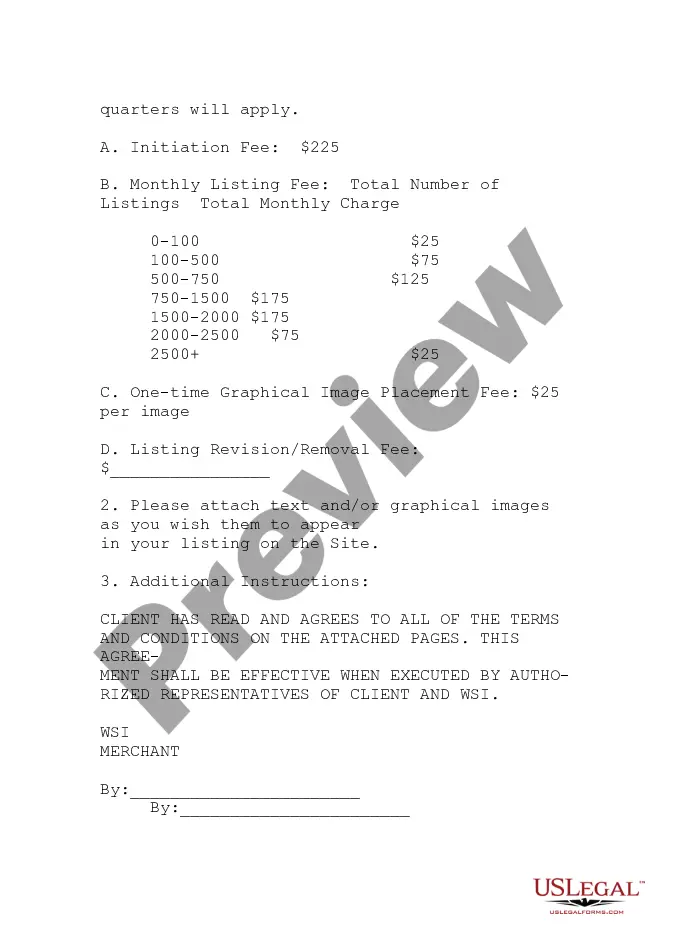

Illinois Retail Internet Site Agreement is a legal contract that governs the relationship between an online retailer and its customers in the state of Illinois. This agreement sets forth the terms and conditions under which the retailer will provide its products or services through its website to customers residing or accessing the website from Illinois. The Illinois Retail Internet Site Agreement covers various important facets, including payment terms, delivery methods, cancellation and return policies, privacy and data protection, intellectual property rights, and dispute resolution procedures. By accessing or using the retailer's website, customers are deemed to have accepted and agreed to abide by the terms and conditions outlined in this agreement. It is essential for both online retailers and customers to comprehend the Illinois Retail Internet Site Agreement to ensure a transparent and satisfactory online shopping experience. This agreement protects the rights and responsibilities of both parties and outlines the rules and regulations that govern their interactions. Different types of Illinois Retail Internet Site Agreements may exist, depending on the nature of the online retailer's business and the products or services offered. Some notable variations include: 1. E-commerce Retail Internet Site Agreement: This type of agreement pertains to online retailers selling physical products through their website. It covers aspects such as product descriptions, pricing, shipping methods, and return policies. 2. Digital Content Retail Internet Site Agreement: This agreement applies to online retailers selling digital products, such as e-books, software, or audio/video downloads. It outlines the terms under which customers can access, download, and use the digital content. 3. Subscription-based Retail Internet Site Agreement: Some online retailers offer subscription-based services, such as streaming platforms or membership websites. This agreement details the terms and conditions specific to recurring payments, cancellation methods, and content access. 4. Marketplace Retail Internet Site Agreement: Online marketplaces that connect buyers and sellers may have their own unique agreement. It encompasses rules regarding product listings, seller obligations, dispute resolution processes, and payment mechanisms. In conclusion, the Illinois Retail Internet Site Agreement governs the relationship between online retailers and customers in the state. It is important for both parties to understand and comply with the terms and conditions outlined in this agreement to ensure a secure and satisfactory online shopping experience.

Illinois Retail Internet Site Agreement

Description

How to fill out Illinois Retail Internet Site Agreement?

US Legal Forms - one of several most significant libraries of legitimate kinds in the USA - gives a wide array of legitimate papers templates you are able to down load or print. Utilizing the site, you can find thousands of kinds for company and person uses, sorted by classes, states, or search phrases.You will discover the most up-to-date types of kinds such as the Illinois Retail Internet Site Agreement within minutes.

If you already have a membership, log in and down load Illinois Retail Internet Site Agreement from your US Legal Forms catalogue. The Download switch will show up on every single type you see. You get access to all formerly downloaded kinds in the My Forms tab of your own profile.

In order to use US Legal Forms for the first time, here are basic recommendations to obtain began:

- Ensure you have chosen the right type for your town/county. Go through the Preview switch to check the form`s content material. Look at the type description to actually have chosen the proper type.

- In case the type does not suit your specifications, utilize the Look for discipline towards the top of the display screen to find the one that does.

- When you are satisfied with the shape, validate your decision by clicking the Acquire now switch. Then, opt for the rates program you prefer and provide your qualifications to sign up to have an profile.

- Method the financial transaction. Utilize your charge card or PayPal profile to accomplish the financial transaction.

- Choose the file format and down load the shape on the device.

- Make adjustments. Fill out, revise and print and indicator the downloaded Illinois Retail Internet Site Agreement.

Every design you put into your account lacks an expiration particular date and is your own property forever. So, if you wish to down load or print an additional copy, just proceed to the My Forms area and click about the type you want.

Get access to the Illinois Retail Internet Site Agreement with US Legal Forms, one of the most extensive catalogue of legitimate papers templates. Use thousands of expert and express-certain templates that fulfill your business or person requirements and specifications.

Form popularity

FAQ

You are a remote retailer. You must register to collect destination- based sales tax for your sales into Illinois.

Amazon as marketplace facilitator is responsible to collect the taxes - as it does in IL with a flat 6.25% rate.

If you sell items at retail in Illinois that are of the type that must be titled or registered by an agency of Illinois state government (e.g., vehicles, watercraft, aircraft, trailers, manufactured (mobile) homes), you must report these sales on Form ST?556, Sales Tax Transaction Return.

There are 12 origin-based states. Arizona. California (considered a "mixed sourcing state" as city, county and state sales taxes are origin-based, while district sales taxes - supplementary local taxes - are destination-based) Illinois. Mississippi. Missouri. New Mexico. Ohio. Pennsylvania.

How much is sales tax in Illinois? The base state sales tax rate in Illinois is 6.25%. Local tax rates in Illinois range from 0% to 4.75%, making the sales tax range in Illinois 6.25% to 11%.

It is flat rate throughout the state of 6.25% for general merchandise and 1% for qualifying food, drugs and medical appliances. Out-of-state sellers, remote retailers, and marketplace facilitators, see the Leveling the Playing Field for Illinois Retail Act Flowchart to determine which tax you are to collect.

Illinois is an origin-based sales tax state. So if you live in Illinois, collecting sales tax is fairly easy. Collect sales tax at the tax rate where your business is located. You can look up your local sales tax rate with TaxJar's Sales Tax Calculator.

If selling activities occur outside Illinois, 6.25% Use Tax must be collected (no local taxes apply). Responsibilities Flowchart for information on how to report your sales.