Illinois Instructions for Completing IRS Form 4506-EZ The Illinois Instructions for Completing IRS Form 4506-EZ provide comprehensive guidance on properly filling out this particular tax form for residents and businesses in the state of Illinois. This document aims to simplify the process of completing Form 4506-EZ, which is used to request a copy of a previously filed tax return from the Internal Revenue Service (IRS). By following these instructions, individuals and organizations can ensure accurate and timely completion of the form. Key elements covered in the Illinois Instructions for Completing IRS Form 4506-EZ include: 1. Basic Information: The instructions outline the general details that need to be provided, such as the taxpayer's name, social security number (SSN) or employer identification number (EIN), current address, and phone number. Attention to detail is crucial, as any inaccuracies might delay the retrieval of the requested tax return. 2. Filing Status: Individuals need to indicate their current filing status, which may include single, married filing jointly, married filing separately, head of household, or qualifying widow(er) with dependent child. This information helps the IRS process the request accurately. 3. Copies Requested: The instructions specify the number of copies of the tax return being requested, along with the years or periods for which the copies are required. It is essential to accurately enter the tax years to avoid any delays in processing the form. 4. Signature Authorization: There is a section dedicated to authorizing a third party to receive the requested copies of the tax return. This requires providing the third party's name, address, and phone number, as well as the taxpayer's explicit consent for the third party to receive the information. 5. Attention to Deadlines: The instructions emphasize adhering to the applicable deadlines for submitting Form 4506-EZ. Failure to meet the deadlines may result in delays or denial of the request, so taxpayers are urged to pay close attention to the timeline. While there may not be different types of Illinois Instructions for Completing IRS Form 4506-EZ, there are various versions and updates of the form itself. Taxpayers are advised to use the most recent version of the form and consult the corresponding instructions to ensure compliance with the latest guidelines provided by the IRS. By following the Illinois Instructions for Completing IRS Form 4506-EZ, taxpayers in Illinois can accurately complete the form and obtain the requested copies of their previous tax returns efficiently. It is important to review the instructions carefully, provide accurate information, and meet all the necessary deadlines to ensure a smooth and successful request process.

