Illinois Partnership Agreement

Description

How to fill out Partnership Agreement?

You may spend hrs on-line looking for the legal file format that fits the state and federal specifications you want. US Legal Forms offers thousands of legal forms that are evaluated by specialists. You can easily obtain or printing the Illinois Partnership Agreement from our services.

If you currently have a US Legal Forms profile, it is possible to log in and then click the Acquire option. After that, it is possible to full, edit, printing, or sign the Illinois Partnership Agreement. Each and every legal file format you acquire is the one you have eternally. To have another backup of the obtained form, check out the My Forms tab and then click the corresponding option.

If you work with the US Legal Forms internet site for the first time, adhere to the basic directions beneath:

- First, make sure that you have selected the right file format for your region/area of your choice. See the form information to ensure you have chosen the correct form. If offered, take advantage of the Preview option to search throughout the file format as well.

- In order to locate another model in the form, take advantage of the Lookup discipline to find the format that meets your needs and specifications.

- Upon having discovered the format you want, simply click Buy now to move forward.

- Select the costs prepare you want, type your qualifications, and sign up for a free account on US Legal Forms.

- Total the purchase. You may use your credit card or PayPal profile to fund the legal form.

- Select the format in the file and obtain it to the system.

- Make adjustments to the file if needed. You may full, edit and sign and printing Illinois Partnership Agreement.

Acquire and printing thousands of file web templates using the US Legal Forms Internet site, that offers the largest variety of legal forms. Use skilled and condition-particular web templates to tackle your company or personal demands.

Form popularity

FAQ

Partnerships and S corporations do not pay Illinois income tax (the members pay Illinois income tax) but they are subject to the replacement tax at a rate of 1.5 percent (. 015) on income taxable to Illinois. Trusts pay both Illinois income and replacement taxes.

There are several different types of partnerships, each with different characteristics, benefits, and possible disadvantages. A general partnership is the simplest form of a partnership.

You must file Form IL-1065, Partnership Replacement Tax Return, if you are a partnership, as defined in "Definitions to help you complete your Form IL-1065" in the Form IL-1065 instructions, and you have base income or loss as defined under the Illinois Income Tax Act (IITA) allocable to Illinois.

