The Illinois Registration Rights Agreement between Object Soft Corp. and Investors is a legal document that outlines the terms and conditions regarding the sale and purchase of 6% Series G convertible preferred stocks in the state of Illinois. This agreement is essential for protecting the rights and ensuring transparency between Object Soft Corp. and the investors involved in the transaction. The Illinois Registration Rights Agreement details the process and obligations related to the registration of the preferred stocks with the Securities and Exchange Commission (SEC). It ensures that Object Soft Corp. complies with all necessary securities laws and regulations during the sale and purchase of the stocks. This agreement grants certain rights to the investors, commonly known as registration rights. These rights may include demand registration rights, piggyback registration rights, and Form S-3 registration rights. 1. Demand Registration Rights: This type of registration right allows the investors to request Object Soft Corp. to register the preferred stocks for public sale at any time after a specified waiting period. The agreement specifies the conditions and limitations under which the investors can exercise these rights. 2. Piggyback Registration Rights: Under these rights, the investors have the opportunity to "piggyback" their preferred stocks onto a registration statement filed by Object Soft Corp. for another offering. This allows the investors to sell their stocks alongside the company's offering, with Object Soft Corp. bearing the expenses associated with the registration process. 3. Form S-3 Registration Rights: This type of registration right allows the investors to request registration of their preferred stocks on Form S-3, a simplified registration form used by well-established companies with a history of timely securities filings. Form S-3 registration generally provides a quicker and more straightforward process for the registration and subsequent sale of the preferred stocks. The Illinois Registration Rights Agreement also covers important provisions such as indemnification, representation and warranties, limitations on transfer, and confidentiality. These provisions protect the interests of both Object Soft Corp. and the investors and ensure fair treatment throughout the transaction process. In summary, the Illinois Registration Rights Agreement between Object Soft Corp. and Investors for the sale and purchase of 6% Series G convertible preferred stocks is a crucial legal document that outlines the rights, obligations, and procedures involved in registering and selling the preferred stocks in the state of Illinois. The agreement includes various types of registration rights like demand registration rights, piggyback registration rights, and Form S-3 registration rights, each serving different purposes for the investors. It aims to ensure transparency, compliance with securities laws, and fair treatment for all parties involved in the transaction.