Illinois Instructions for Completing IRS Form 4506-EZ

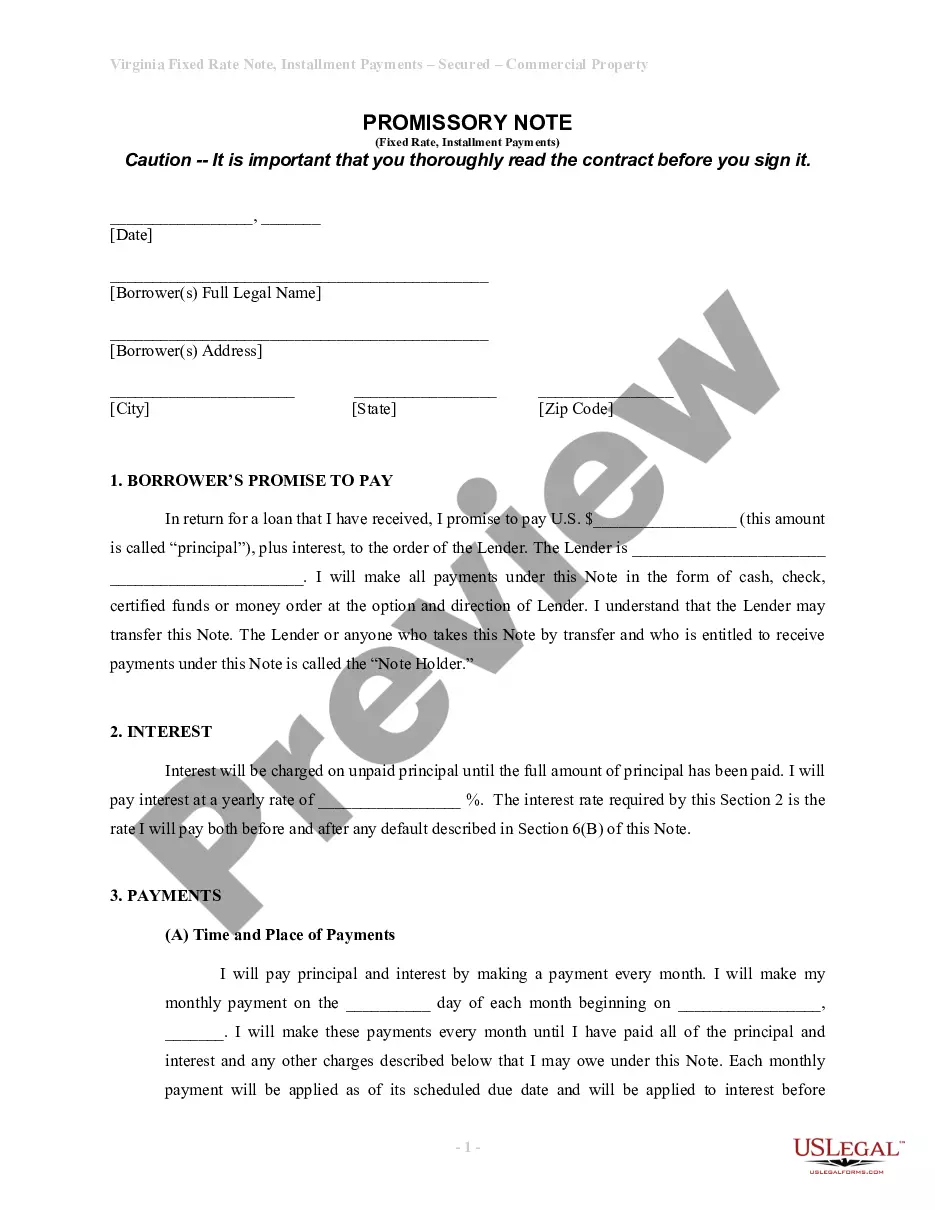

Description

How to fill out Illinois Instructions For Completing IRS Form 4506-EZ?

If you need to total, obtain, or print out authorized record themes, use US Legal Forms, the largest collection of authorized varieties, which can be found online. Use the site`s simple and easy hassle-free lookup to get the documents you will need. Various themes for business and individual functions are sorted by groups and claims, or keywords and phrases. Use US Legal Forms to get the Illinois Instructions for Completing IRS Form 4506-EZ with a handful of mouse clicks.

If you are previously a US Legal Forms consumer, log in to the profile and then click the Obtain option to have the Illinois Instructions for Completing IRS Form 4506-EZ. You can even accessibility varieties you previously delivered electronically from the My Forms tab of your respective profile.

If you work with US Legal Forms the first time, follow the instructions beneath:

- Step 1. Be sure you have selected the form for your appropriate city/nation.

- Step 2. Use the Review method to look over the form`s articles. Never forget about to see the information.

- Step 3. If you are unsatisfied together with the kind, use the Look for industry towards the top of the display to get other variations in the authorized kind format.

- Step 4. When you have found the form you will need, click on the Purchase now option. Select the prices prepare you like and put your references to register for an profile.

- Step 5. Process the financial transaction. You may use your charge card or PayPal profile to complete the financial transaction.

- Step 6. Select the formatting in the authorized kind and obtain it on the gadget.

- Step 7. Total, change and print out or signal the Illinois Instructions for Completing IRS Form 4506-EZ.

Every single authorized record format you get is your own forever. You possess acces to every kind you delivered electronically within your acccount. Click the My Forms area and select a kind to print out or obtain once again.

Remain competitive and obtain, and print out the Illinois Instructions for Completing IRS Form 4506-EZ with US Legal Forms. There are thousands of professional and express-distinct varieties you can utilize for your business or individual requires.