Illinois Subscription Agreement

Description

How to fill out Subscription Agreement?

US Legal Forms - one of many most significant libraries of legitimate kinds in the United States - delivers a variety of legitimate document layouts you may obtain or print. Utilizing the web site, you may get a large number of kinds for organization and individual functions, sorted by groups, suggests, or key phrases.You can get the most recent types of kinds such as the Illinois Subscription Agreement in seconds.

If you already have a monthly subscription, log in and obtain Illinois Subscription Agreement from the US Legal Forms catalogue. The Obtain option will appear on every develop you see. You get access to all earlier downloaded kinds within the My Forms tab of your accounts.

If you want to use US Legal Forms the first time, listed here are simple guidelines to help you get began:

- Ensure you have picked the right develop for the town/state. Go through the Review option to analyze the form`s content material. Read the develop outline to actually have selected the right develop.

- In case the develop does not suit your requirements, take advantage of the Lookup industry at the top of the screen to find the one who does.

- When you are satisfied with the shape, affirm your decision by clicking on the Get now option. Then, pick the pricing program you prefer and give your references to sign up to have an accounts.

- Approach the financial transaction. Use your Visa or Mastercard or PayPal accounts to complete the financial transaction.

- Pick the format and obtain the shape on your own device.

- Make alterations. Load, change and print and indicator the downloaded Illinois Subscription Agreement.

Each and every web template you included in your account lacks an expiry date which is your own property for a long time. So, if you would like obtain or print another copy, just go to the My Forms section and click about the develop you need.

Gain access to the Illinois Subscription Agreement with US Legal Forms, by far the most comprehensive catalogue of legitimate document layouts. Use a large number of expert and status-certain layouts that meet up with your small business or individual requirements and requirements.