Illinois Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks

Description

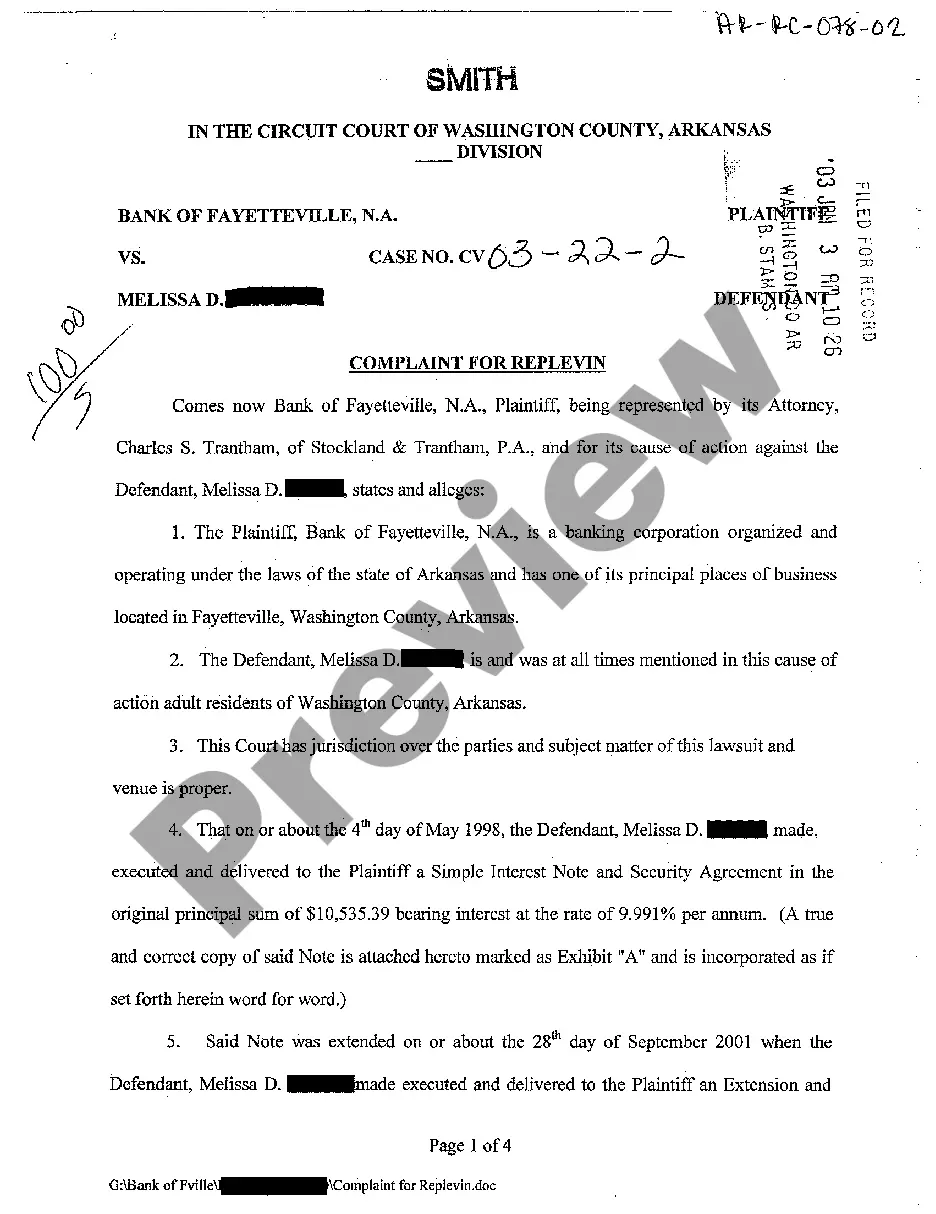

How to fill out Illinois Registration Rights Agreement Between ObjectSoft Corp. And Investors Regarding Sale And Purchase Of 6% Series G Convertible Preferred Stocks?

US Legal Forms - among the largest libraries of authorized kinds in America - provides a variety of authorized document web templates you are able to download or print out. Using the website, you may get 1000s of kinds for company and personal functions, categorized by groups, suggests, or keywords and phrases.You will discover the newest versions of kinds such as the Illinois Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks within minutes.

If you already have a monthly subscription, log in and download Illinois Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks from the US Legal Forms library. The Obtain switch can look on every type you look at. You have accessibility to all in the past saved kinds in the My Forms tab of the account.

If you would like use US Legal Forms for the first time, listed here are straightforward instructions to obtain started:

- Make sure you have picked out the right type for your city/region. Click on the Preview switch to review the form`s content. Read the type outline to ensure that you have chosen the correct type.

- If the type doesn`t fit your requirements, take advantage of the Search industry on top of the display to find the one that does.

- In case you are content with the shape, confirm your decision by visiting the Buy now switch. Then, opt for the pricing program you want and supply your accreditations to sign up on an account.

- Process the purchase. Make use of credit card or PayPal account to accomplish the purchase.

- Select the format and download the shape on the device.

- Make adjustments. Fill out, revise and print out and indication the saved Illinois Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks.

Each and every template you put into your account does not have an expiry day which is the one you have for a long time. So, in order to download or print out another copy, just check out the My Forms area and click in the type you require.

Obtain access to the Illinois Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks with US Legal Forms, the most substantial library of authorized document web templates. Use 1000s of skilled and status-distinct web templates that satisfy your organization or personal requirements and requirements.

Form popularity

FAQ

Related Content. In an unregistered securities offering, an agreement between the issuer and the purchasers of the security that creates an obligation for the issuer to register the re-offer and resale of the securities being offered at some time in the future (usually within six months).

?Definition? A registration rights provision in a term sheet allows an investor to require a company to register the investor's shares with the SEC when certain conditions are met, ensuring that the investor has the opportunity to sell their shares in the public market.

In an unregistered securities offering, an agreement between the issuer and the purchasers of the security that creates an obligation for the issuer to register the re-offer and resale of the securities being offered at some time in the future (usually within six months).

An Investor Rights Agreement (IRA) is an agreement between an investor and a company that contractually guarantees the investor certain rights including, but not limited to, voting rights, inspection rights, rights of first refusal, and observer rights.

Demand registration rights, where an investor can force a company to file a registration statement to register the holder's securities so the investor can sell them in the public market without restriction.