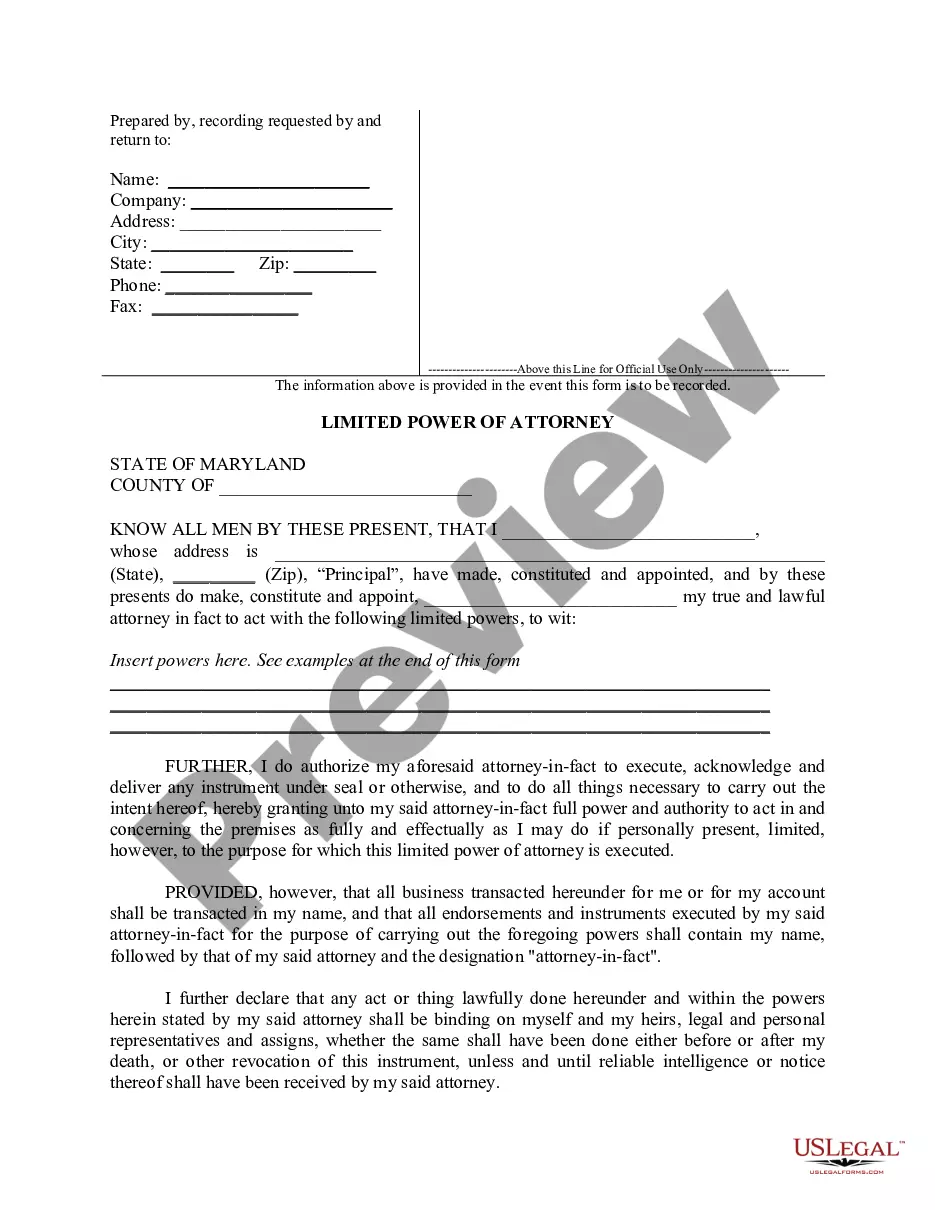

- Utilize the Review button to review the shape.

- Read the description to ensure that you have chosen the proper form.

- In the event the form isn`t what you`re trying to find, make use of the Lookup area to find the form that meets your requirements and demands.

- If you obtain the appropriate form, click Buy now.

- Opt for the costs strategy you desire, fill in the specified information to create your bank account, and purchase an order with your PayPal or charge card.

- Decide on a hassle-free data file formatting and acquire your backup.

Get every one of the record themes you might have bought in the My Forms menu. You can aquire a extra backup of Illinois Administration Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Association at any time, if needed. Just select the necessary form to acquire or print the record format.

Use US Legal Forms, probably the most substantial collection of authorized types, in order to save time as well as prevent blunders. The service offers skillfully made authorized record themes which you can use for a range of uses. Create a free account on US Legal Forms and initiate producing your way of life easier.