Illinois Registration Rights Agreement Agreement between VIA Net.Works, Inc. and certain stockholders

Description

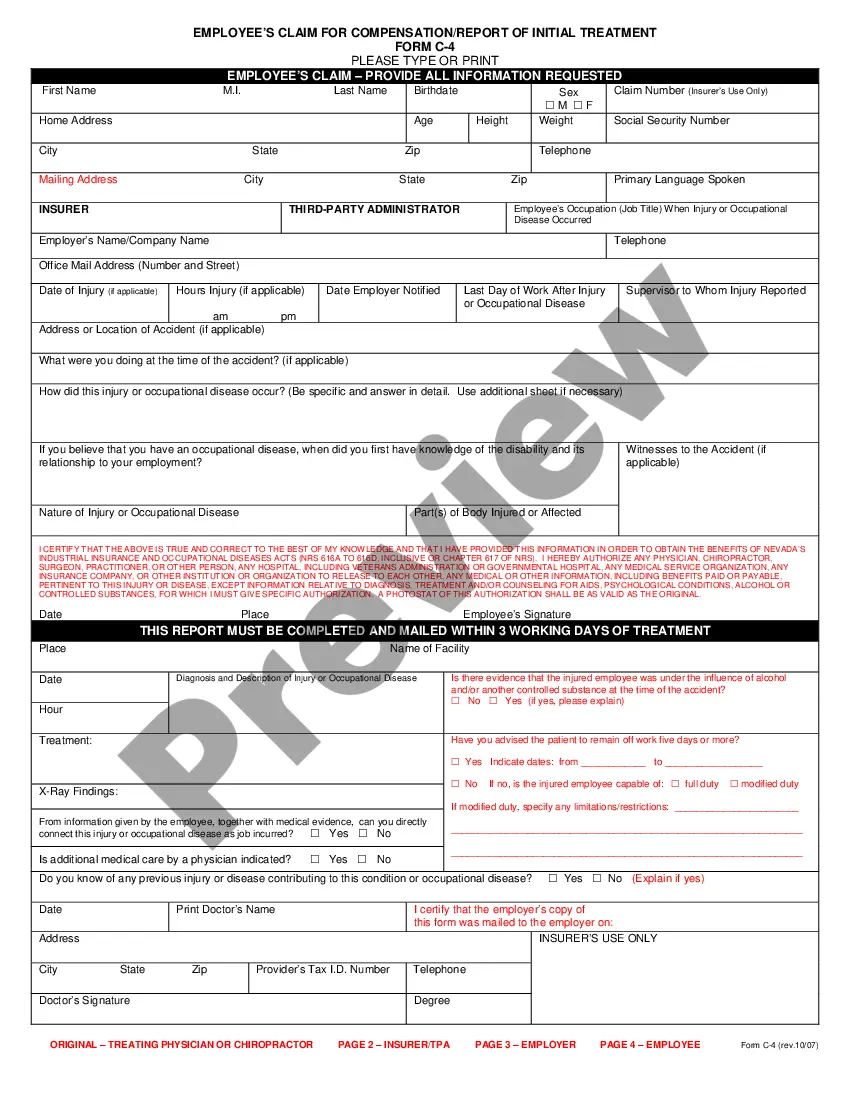

How to fill out Registration Rights Agreement Agreement Between VIA Net.Works, Inc. And Certain Stockholders?

If you have to comprehensive, obtain, or print lawful file web templates, use US Legal Forms, the largest collection of lawful kinds, that can be found on the Internet. Take advantage of the site`s simple and convenient lookup to get the papers you need. Various web templates for enterprise and personal functions are sorted by groups and says, or keywords and phrases. Use US Legal Forms to get the Illinois Registration Rights Agreement Agreement between VIA Net.Works, Inc. and certain stockholders within a number of click throughs.

When you are previously a US Legal Forms customer, log in to your profile and then click the Obtain option to get the Illinois Registration Rights Agreement Agreement between VIA Net.Works, Inc. and certain stockholders. Also you can entry kinds you previously delivered electronically inside the My Forms tab of the profile.

Should you use US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Make sure you have selected the shape for the appropriate metropolis/country.

- Step 2. Utilize the Preview choice to look over the form`s articles. Don`t neglect to read through the information.

- Step 3. When you are unsatisfied together with the form, make use of the Look for discipline near the top of the screen to locate other versions in the lawful form format.

- Step 4. Upon having identified the shape you need, select the Get now option. Opt for the costs strategy you choose and put your qualifications to register for the profile.

- Step 5. Approach the transaction. You can use your bank card or PayPal profile to complete the transaction.

- Step 6. Find the format in the lawful form and obtain it on the system.

- Step 7. Total, revise and print or sign the Illinois Registration Rights Agreement Agreement between VIA Net.Works, Inc. and certain stockholders.

Each and every lawful file format you acquire is the one you have for a long time. You have acces to each form you delivered electronically in your acccount. Go through the My Forms area and pick a form to print or obtain once more.

Remain competitive and obtain, and print the Illinois Registration Rights Agreement Agreement between VIA Net.Works, Inc. and certain stockholders with US Legal Forms. There are many expert and express-distinct kinds you can utilize to your enterprise or personal needs.

Form popularity

FAQ

Demand registration vs Piggyback registration Demand registration allows shareholders to demand that a company undergo an IPO, whereas investors relying on piggyback registration do not share that right of pushing a company to undertake an IPO.

Piggyback registration rights, where the investor is entitled to register its securities when either the company or another investor initiates the registration. Holders of piggyback rights are allowed to include their securities in a registration initiated by the company or another investor.

In an unregistered securities offering, an agreement between the issuer and the purchasers of the security that creates an obligation for the issuer to register the re-offer and resale of the securities being offered at some time in the future (usually within six months).

Qualified Piggy Back Registration means a Registration by the Company of its equity securities for its own account or for the account of Other Stockholders that either (a) occurs at a time when any Registrable Securities are not registered under a Shelf Registration Statement or (b) is a registered public offering that ...

One type of registration rights?known as demand rights?allows investors to force a company to go public. Piggyback rights, another type, allow investors to have their shares included in a liquidity event.

Piggyback registration rights, where the investor is entitled to register its securities when either the company or another investor initiates the registration. Holders of piggyback rights are allowed to include their securities in a registration initiated by the company or another investor.