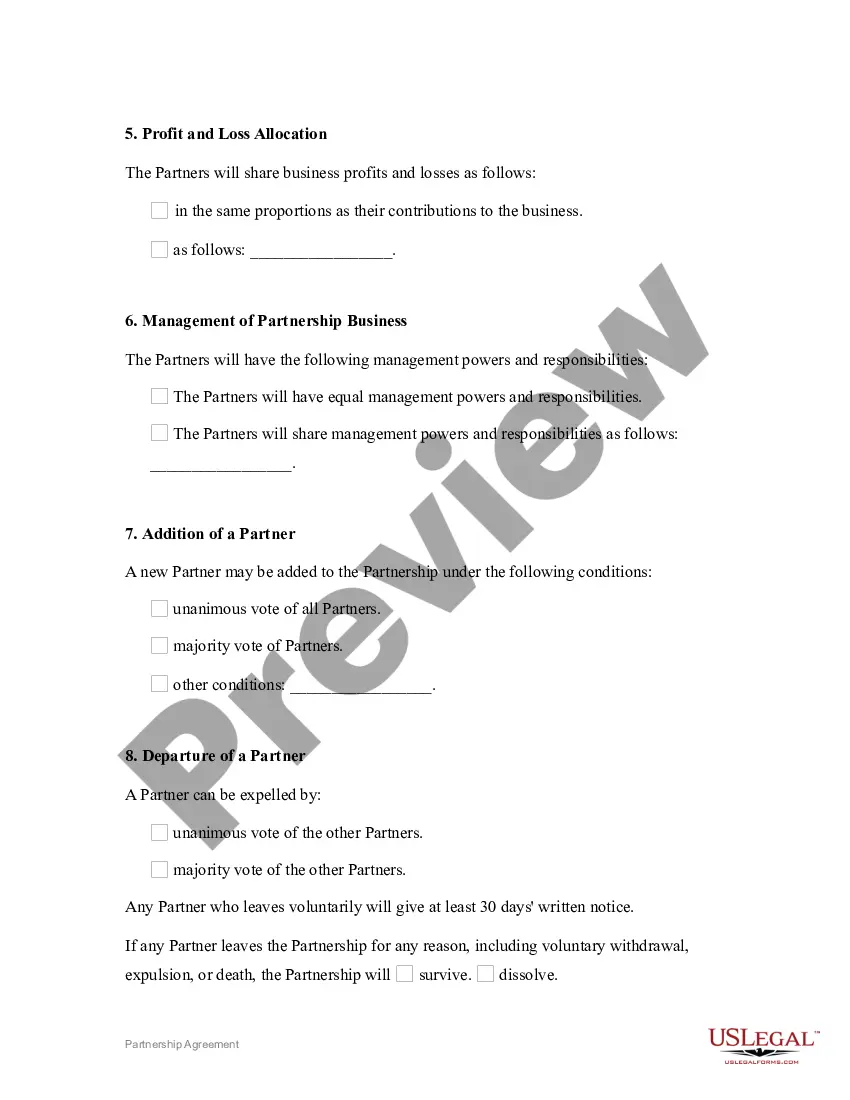

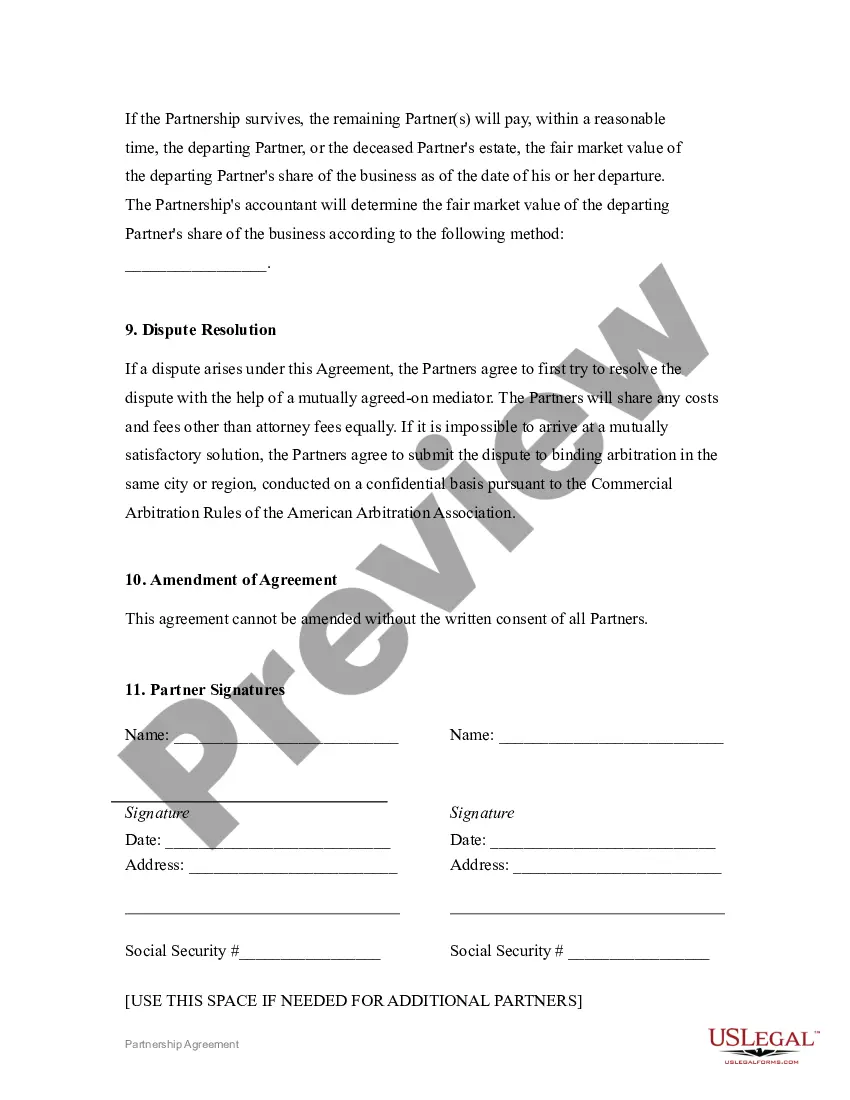

How to Write a Partnership Agreement Outline Partnership Purpose. ... Document Partner's Name and Business Address. ... Document Ownership Interest and Partner Shares. ... Outline Partner Responsibilities and Liabilities. ... Consult With a Lawyer.

How do I create a Partnership Agreement? Provide partnership details. Start by specifying the industry you're in and what type of business you'll run. ... Detail the capital contributions of each partner. ... Outline management responsibilities. ... Prepare for accounting. ... Add final details.

Step 1: Select a business name. Any Illinois partnership must operate with a unique name. ... Step 2: Register the business name. ... Step 3: Complete required paperwork. ... Step 4: Determine if you need an EIN, additional licenses, or tax IDs. ... Step 5: Get your day-to-day business affairs in order.

How to draft a contract between two parties: A step-by-step checklist Check out the parties. ... Come to an agreement on the terms. ... Specify the length of the contract. ... Spell out the consequences. ... Determine how you would resolve any disputes. ... Think about confidentiality. ... Check the contract's legality. ... Open it up to negotiation.

A partnership agreement is a legal document that dictates how a small for-profit business will operate under two or more people. The agreement lays out the responsibilities of each partner in the business, how much of the business each partner owns, and how much profit and loss each partner is responsible for.