Illinois Merger Plan and Agreement between Ichargeit.Com, Inc. and Para-Link, Inc.

Description

How to fill out Merger Plan And Agreement Between Ichargeit.Com, Inc. And Para-Link, Inc.?

You are able to spend time on the web trying to find the lawful document template that meets the federal and state requirements you need. US Legal Forms gives a huge number of lawful varieties that happen to be evaluated by experts. You can easily download or produce the Illinois Merger Plan and Agreement between Ichargeit.Com, Inc. and Para-Link, Inc. from our service.

If you already have a US Legal Forms profile, you may log in and click the Acquire option. Following that, you may comprehensive, revise, produce, or sign the Illinois Merger Plan and Agreement between Ichargeit.Com, Inc. and Para-Link, Inc.. Every lawful document template you get is yours permanently. To get an additional copy for any purchased type, proceed to the My Forms tab and click the corresponding option.

If you are using the US Legal Forms website the very first time, follow the simple guidelines below:

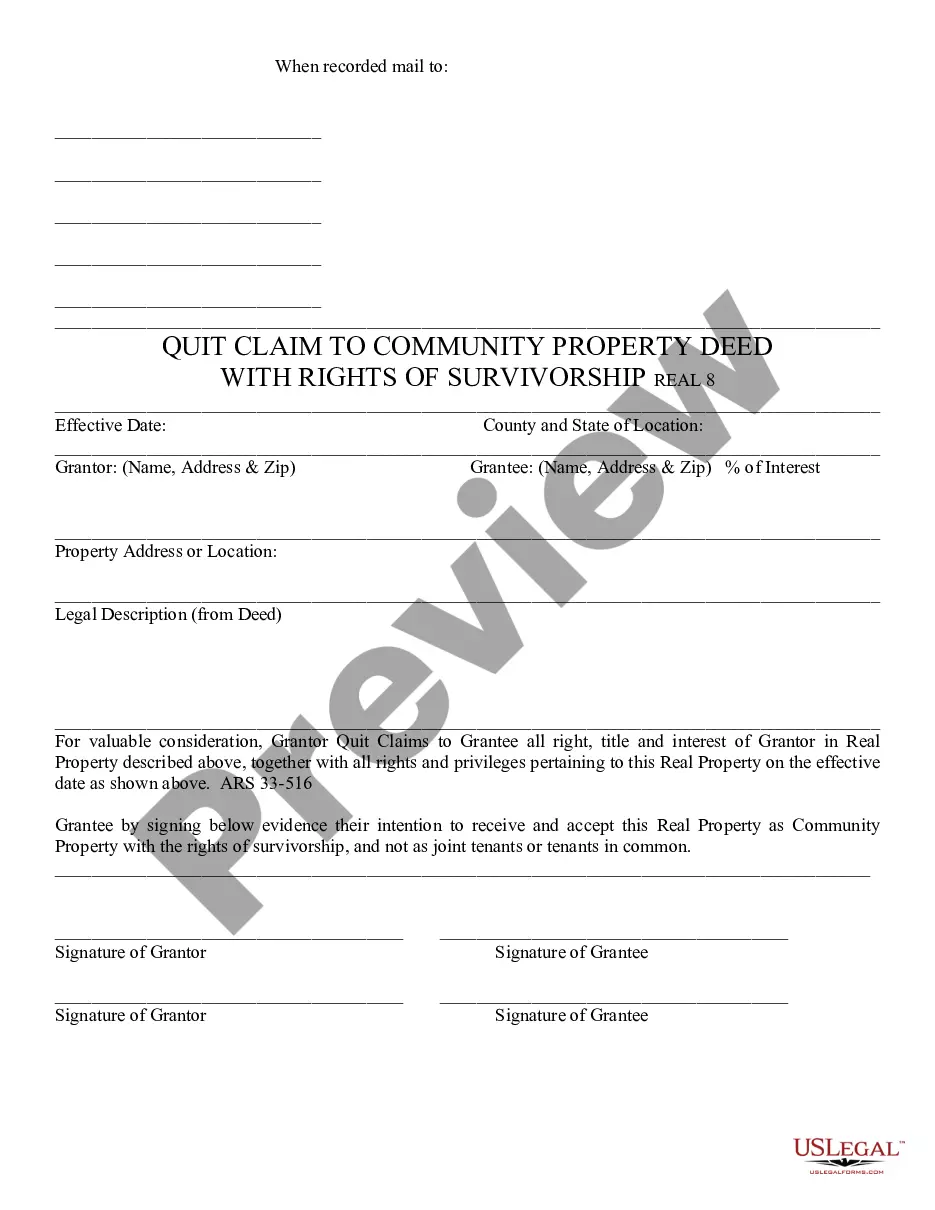

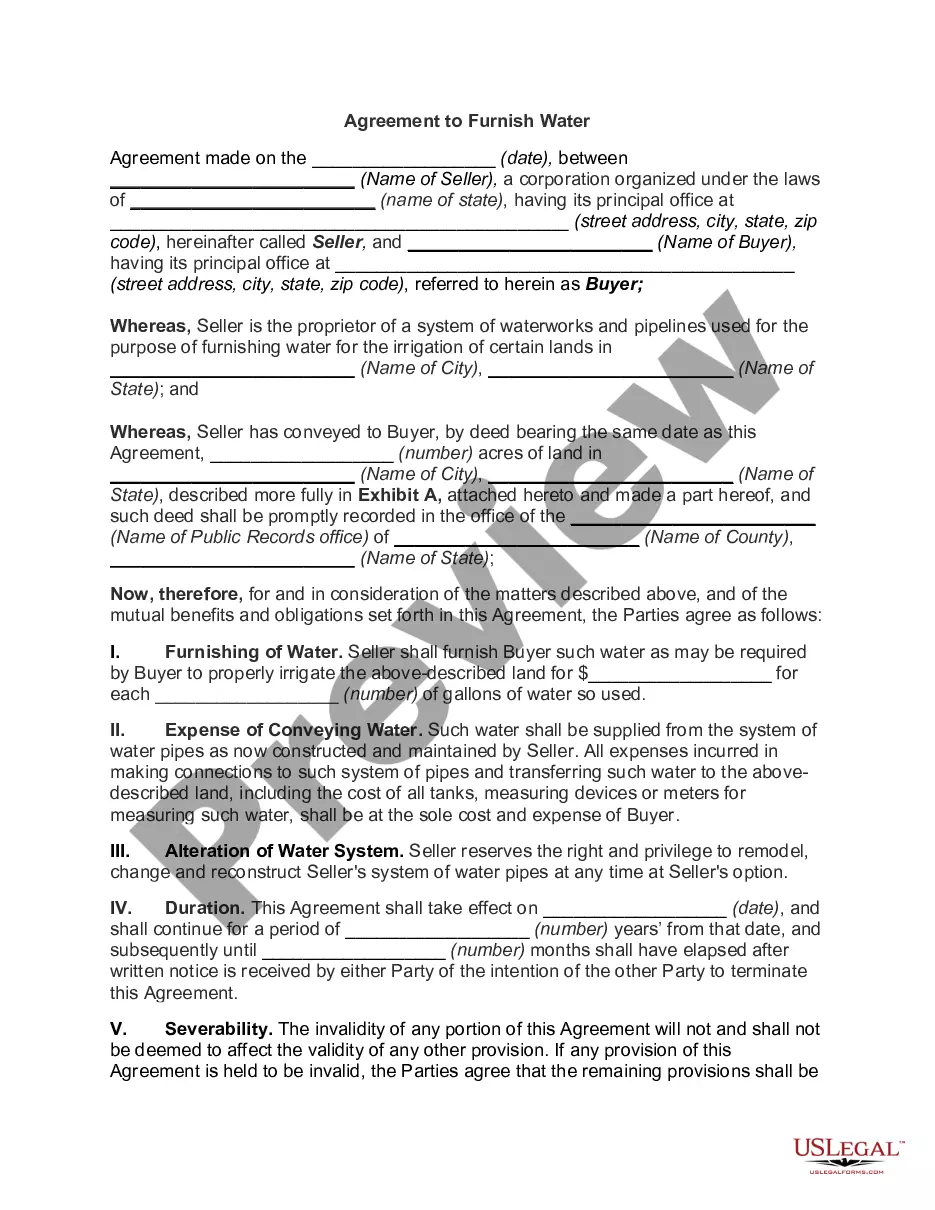

- Initial, make sure that you have selected the proper document template for that region/area of your choice. See the type description to make sure you have chosen the right type. If offered, make use of the Preview option to look with the document template at the same time.

- If you wish to discover an additional model of the type, make use of the Lookup field to obtain the template that meets your requirements and requirements.

- Upon having found the template you desire, simply click Get now to carry on.

- Choose the rates prepare you desire, type your credentials, and register for a merchant account on US Legal Forms.

- Complete the transaction. You may use your credit card or PayPal profile to pay for the lawful type.

- Choose the file format of the document and download it in your device.

- Make adjustments in your document if required. You are able to comprehensive, revise and sign and produce Illinois Merger Plan and Agreement between Ichargeit.Com, Inc. and Para-Link, Inc..

Acquire and produce a huge number of document layouts while using US Legal Forms site, which provides the biggest selection of lawful varieties. Use expert and express-distinct layouts to tackle your organization or individual demands.