Form popularity

FAQ

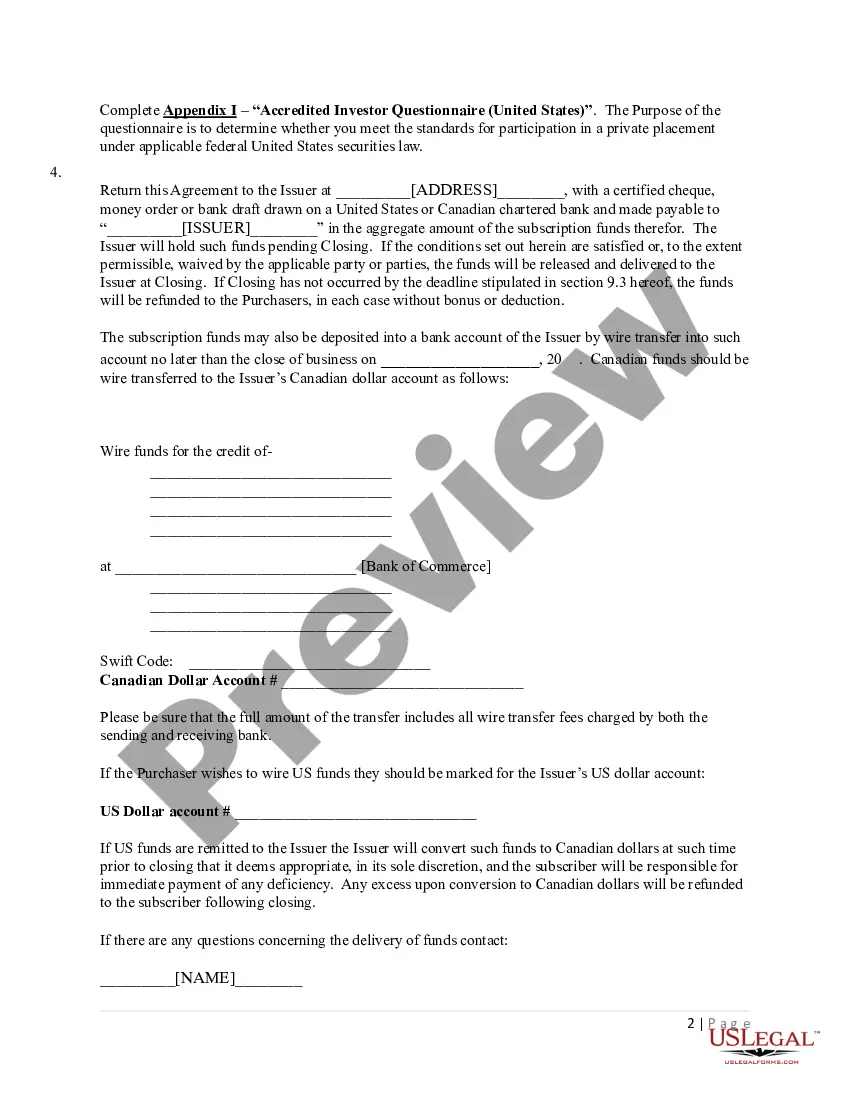

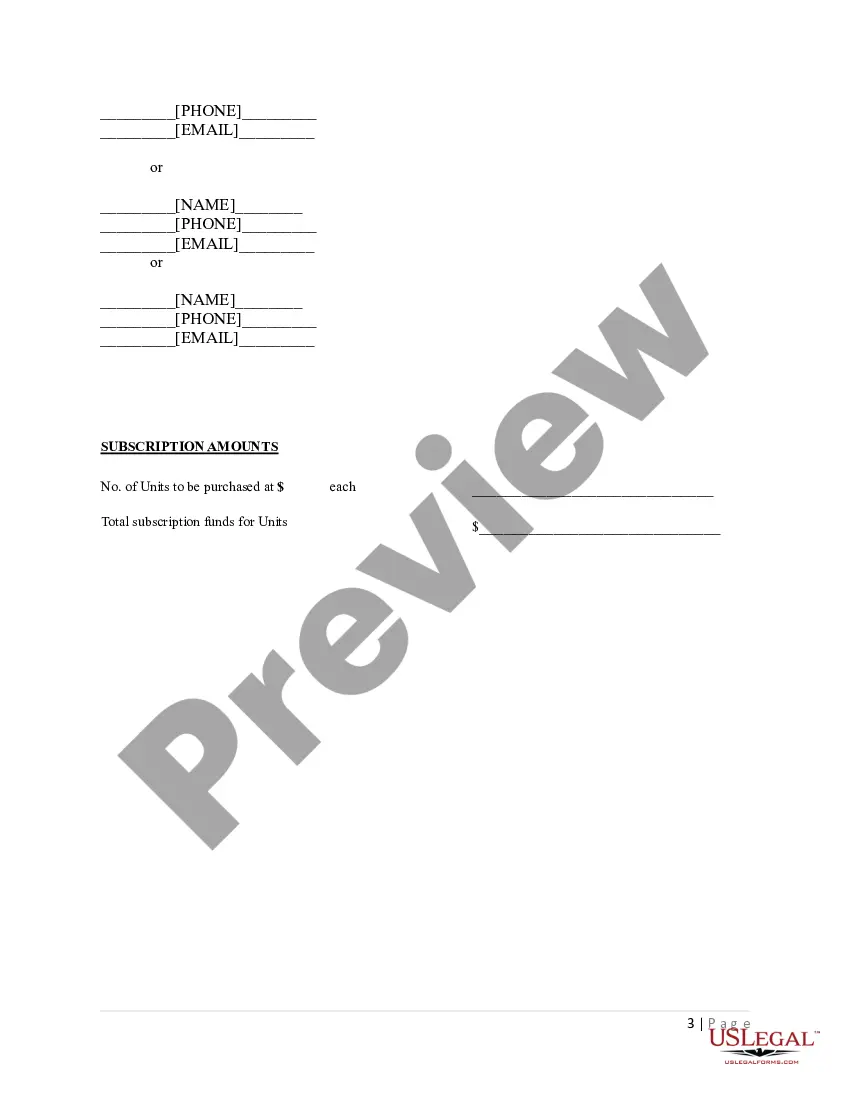

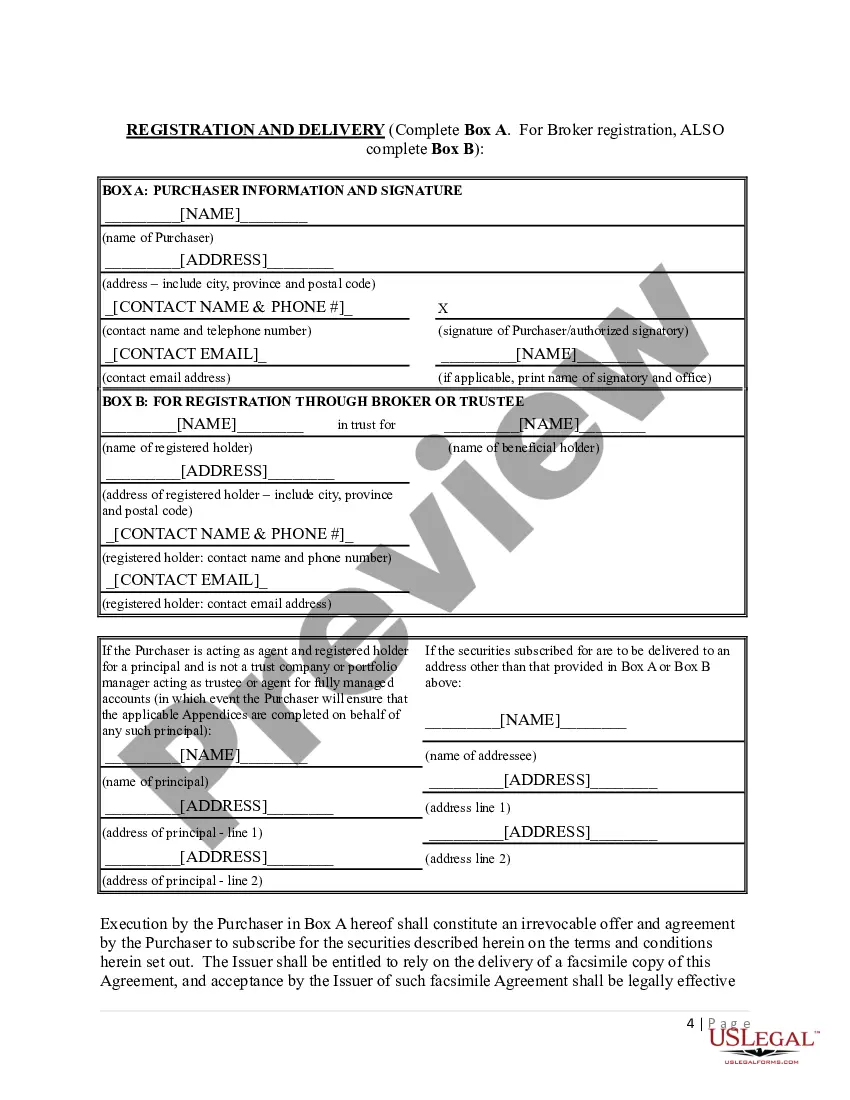

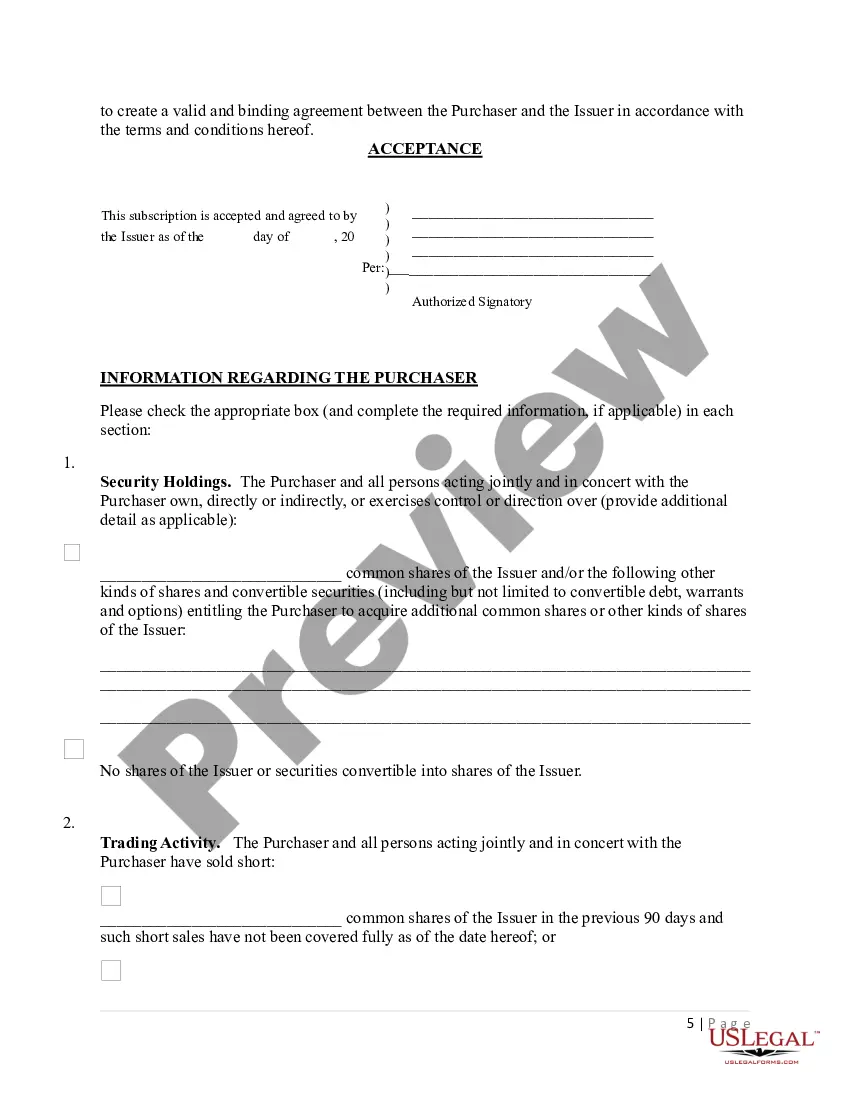

Summary. A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

A subscription contract can be defined as regular or continuous use of a certain service or product by paying a certain amount. In this type of contract, the buyer has the right to demand a product or service from the other party for a certain period or continuously by paying a certain amount.

What is an LLC Subscription Agreement? An LLC subscription agreement is an investor's application to join a limited liability company (LLC). It is also a two-way guarantee between a company and a new shareholder (subscriber).

1.1 The Agreement provides for the sale of ________ [insert number and type of shares] to the Buyer by the Seller at a price of ______ [insert price per share], par value per share (the ?Shares?). 1.2 Purchase and Sale. The Seller agrees to sell and the Buyer agrees to buy the Shares. 1.3 Delivery of Shares.

There are two key documents that set out the terms and the structure of an LLC, the Operating Agreement and the Subscription Agreement. Note that investors do not buy shares in an LLC ? they buy an interest, which determines their percentage ownership and is documented in the Subscription Agreement.

A Share Subscription Agreement is a legally binding contract between a company and an investor or subscriber. It outlines the terms and conditions under which the investor agrees to purchase newly issued company shares.

By including these five key elements in your Share Subscription Agreement ? subscription price, payment terms, representations and warranties, closing conditions, and indemnification ? you can help safeguard against any potential issues or disputes that may arise down the road.